We use cookies to offer you a better browsing experience and analyse site traffic. If you continue to use this site, you consent to our use of cookies. Find out more.

Every year in late December/ early January, we meet with several investment houses, as well as do our own research, to determine whether any changes should be made to our models. This could include fund switches, changes to the asset allocation, the geographical weights, or the tilts to small cap and value funds.

Conclusion:

After much deliberation, portfolio modelling and discussion, we have decided to make the following changes to our funds or model:

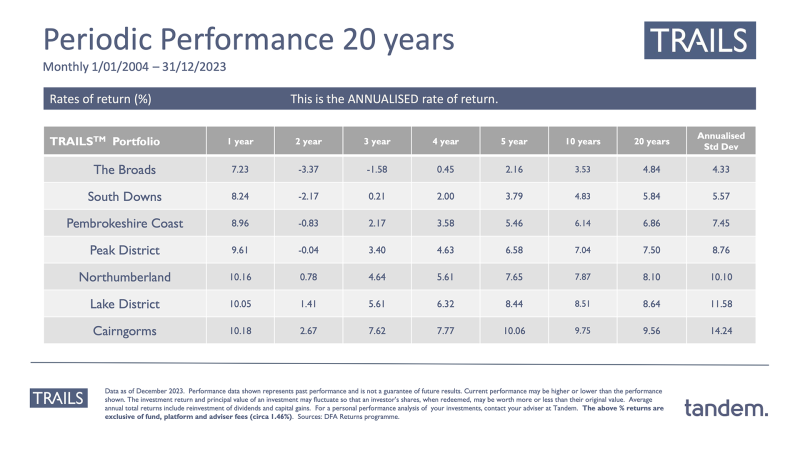

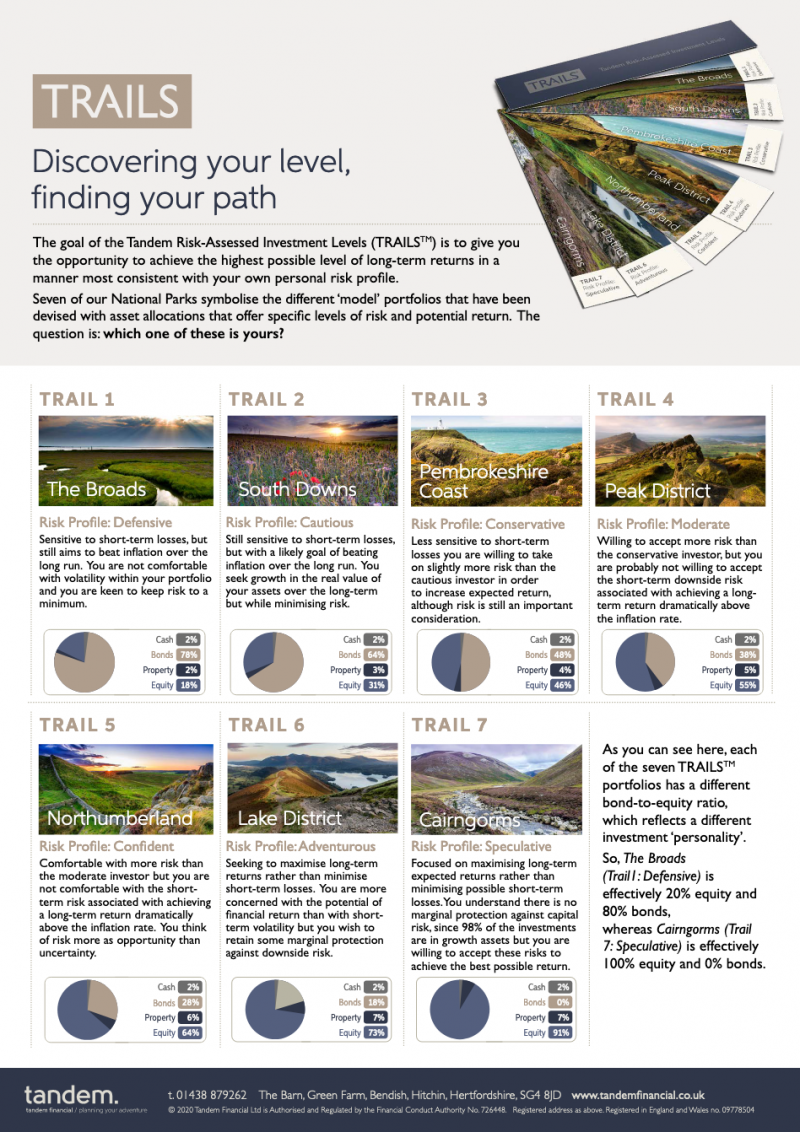

- The Equity: Bond ratios (overall asset allocation) should remain the same throughout the seven TRAILS™ models.

- However, we have decided to amend the geographical weighting of all models as follows:

- Reduce property allocation to 0%

- Reduce UK allocation to 4%

- Increase world allocation to 84%,

- Increase Emerging Markets allocation to 12%

- These changes are to bring the equity weighting more in line with the current global market capitalisation, a core principle of the TRAILS™ investment philosophy.

- SELL the iShares Environment & Low Carbon Tilt Real Estate Index (UK) D Acc Fund. The proceeds from this will be reallocated to the Vanguard FTSE Developed World ex-UK Equity Index.

- SELL the Vanguard UK Investment Grade Bond Index. The proceeds from this will be reallocated equally to the existing Vanguard Global Bond Index and Dimensional Global Core Fixed Income funds.

- Therefore, new models will have a maximum of 8 funds (was 10).

- Re-balance all models to the new template at the same time.

What to do now:

- Do read our rationale below if you want to know more about the specific reasons for the changes.

- Please complete the form below, include your name, email address, tick to agree and press submit.

- Login to TRAILS™ on-line to view and download the latest 2024 Portfolio Breakdown for your model, DFA returns data, Morningstar Snapshot, Factsheets and Key Investor Information Documents.

- Do get in touch if you wish to change risk profiles or have any questions.

- If you have a GIA (General Investment Account), we will check beforehand regarding CGT (capital gains tax) if/ when you agree to our above fund sale fund recommendations, as sales are disposals which can result in gains that above your CGT allowance.

- If you have used some or all of your CGT allowance for 2023-24 please let us know.

N.B. If you invest in TRAILS™ Ethical you will receive a separate email with implications and advice.

“In the business world, the rearview mirror is always clearer than the windshield.”

Warren Buffett, CEO of Berkshire Hathaway

To accept the recommended changes above, please complete the boxes below:

Please then PRESS SUBMIT and someone from Tandem will get in touch with you soon.

Please feel free to call or email us if you have any questions.

Below are some useful resources you can download:

-

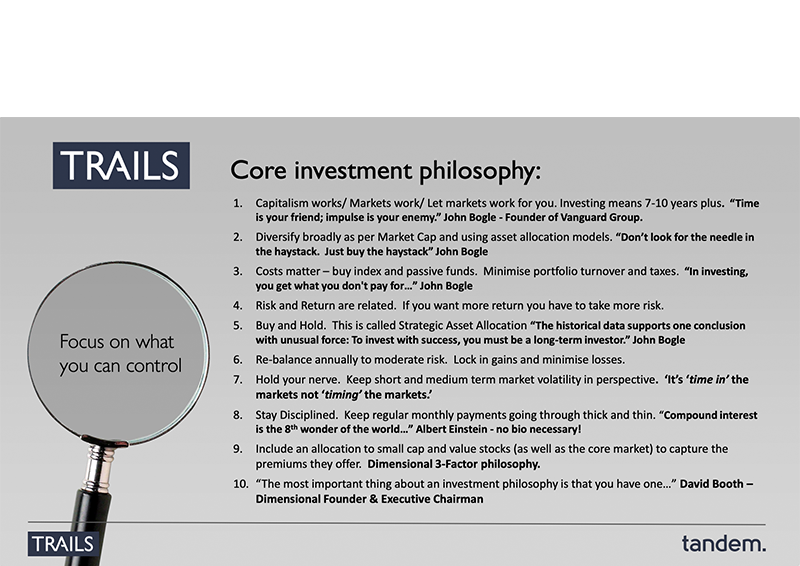

Tandem Core Investment Philosophy

-

TRAILS™ Rationale for Recommendations and FAQs

-

TRAILS™ Portfolio Information

-

Tandem Guide to Bonds

-

Tandem Re-balancing FAQs

-

TRAILS™ Brochure