As an investor, you likely have heard of stocks, bonds and property (e.g. Buy to Let). However, less commonly understood is the world of alternative investments.

This mystery can be alluring. Regularly, I get asked about investing in commodities (e.g. gold), wine, cryptocurrency, private equity and more. What do I think of these options as a financial planner? Are they good possibilities for an investment portfolio?

In this article, I’ll dive into the nature of alternative investing and some of the quirks of different asset classes within this broader category.

I’ll also make the case that, for most people, the “low-cost, evidence-based” approach to investing will be the best option for building the bulk of a portfolio.

What is alternative investing?

The definition of alternative investing is somewhat circular – i.e. assets that fall outside of the ‘traditional’ options. The latter tends to encompass stocks, bonds and cash (perhaps including certain property investments).

As such, alternative investing largely refers to “everything else, and can be more eclectic in nature. Think of the following:

Fine wine, classic cars, art, and gold bullion. These are often tied to collectibility, scarcity or physical appreciation over time.

Then, there are the “financially engineered” alternative investments. For instance, hedge funds, venture capital trusts (VCTs) and private equity. These get into “Dragon’s Den” territory.

Finally, you have the digital frontier of alternative investing. These include the likes of NFTs (non-fungible tokens, such as digital art), cryptocurrencies and other blockchain-based “assets”.

Somewhere within this mix lie commodities – precious metals like gold, silver and platinum, as well as crude oil, natural gas, even certain property investments – e.g. commercial buildings like healthcare facilities.

What makes them unique?

When we list alternative investments like these, we can start to see some common (albeit not universal) patterns.

Firstly, they usually lack the transparency and regulation of traditional markets. For instance, a company must jump through many strict legal hoops before getting listed on the London Stock Exchange (LSE). However, far fewer hurdles stand before a company listing in the Alternative Investment Market (AIM).

Secondly, alternative investments are typically more illiquid than traditional ones – i.e. they are harder to buy and sell quickly. Their pricing may also be less consistent or publicly available.

Thirdly, they are usually more exclusive. In particular, they might require greater knowledge or access to investors. The entry thresholds (e.g. up-front investment values) and ongoing fees may also be higher, although these may be justified on the promise of higher potential returns.

Navigating alternative investments

Many of these investments can be exciting to investors. They sound unusual and even exotic. We imagine ourselves dropping into conversations at dinner parties: “Well, I invest in wine…”

However, different does not always mean “better”. Different does not mean “diversified”.

As with any investment, it is vital to grasp what you are investing in before committing capital – especially the underlying value you are looking at, and the risks involved.

This is where alternative investing starts to be less compelling. They are often more complex and less transparent.

Significant issues can lie underneath the surface of what you are being sold. For instance, you might like the idea of higher potential returns offered by a private equity fund. However, these often involve locking in your money for several years. If life changes or financial emergencies arise, this lack of flexibility can create real stress.

The opaque nature of alternative investments can also be a problem. Do you really understand the complex strategies and derivatives going on “under the hood” at that hedge fund?

There might be multiple layers of legal and financial engineering limiting your visibility. If you cannot see how your money is being used, how can you be confident you will see it again?

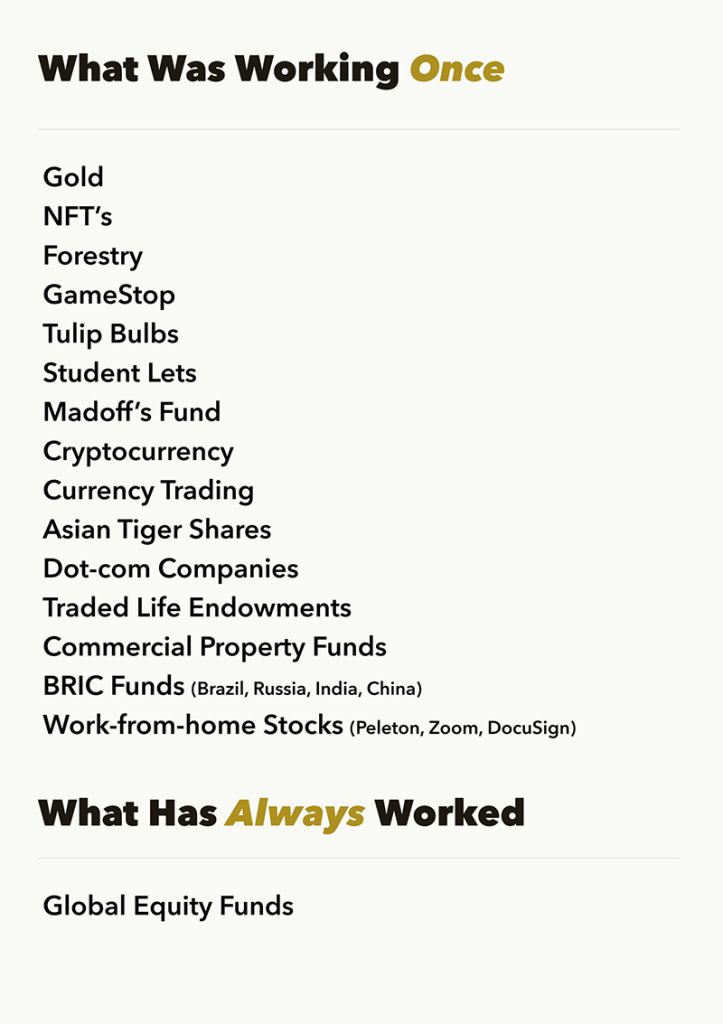

What has always worked is Global Equities (and better if held via a broadly diversified low-cost index fund!)

The 5% “play pen”

These are just some of the reasons I generally do not steer clients towards alternative investments. They are simply too risky, nuanced or obscure to offer peace of mind.

That said, I understand that it is human nature to be curious. We all want interesting things going on in our lives. Alternative investments can help scratch those itches.

So, if clients must engage in alternative investments, I often suggest the “5% play pen” as an option. Here, we agree on a 5% cap on alternative assets within a broader portfolio.

This can help satisfy emotional impulses whilst keeping your “serious money” protected from trendier or more speculative investments. This is about controlled exploration, letting you also benefit from the long-term compounding engine provided by traditional, market-cap-weighted investments.

The key here is to stay disciplined and avoid chasing performance. Resist the temptation to “top up” an alternative investment if it underperforms or even if it is performing really well! Talk regularly with your financial adviser and engage in periodic reviews.

I hope that helps. If you are yet to do so, we invite you to experience the Tandem difference. For those we currently serve, I hope these thoughts have helped and inspired you.

Until next time!

Your capital is at risk. Investments can go down as well as up. Past performance is not a reliable indicator of future results. Financial plans can be affected by inflation, market downturns and tax changes. The content of this article is for information only and does not constitute financial advice. Always seek independent financial advice.