Following several years of global challenges, the collapse of SVB and subsequent turmoil in the banking sector is the latest crisis to dominate the headlines. It has been reported that this is the largest banking failure since 2008, with implications for the wider market and the economy. Many investors are concerned about how their own situation will be affected.

In this guide, we explain how you can keep a cool head and invest successfully, regardless of what’s going on in the market.

Focus on What’s Important

Financial planning is not about the daily fluctuations in the market or the ability to buy low and sell high. It is about your goals and creating your desired lifestyle – managing your money is simply a means to achieving this.

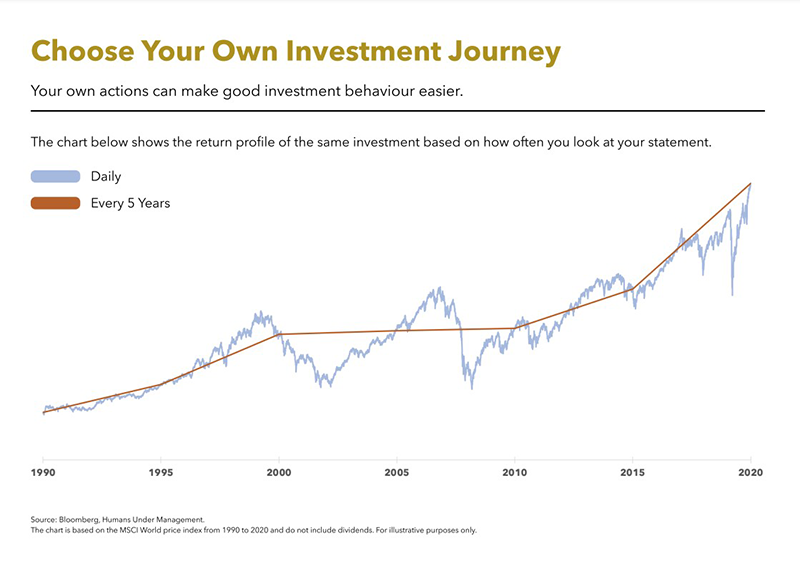

Checking your investments daily and worrying about the ups and downs can distract you from your long-term plan. If you know what you want to achieve, there is only one question that you need to ask when it comes to your investments – are you on track or not?

A cashflow plan can help you build your investment plan around your lifestyle and goals. This takes a number of assumptions around investment returns, inflation, and life events to create a projection of your financial future. The idea is to start with some reasonable estimates and adjust as you go along.

By looking at the bigger picture, short term volatility becomes easier to deal with.

Decide What You Can Control

We can’t control the market, the economy, or world events. We simply need to accept that there are ups and downs and create a plan that works around this.

There are a few things you can do to increase your chance of success:

- Invest in a diverse range of assets from across the market. This helps to spread risk and smooth returns. Our TRAILS™ profiles invest in over 12,000 stocks and 15,000 bonds. If any one company collapses, the effect on the portfolio is limited.

- Invest with reputable and financially strong investment houses. We undertake extensive due diligence and invest with global companies such as Vanguard, Dimensional, and BlackRock. The companies we use have strong controls over client money, which means that even in the unlikely event the provider itself fails, investors’ funds are ring-fenced.

- Invest at an appropriate risk level depending on your goals, timescale, and how much volatility you can cope with.

- Keep costs under control and seek value for money.

- Invest tax-efficiently, for example, by using your ISA and pension allowances.

- Make sure you have enough cash so that you can avoid dipping into your investments at short notice.

- It’s a good idea to spread your deposits in case of bank failure. The Financial Services Compensation Scheme will cover up to £85,000 of your savings with any, one banking group.

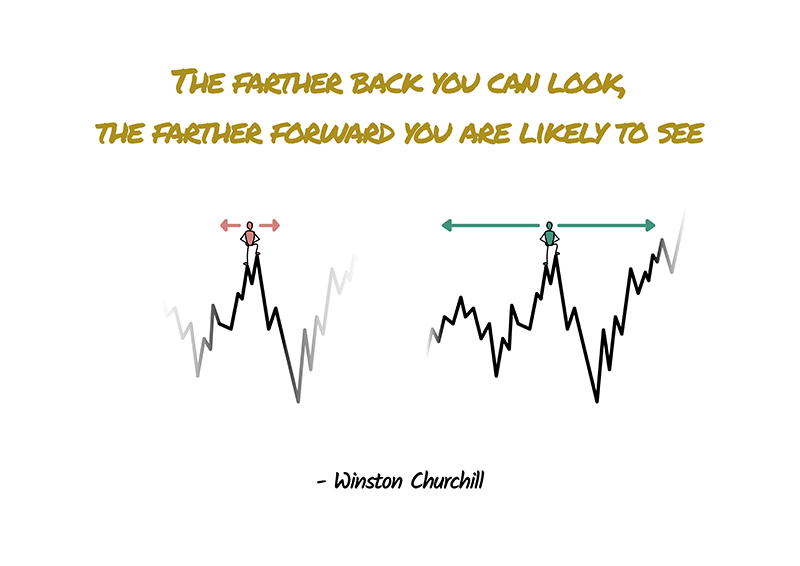

Think Long Term

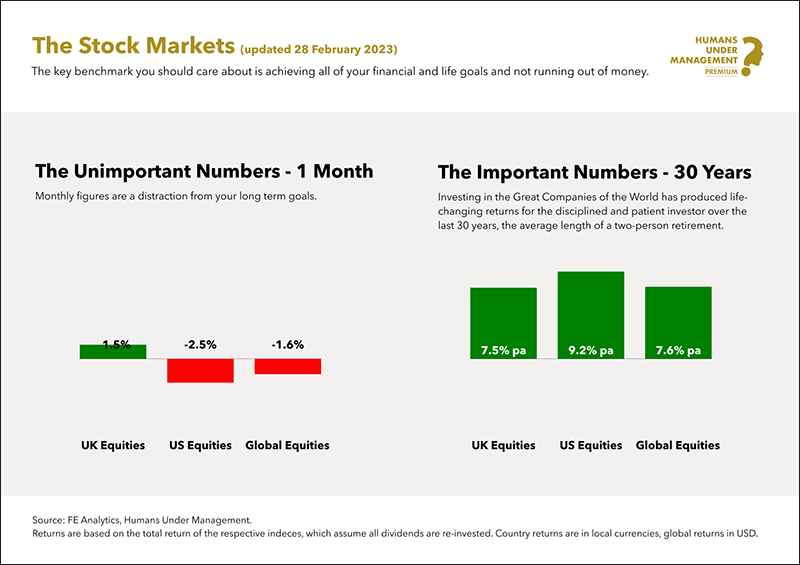

The market has, of course, taken a downturn following recent events. We have seen several significant dips in the market, including the recession of the late 1980s, the tech bubble of the early 2000s, and the financial crisis of 2008.

There are a couple of important observations to be made here. Firstly, a major market downturn (and potentially a recession) occurs roughly every ten years. The triggers vary, but ultimately, the economy needs to expand and contract at regular intervals.

Secondly, a dip is always followed by a recovery. This usually happens fairly quickly and restores the market to a higher point than before. Historically, there have been more good days in the market than bad, and the general trend is upwards.

If you are investing for more than 20-30 years, this is enough time for the volatility to be smoothed out. In fact, providing you invest in a diverse range of assets, you could normally expect to see positive returns in any five-year period. If your timeframe is shorter than this, the market could go either way and the safer option is to keep your money in cash.

Keep Your Discipline

Successful investing is not simply about making the right call at the right time. It is about creating a plan and sticking with it throughout different market conditions. For example:

- Avoid trying to time the market. It’s impossible to get this right consistently and is usually counterproductive. Time in the market is key.

- Invest in the whole market rather than following trends or stock tips.

- Don’t sell during a downturn as you won’t benefit when the market recovers.

- Make investment decisions that are led by evidence and reasoning rather than emotion.

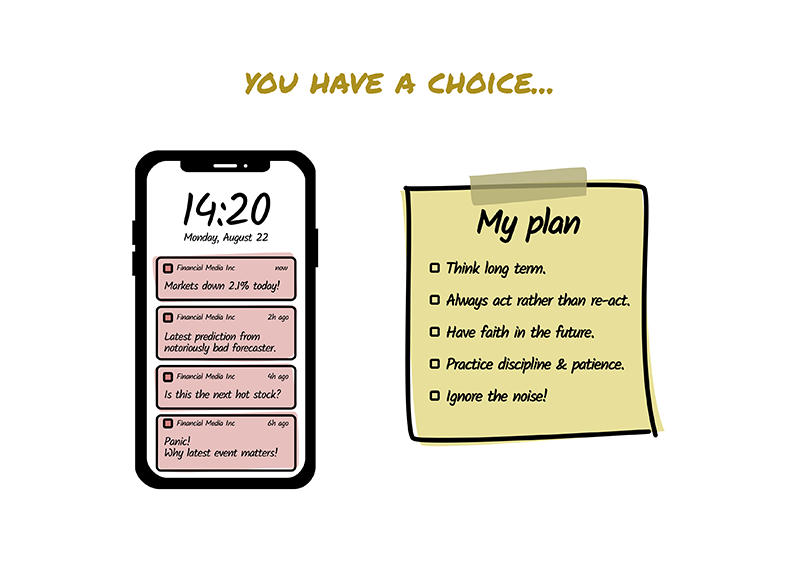

Ignore Sensationalist Headlines

Stability and discipline do not make good headlines. When you see something in the financial press that causes you to worry, remember, they are in the business of attracting attention. If a headline creates fear or panic, there is a good chance that the public will want to find out more.

While we can expect certain ethical standards from reputable newspapers and TV broadcasters, financial influencers are not regulated. Some promote sound principles such as saving a proportion of your income and investing passively, while others suggest that you can get rich quick by investing in crypto or borrowing heavily.

Rather than paying attention to headlines or social media, it’s worth doing your own research, seeking advice if required, and sticking with your plan.

Remember This Will Pass

In the midst of financial turmoil, it can be difficult to see the next steps. We have had a challenging few years, and still face a cost of living crisis and potential recession.

To give yourself the best chance of success:

- Focus on your own plan and goals. What can you do today that will improve your life?

- Review your plan regularly and make small adjustments over time rather than bigger changes later in life.

- Spend time with family and friends and look after your health. Some things are more important than money.

- Remember, volatility is temporary and is simply part of the market cycle. Things will get better. It just takes time.

Please don’t hesitate to contact a member of the team to find out more about the topics covered.