With the challenges the world has faced over the last few years, coupled with a cost of living crisis and looming recession, many people have a gloomy view of the future. This is not helped by the media, who tend to speculate over the worst case scenario.

2022 has certainly been a difficult year for investors. Equities have been volatile as we would expect. But bonds, traditionally a stable asset class, have taken the brunt of recent inflationary pressures and rising interest rates.

As well as economic concerns, we must also consider the impact of war, climate change, and a widening wealth gap. With 24 hour news coverage, it’s easy to believe that things have never looked so bleak, and if only we could return to the ‘good old days’ all the problems in the world would be solved.

Reality is never so simple. Looking at the longer-term view, there are plenty of reasons to be cautiously optimistic about the future.

The World Has Never Been a Better Place

We constantly hear about how the fabric of society is deteriorating and quality of life is worse than ever. But is that actually true, or is it simply a result of wider news coverage, more platforms for people to voice their opinions and lightning-quick sharing on social media?

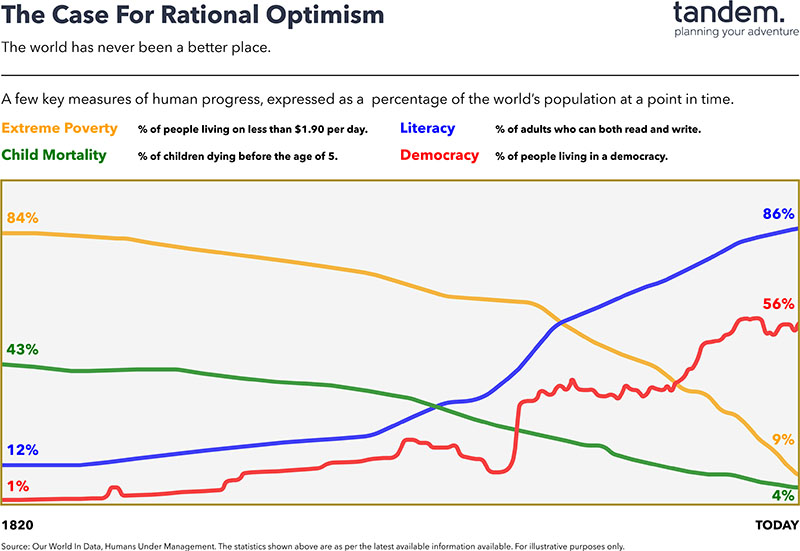

In reality, many of the key measures of a prosperous society have continuously improved, as shown in the chart below:

The wealth gap may be increasing, but fewer people than ever are living in extreme poverty. The NHS is stretched, but child mortality is at the lowest rate in history. We may be frustrated with politicians at home and abroad, but our democratic rights have never been more robust. And despite evidence to the contrary on social media, literacy levels are constantly improving.

Of course, there are challenges today that didn’t exist in the past. Moving more of our lives online means both greater scrutiny and less in-person contact. But returning to the good old days often mentioned would wipe out years of technological, social, and healthcare improvements.

The evidence suggests that we should be optimistic, because throughout human history, things have continued to get better.

Everything is Cyclical

There is no denying that we are currently in an economic downturn, and that there is probably some financial pain ahead.

But this is not the first time we have encountered a recession, spiralling inflation, or rapidly rising interest rates. We expect all of these things to happen at some point, otherwise the economy would no longer be functioning. We might not know the depth of the recession or the timing of the recovery, but we do know that things will get better at some point.

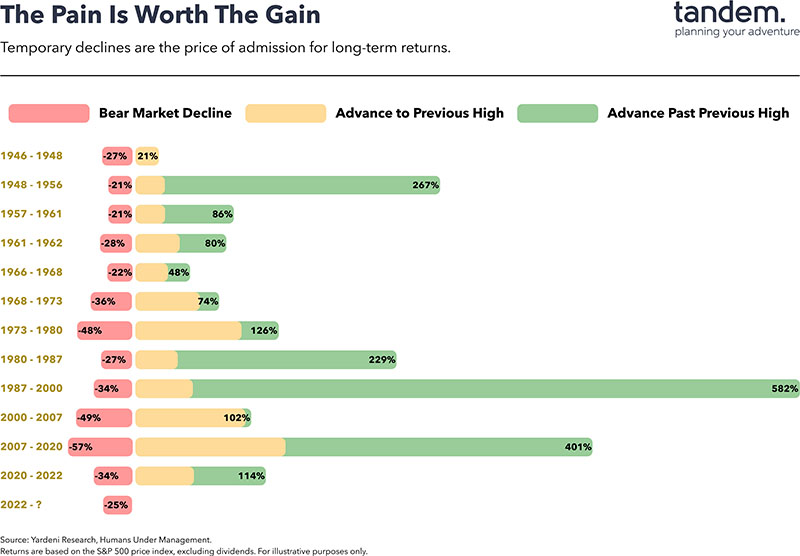

The graph below illustrates the impact of previous market declines and how long they took to recover:

These figures tell us a number of things:

- Market downturns are a fairly regular occurrence.

- Recovery always follows shortly afterwards.

- The recovery is usually more robust, and lasts longer than the decline.

- The markets return to a higher point than before.

Simply put, we need the lows for the highs to be possible. Volatility is a feature of investing – if returns were smooth, there would be no market.

To achieve long-term growth, you need to be in the market. Keeping your money in cash might offer capital protection, but the value will eventually be eroded by inflation. Selling investments during a downturn means missing out on the recovery and locking in underperformance.

We have already started to see signs of a recovery, with many portfolios producing strong returns over the last few weeks. The market may go up or down from this point, but these short term ‘rallies,’ multiplied over time, generally more than compensate for the downturns.

Control What You Can

There are aspects of your investment plan that you can control, and others you can’t.

You can enhance your investment plan by:

- Investing in the right asset allocation, taking into account your views on risk and what you want to achieve.

- Diversifying your investments so you are not concentrating too much risk in one place.

- Investing tax efficiently and making use of your allowances.

- Reducing costs where possible.

- Keeping enough in cash so that you are not tempted to dip into your investments early.

- Maintaining good financial discipline, and following the evidence rather than emotion.

You can’t control:

- The economy

- World events or politics

- Media coverage

- The timing of ups and downs in the market

A good financial plan means controlling the things you can, and working out how to achieve your goals despite the things you can’t control. Accepting the risks, and making a plan to address them, is far more effective than reacting to events as they arise. Turning off the news and focusing on your own financial plan will give you the best chance of success.

Please don’t hesitate to contact a member of the team to find out more about the topics covered.