There have been some volatile moments in markets around the world in 2024 (and certainly over the last 4 years). How can investors stay calm and true to their long-term strategy during periods of turbulence?

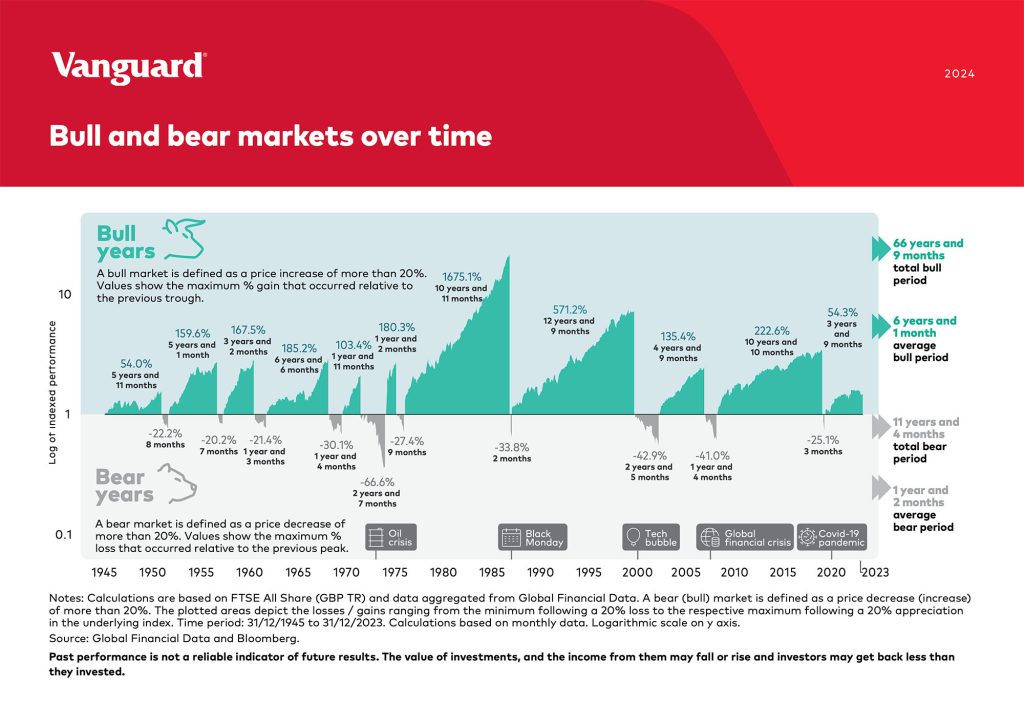

A bull market is typified by a sustained increase in prices. In the case of equity markets, a bull market denotes a rise in the prices of companies’ shares. This has occurred in the last 12 months, especially since 1st Nov 2023. Equity markets have risen dramatically during this period with the S&P 500 and MSCI World Index at over 30% in the last 12 months, the DAX up over 25%, the FTSE All share at over 8.5%

A bear market is when markets fall by 20% or more. This can happen over a few weeks or even years. As an investor, the key is accepting that bear markets will happen.

The good news is that they are only ever temporary. Markets move on. If you stay true to the investment strategy agreed with your financial adviser, you put yourself in the best position to achieve your goals.

See the image below for all the bull and bear markets since 1945. There are FAR more bull markets than bear markets and each time the average period of a bull market is c. 5-6 x the length of a bear market.

Why do bear markets occur?

Economies and markets are dynamic. Consumer behaviour, trade relationships and prices change – for many reasons. Perhaps relations break down between two closely intertwined economies, slowing down imports and exports. A new government may take power and change policies about a key part of the economy, e.g. house building or financial services regulation.

Bear markets often (but not always) go hand-in-hand with a slowing economy, when poor economic data comes out, or during a recession. Maybe firms make fewer sales due to lower disposable incomes of the masses. Perhaps profits are squeezed by rising input prices or new rules about compliance or environmental protection.

These factors could lead to directors making unpopular decisions or outcomes, such as lower-than-expected earnings or suspended dividend payouts. Investors might then start selling their shares, leading to a fall in asset prices.

If these sorts of events occur simultaneously and investor sentiment goes down, it can lead to a bear market. At other times, it can be a clash of several random events that together result in falling equity prices, such as a public health crisis (e.g. SARS and Covid-19) or geo-political crisis (Persian Gulf Ware and the War in Ukraine). The point is that in most cases, it is hard (if not impossible) to predict how, and when bear markets occur.

Will there be a bear market soon?

Nobody knows the day or the hour of the next bear market. Similar to a weather forecast, there may be tell-tale signs of a storm coming. However, unfortunately, when it comes to markets, the more we know, the less we can predict. Sounds nuts doesn’t it?

The weather is not sentient. However, human beings are sentient, conscious beings. We are critical agents, and our thought process changes, as does how we react, via knowledge acquired throughout changes in markets and economies. This brings uncertainty and unpredictability into our equations. Yuval Harari illustrates this with an example in his book Homo Deus:

“Imagine …one day experts decipher the basic laws of the economy. Once this happens, banks, governments, investors and consumers will begin to use this new knowledge to act in novel ways, and gain an edge over their competitors…..once people change the way they behave, the economic theories become obsolete. We may know how the economy functioned in the past—but we no longer understand how it functions in the present, not to mention the future.”

In short, you cannot control when a bear market might happen. Nor can you accurately predict how long it might last, or when the next one will arrive.

A new Budget, a change of government, an election, wars, conflicts – these can all trigger economic change and market volatility, but it is futile to try to predict that one or more events will definitely result in economic or market decline (or assume that markets or the economy with dramatically improve).

Managing emotions during volatile periods:

So, what can you do when the next market storm finally arrives?

Nothing. Stay invested. Stay diversified. Don’t sell out. Ideally reduce your withdrawals. Remain calm. Don’t panic. Use cash. Don’t disinvest. Wait for markets to recover. It is all about controlling your behaviour and remaining rational. Not always an easy task!

It is tempting for humans to make knee-jerk reactions or panic. However, if you sell an asset out of fear of further price deterioration, you simply guarantee a crystalised loss. When markets later stabilise and grow again, you stand to lose out on the recovery.

This is why an “investor mindset” is so important – from the very beginning of crafting your long-term portfolio strategy. Volatility is par for the course. The question is not how to avoid bear markets but how you will manage your emotions when they arrive.

It helps to arm yourself with solid statistics and remind yourself of them during volatile periods.

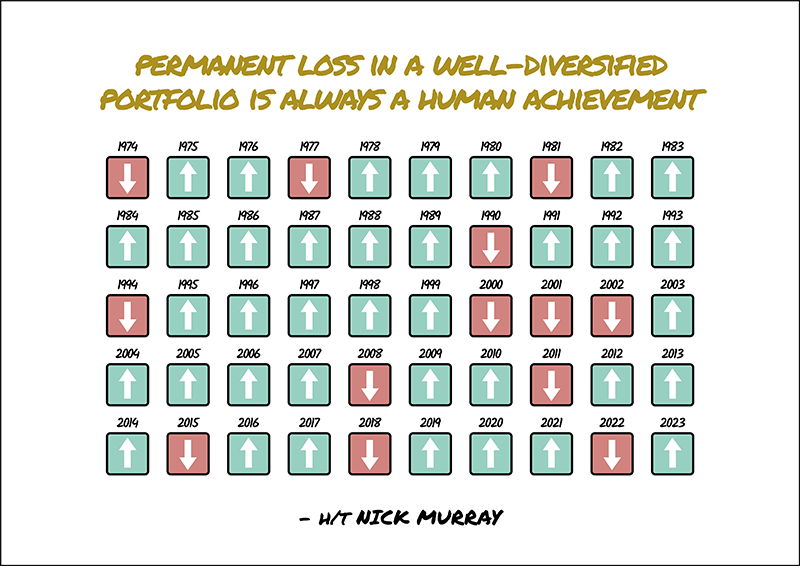

For instance, 1 in 4 years is negative (market return). That means 3 in 4 are positive!

Downturns are not rare. If you started investing in 1972, you may have endured at least eight global bear markets (from a sterling point of view).

Markets move on after they fall down. Be careful not to “time the market” – e.g. pulling out investments to try and avoid the market fall and jumping back in to try and ride the recovery. Remember, the worst and best trading days often happen near each other during conditions of high market uncertainty and distress – very difficult conditions in which to make rational decisions.

If you face the urge to “panic sell”, remind yourself of the statistics about cash. If you took your money out of the markets and held it for three months in cash, there is a 61% probability of underperforming a 60:40 portfolio (equity to bonds).

Over 6 and 12 months, these figures rise to 72% and 79%, respectively.

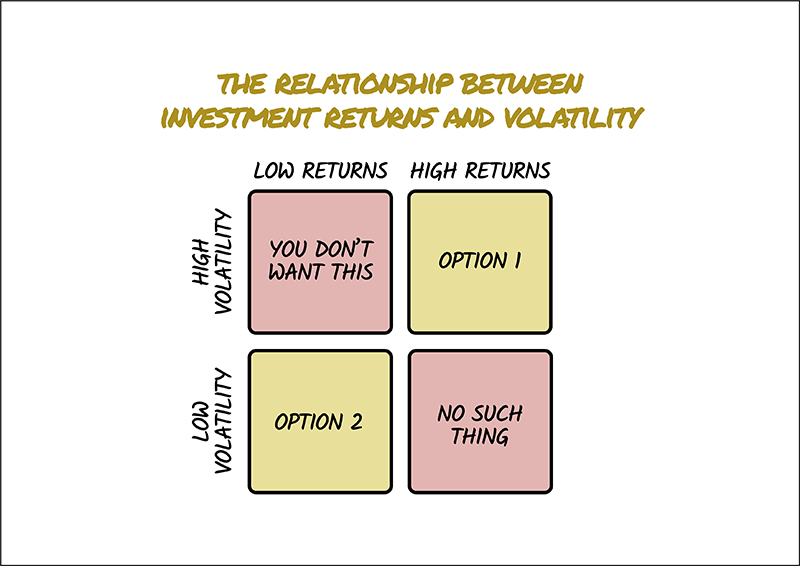

The relationship between investment returns and volatility:

If you want a low return with low volatility leave your money in cash or NS&I. But if you want a high return, you must use assets other than cash such as equities (stocks and shares). Investing means achieving a return higher than both cash and inflation. Global equities are the biggest driver of global growth and investment return. Everything else is noise such as property, commodities, alternatives etc. You just do not ‘need’ these. Bonds are used to reduce volatility (not for growth). See this simple matrix which explains how higher volatility is par for the course with any investment or asset class where you expect a high/er return.

How can you prepare for a bear market?

There are two things you can do – take psychological steps and practical ones.

Psychologically, try to keep your mind on the long-term view. A sailor in a storm runs higher risks if he focuses on the waves around him. Concentrating on the horizon, however, helps to keep a sense of stability and movement towards a destination.

In investing, this means avoiding the temptation to stare at the charts and price tickers in your portfolio during volatile periods. Instead, focus on long-term trends and goals.

For instance, a portfolio may fall 20% or more during a bear market. However, this does not mean your long-term strategy is derailed. For instance, a realistic net annualised return rate over 20 years is about 6% net per annum for a 60:40 (equity:bonds) model – even accounting for bear markets. For a model based on 100% equities, an 8% plus return per annum is more achievable over 20 years. The long-term difference factoring in compounding is massive as our model portfolio results show over 20 years. But, to achieve this higher return you have to be able to withstand the volatility. It is easy if you don’t look at it often!

On the practical front, you may wish to tighten your belt and spend less during a bear market. Paying down expensive debt can also be a good idea.

Be careful not to suspend your pension or other investment contributions. By continuing to contribute monthly (pay in) during volatile periods, you benefit from “pound-cost averaging” and may even buy some attractive assets on the cheap!

Maintaining a well-diversified portfolio during a bear market is sensible too. As the infamous Nick Murray has said, ‘permanent loss in a well-diversified portfolio is always a human achievement.’ Selling after a decline is not advisable unless absolutely necessary!

Certain investors may benefit from speaking with a financial adviser if they need to review their risk profile. For instance, rebalancing a portfolio to include more bonds could reduce some of your exposure to volatility. However, if you have a time horizon greater than ten years, this will likely result in a lower return in the future.

Please don’t hesitate to contact your Tandem adviser to find out more about the topics covered.