In late July 2024, the new Chancellor, Rachel Reeves, announced that she would raise taxes in the Autumn Statement (expected on 30 October). Why is the UK government planning such a move, and how can you protect your finances?

To understand what is happening (and where the “axe” may fall with tax rises), it is important to look under the hood of the public finances. We must also look at Labour’s manifesto commitments leading up to their general election victory on 4 July.

Which taxes are off the table?

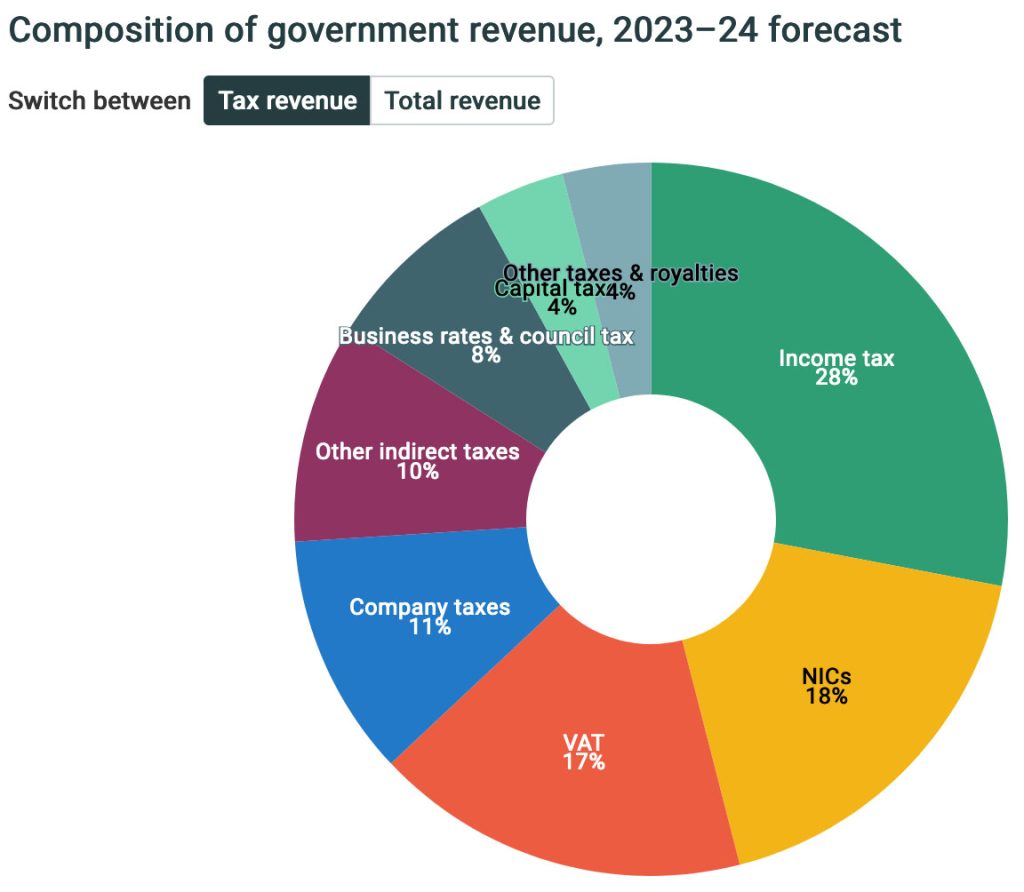

Before Labour took power in July, it promised not to raise taxes on “working people” – specifically mentioning income tax, National Insurance (NI) and VAT.

Source: IFS

These taxes raised 63% of total UK government revenue in 2023-24. There are over 40 types of taxes in the UK, but the aforementioned are the most important. This hugely constrains Labour’s options, with “wealth-related” taxes (e.g. capital gains tax) coming into the firing line.

However, the Government is further constrained by the UK’s fiscal rules, which have existed since 1997. In short, Labour cannot raise taxes too much. If they do, they will be accused of mismanagement (although this has not stopped previous UK governments from breaking the rules!).

It is worth noting that Labour has not abandoned the longstanding income tax freeze, which amounts to a “stealth tax” due to fiscal drag (i.e. taxpayers getting dragged into higher tax rates as their incomes rise).

Can’t the Government just cut spending?

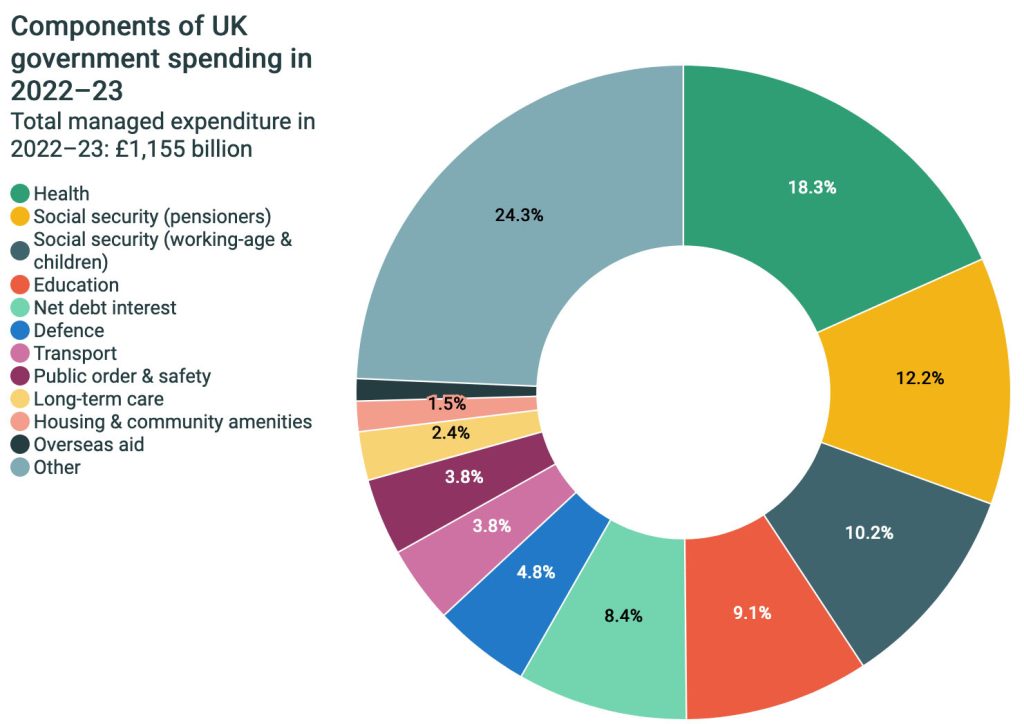

Few people are aware of how the UK government spends tax receipts. Most of it goes towards health, social security, education and net debt interest – totalling 58.2% of spending in 2022-23.

Source: IFS

In 2024-25, the figures are expected to be £1.139 trn HMRC tax receipts and £1.226 trn in spending. This shows a fiscal deficit (shortfall between receipts and spending) of £87bn, also known as PSNB – public sector net borrowing.

This is not to be confused with the National Debt – public sector net debt (PSNB). This is the total stock of UK government debt, which currently stands at £2.7trn, or 99.4% of GDP.

Labour has already announced a cut in spending by abolishing the universal Winter Fuel Payment (which it claims will save £1.3bn in 2024-25). However, this is a drop in the ocean compared to the £1,155bn spent overall in 2022-23.

We now start to see the heart of the problem. The UK’s fiscal deficit was £120bn in 2023-24, equivalent to 4.4% of GDP. This simply cannot be sustained. Labour will have to raise taxes, cut spending or both to restore confidence in the country’s finances.

What does this mean for you?

Right now, tax as a percentage of GDP is about 37% – the highest since World War 2. Raising taxes too far not only risks breaking fiscal rules but also risks excessively violating the Laffer Curve (the optimum tax rate for raising revenues, making further rises counterproductive).

As mentioned above, the government has ruled out income tax, NI, and VAT increases. However, plenty of other taxes will be attractive targets. Capital gains tax (CGT) and inheritance tax (IHT) are highly speculated for the Autumn Statement.

Changes to pensions could also be on the table – e.g. bringing them into an individual’s estate (meaning that they might be liable to Inheritance Tax), changing tax-free cash rules, reducing the annual allowance and altering the amount of tax relief when paying into pensions. This is ALL SPECULATION at present though. We cannot stress this enough. We don’t know the new rules until they are introduced.

How can you prepare?

It is generally not wise to plan or make big decisions with your finances based on the unknown or speculation. With that said, there are steps you could take after discussing with a financial adviser.

Consider using your CGT allowance (for both spouses if married or just you if single). This stands at £3,000 for 2024-25. You can also factor in losses from previous tax years. If you don’t use it, you lose it. You cannot use any previous years’ allowances, but you can bring forward losses incurred.

This will be most relevant if you own direct shares, or collectives (e.g. Unit Trusts or OEICS, or ‘funds) in a general investment account (GIA), or other assets you can or want to sell before any possible increases in CGT. Remember, any unused CGT allowance is lost when the new tax year arrives! Since we are so close to the Budget on 30th Oct, it is unreasonable to sell any investment properties (Buy-to-lets) between now and then as it usually takes 3-4 months minimum to sell a property.

For pension planning, consider fully using the maximum annual allowance (£60,000 in 2024-25). Also, use ‘Carry Forward’ if you can where you utilise allowances from previous tax years. If you are a Higher Rate taxpayer, make sure you claim the extra 20% relief on your tax return (25% for Additional rate taxpayers) to get the full extra “boost” to your contribution from the government! You do this by via your self-assessment/ tax return.

If you are married or in a civil partnership, consider putting cash savings in the lower taxpayer’s name. A Basic Rate taxpayer can earn up to £1,000 from interest without tax, and the rate after that is 20%. Someone on the Higher Rate, by contrast, only gets a £500 Personal Savings Allowance (and Additional Rate taxpayers get £0). Paying your marginal rate of tax (20%,40% or 45%) on interest after your allowance, can be a lot!

Make the most of your ISAs and Junior ISAs and use the Marriage Allowance (if relevant). For estate planning, consider using your annual exemption, which is £3k per adult per tax year. This means gifting up to £3,000 annually and it is outside of your estate on day one.

Other IHT-saving mechanisms may be available to you, such as the Nil Rate band and RNRB (residence nil rate band). Under current rules as a couple, you can have as much as a one-million-pound estate and pay no Inheritance on second death. However, this depends on your circumstances, your estate size and any gifts you have made in the last seven years, as to what allowances you have.

Mitigating or saving inheritance tax is a complicated subject and involves creating a strategy using gifting, bonds, trusts, and protection products. Sometimes for the right client, we explore using other tax-efficient options, such as utilising BPR-type products (Business Property Relief) via AIM-listed investments. This is certainly a higher risk, but has its place for the right client.

Please do not hesitate to contact your Tandem adviser to find out more about the topics and points covered in this article.