The global economy looks bleak at the moment. Having barely had a chance to recover from the peak of the pandemic, we are faced with an energy crisis, spiraling costs, and war. It is not only these issues that are causing the current market volatility, but also the uncertainty around how things are going to play out.

But none of these challenges are new or unique. For someone retiring today at age 65, think about what they have already lived through:

- The oil crisis of the 1970s

- Inflation levels peaking at 25%

- Black Monday and the recession of the late 1980s

- The tech bubble of the early 2000s

- The global financial crisis of 2007-2008

- Several wars and conflicts

Would this person have invested any of their first pay cheque in the stock market if they knew these events would happen?

How about if they also knew that innovation and technology would completely revolutionise every industry, leading to an unprecedented level of growth? Today’s giants, such as Microsoft, Apple, and Amazon all started within the last 50 years from humble beginnings. While you can’t necessarily pick out the titans of the future, you can assume that the market will continue to grow and innovate.

Of course, there are risks, but without some risk, there would be no concept of a ‘market’ and the historical level of return would not be possible.

What Does Long-Term Investing Really Mean?

If you invest, you should be prepared to stay in the market for at least five years. But this is the absolute minimum and does not really qualify as ‘long-term’ when we are thinking about a lifetime of investing.

Over a 25 year period, the US S&P 500 Index produced an average return of 9.8% per year. This means that if you invested £1,000 in 1997, it could be worth over £11,000 today. If you had instead contributed £100 every month, it could be worth up to £130,000. It is only when you take a long-term view that you really see the benefits of investing. This example also demonstrates the merits of regular premium investing.

The Practicalities of Investing

Above is a simplified example, as it doesn’t account for market timing or charges. Additionally, it is not really practical to invest directly in the shares making up an index – most investors would do this through tracker funds, which were not as widely available 25 years ago.

Another important consideration is diversification. The S&P 500 index is made up of US equities, which to be fair, do make up more than half of the world’s economy by market share. US stocks are a pretty good indicator of how global markets are performing.

But diversifying your investments is strongly recommended, as it avoids concentrating too much risk in one area. A well-diversified investment portfolio may contain a mix of equities, bonds, property and cash. It will also diversify by geographical region, sector and fund type (e.g. growth, value and small cap). Factoring in a long investment timeframe and a balanced attitude towards risk, we would expect equities to make up the greater portion of the portfolio.

How Does Diversification Affect Returns?

If you invest in higher risk assets such as equities, you can achieve higher long-term returns, but you also take more risk. There is also a great deal of variation within the equity market – a large, established company in the UK is likely to have a lower risk/reward profile than a tech start-up overseas. This is why it’s important to invest globally across different sectors.

Tempering the portfolio with a mix of bonds, property, and cash might reduce the potential for growth, but could protect your funds from excessive volatility.

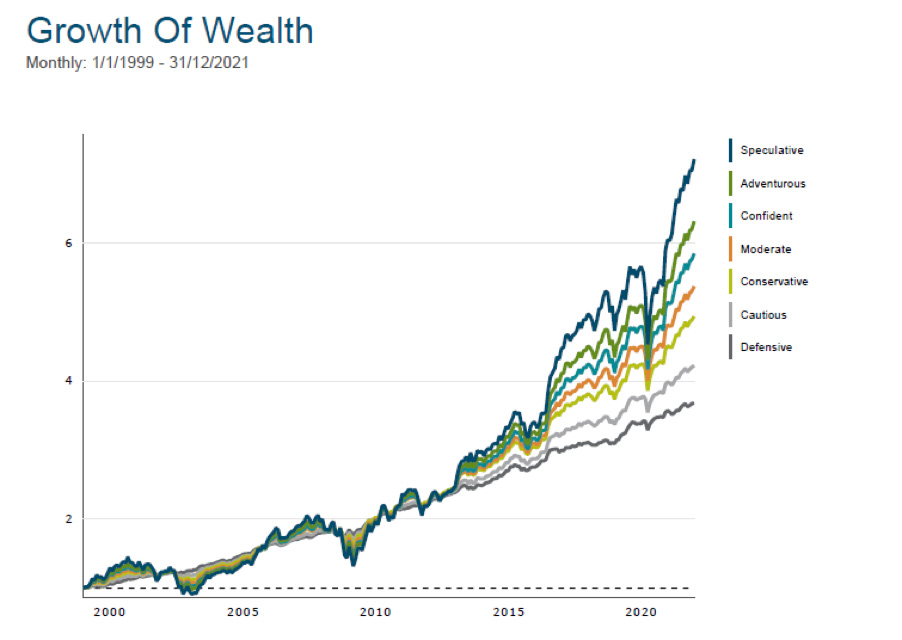

The chart below from Dimensional shows the 20-year return on portfolios ranging from ‘Defensive’ to ‘Speculative,’ (our seven TRAILS™ model portfolios) with each having incrementally higher exposure to riskier assets. The chart shows what £1 has grown to over 20 years:

All of the portfolios have produced positive returns over 20 years, despite some of the bumps in the market. The Speculative portfolio has produced the highest performance but has also taken the greatest hit during market downturns.

There is no right answer or ‘best portfolio.’ It is simply a question of investing in line with your own goals, objectives, and risk tolerance.

What Happens When Equities and Bonds Fall at the Same Time?

Diversification is based on the theory that equities and bonds react differently to the market conditions. When equities fall, bonds are more likely to hold their value and provide the portfolio with some stability.

Of course, it does not always work that way. In a period of high inflation and interest rate rises (like the last 6 months), both equities and bonds can become volatile. But this does not mean that diversification does not work. Remember, we are thinking about the long-term.

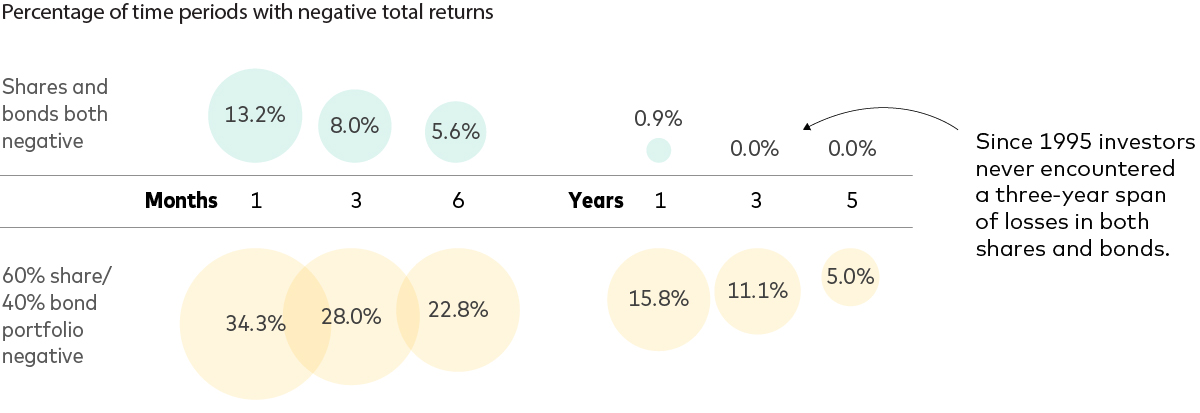

The chart below from Vanguard1 shows some statistics on a portfolio with 60% equities and 40% bonds since 1995:

The chart shows that since 1995, 5.6% of 6 month periods have incurred losses in both the equity and bond markets, with a resulting average loss of 22.8% in a 60/40 portfolio. However, only in 0.9% of cases has the negativity persisted for a full year. There has never been a three year period where both equities and bonds have made losses. While a portfolio might take some time to recover from these negative periods, the impact is lessened the longer you invest.

We have seen periods like this before. And remember, average returns do not form a straight line, but take into account the peaks and troughs of market volatility. A balanced, diversified portfolio, held for the long-term, is still the key to successful investing.

Please do not hesitate to contact a member of the team to find out more about investing and financial planning.

1 Why there is still plenty of life yet in the 60/40 portfolio | Vanguard UK Professional