What does retirement “look like” to you? Do you imagine exploring the world in your 60s with your significant other? Perhaps you dream of becoming completely financially independent in your 50s, continuing to work purely for the joy of it.

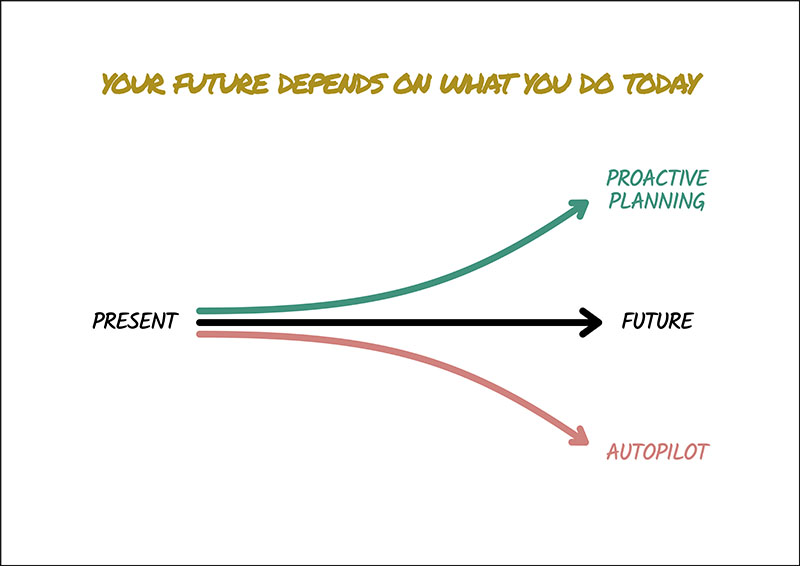

Your “retirement horizon” refers to the period between your current age and the age at which you plan to retire. It greatly impacts your investment strategy, risk tolerance, and savings goals. However, retirement planning is also being shaped by wider forces in 2025.

Clients’ options are changing as more people live longer, interest rates rise (relative to 2021), government policies pivot, and retirement planning options widen. Given this dynamic landscape, how can someone plan for retirement effectively?

Below, I’ll share some thoughts on how to build a robust plan for later life, despite changing circumstances.

What is changing?

Speaking as a financial adviser, I can tell you that my job has changed.

Here is an example. Before 2015, pension planning options were more limited. Many people were forced to buy an annuity with their life savings. Whilst this was a good course for some, it was not ideal for everyone.

All of that changed with the passing of the Pension Schemes Act which became known as ‘Pension Freedoms.’ From April 2015, clients had more options for using their pensions, including cash withdrawals, flexible drawdown, and combinations.

Today, the range of choice is even wider. Not only are “hybrid annuities” available, but there is also the possibility of income drawdown from several different pots, including ISAs, GIAs, onshore and offshore bonds, and pensions.

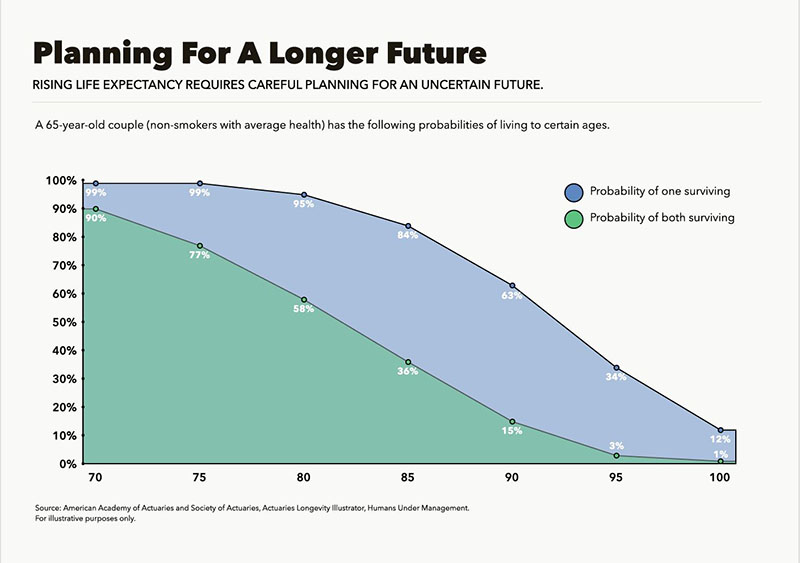

Then there are UK lifespans and lifestyles. Although the Covid-19 pandemic caused a recent dip in life expectancy, British people generally live longer than they did a few decades ago. This means pension savings have to potentially stretch further over a longer retirement.

Moving our lens elsewhere, the economy is shifting. In late 2021, interest rates started to rise. Previously, they had sat close to zero since the Financial Crisis. People had grown accustomed to “cheap” mortgages, poor savings rates and low annuity rates.

That changed as inflation began to rise following months of lockdown. Today, the BOE base rate stands at 4.75%. This is not high by historical standards and it may possibly fall in 2025. Do bear in mind that predicting interest rates is just that, a prediction and it can do three things: stay at 4.75% for all of 2025. It can rise (if inflation becomes an issue) or it could fall! However, it shifts the calculus for many people when considering important financial questions.

For instance, is it now worthwhile to overpay your mortgage? Should I buy an annuity, now that rates are higher than before 2021? Where should I “park” money for emergencies? Which is the best savings account? Will falling interest rates result in bond prices rising?

Finally, there is the policy landscape. Since Labour took power in July 2024, new tax laws have arrived. These changes have also shifted decision making for many. For instance, pensions are set to fall under the IHT “net” from 6th April 2027. (This is only on second death though, so don’t worry if you are married or in a civil partnership as your spouse or partner can still receive the proceeds from your pension free from IHT.)

Business Relief and Agricultural Property Relief (APR) are also changing. These developments are reminders that financial planning – especially retirement planning – is an active process. It requires ongoing advice and the ability to pivot and take action.

As the environment around you changes, how quickly and effectively can you adapt to it? How much do you need to adapt to change?

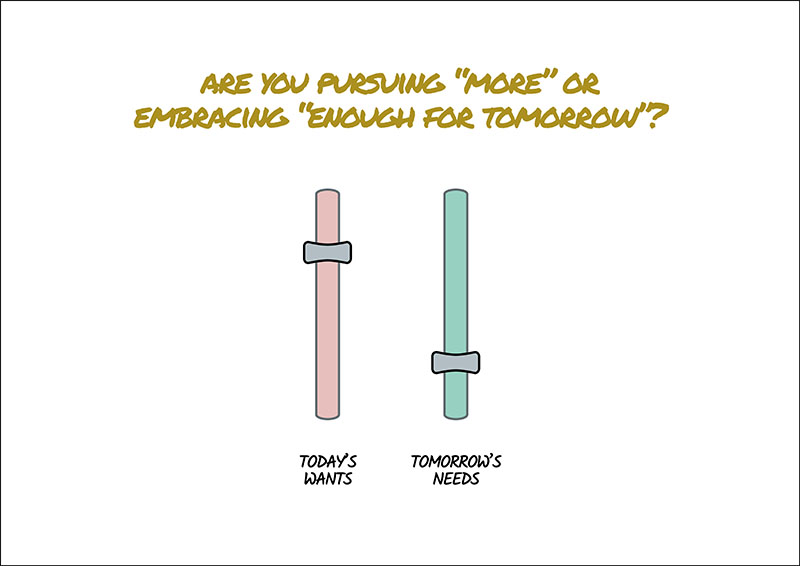

I think it comes down to how prepared you are, how resilient you are, how adaptable you are to change and what your needs and wants are. The concept of ‘more’ is one we all wrestle with, especially when we try to keep up with the Joneses. Are you pursuing more? I don’t think this is a bad thing. It depends, what it is more of. But there has to be a point in finance, when you say, ‘right – I’d like to spend less time (or no time) working and spend more time enjoying other things’ and to get to this point, one must save ‘enough’ for their future, for tomorrow’s needs as opposed to todays wants. This requires restraint and balance between savings and spending.

Preparing for a dynamic retirement

Amidst these uncertainties, it is important to remember the heart of retirement planning: moving you steadily towards your goals, achieving income sustainability and flexibility along the way.

Many factors are at play throughout this process, and it truly helps to have a second opinion (e.g. a financial adviser) to discern the best options amidst the sea of information around you.

Here are just some of the factors that can influence how your unique, dynamic “journey” might unfold for your retirement planning:

- Whether you can still work and your willingness to “unretire”.

- The size of your state pension and that of your spouse/partner

- Defined benefit (DB) schemes – if any.

- Rental income, perhaps from a buy-to-let.

- Any plans for downsizing in the future.

- The likelihood of you inheriting a lot of money.

- Health and longevity.*

- Spending habits, such as fine dining or long-haul holidays.

- Goals (e.g. expensive travel or gardening?)

- Personal circumstances, such as whether you live with dependents.

* You may live longer than you think. Check out the image below about ‘Planning for a longer future.’

That’s a lot to consider when crafting a retirement plan. Add into this the “wider” picture – changing lifespans, interest rates, pension options, and government policy – it is little wonder that many people feel overwhelmed.

You are not alone. Whether you are nearing retirement or considering long-term strategies, there has never been a better time to educate yourself. Amazing resources are available in 2025 to empower you to build a dynamic retirement.

If you are unsure where to start, I suggest taking time to learn about the “behavioural” side of finance – i.e. why we make decisions, how they affect us, and how we can make better choices which improve our options (e.g. sustainability and flexibility!)

You do not need to become an investing expert. However, you should become an expert in knowing yourself. For instance, if you fear market volatility, why is that so? If you feel uncomfortable spending money, where does that come from?

To explore this further, I suggest reading my article “How to Outsmart Common Behavioural Biases in Investing”. You can also peruse this article we wrote about “Keeping Your Cool When the Markets are Volatile”.