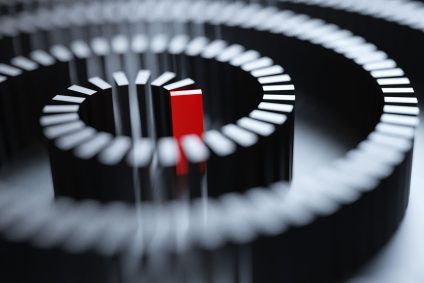

It has never been easier to research and buy your own investments and there are multiple tools online that allow you to build a basic cashflow plan. However, the technology that has made all this possible has also created distraction and an overwhelming array of choice.

A financial adviser can help you to focus on what is important to you and filter out the rest. A financial adviser can: save you time, can find solutions to your specific goals and objectives, can research and explain your options, then help guide your decisions. A good financial adviser can produce a tailormade strategy and above all can help make sure that you not only do not worry about money, but that you do not run out of money.

Of course, advice is not free, so it is important to ensure it is money well spent. To fully benefit from financial advice, you should understand how your adviser can help you, and the factors that are out of their control. In this article, we look at the main areas where your adviser can help you, as those where there are limitations.

They Can Align Your Investments to Your Goals

With thousands of investments to choose from, how do you know you have selected the right ones? A financial adviser will use your goals and objectives as the starting point rather than selecting funds that look good at a given time.

Constructing an investment plan is a multi-step process that works as follows:

- After establishing what you want to achieve, your adviser will determine how much risk you can, or should take with your investments. If you have a long investment timeframe and can cope with some ups and downs, a portfolio of mainly equities may suit you. Equities offer the best chance of long-term returns and beating inflation. If you are close to retirement, it might be appropriate to incorporate some more stable assets, such as bonds and cash.

- Creating a diverse asset allocation is the next stage. Holding a wide range of investments across a range of asset classes, sectors, and world regions can allow you to benefit from market returns without too much concentration in one area.

- Next, your adviser will select the most appropriate investments for you. They will take into account costs, performance, volatility, and the track record of the fund manager.

- Importantly, your adviser will regularly review your investments to ensure they remain suitable for you.

Constructing a financial plan is separate to the investment plan. The financial plan is the roadmap, the strategy. It is the holistic overview of your current circumstances, intertwined with your personal dreams and aspirations. It includes recommendations, tax-planning and realistic projections that help you not only cover any shortfalls but achieve financial independence. Besides building a personal financial plan, a good adviser will help you focus. They will help you stick to it during the tough times and help manage behaviour.

They Can’t Control Investment Performance

All the research and due diligence in the world cannot prevent investment fluctuations. Funds rise and fall on a daily basis. This is simply a consequence of investing.

While it can be worrying when investments drop in value, you should bear in mind that the best days in the market often quickly follow the worst. This momentum is vital for longer term growth. Over a 5, 10, or 20 year period, most well-diversified portfolios will increase in value, even if the road is a little bumpy at times. Remember, that when unit prices fall, you are not losing units. It’s like your home falling in value. You don’t lose any bricks!

They Can Coach You to Make Good Decisions

Investing takes discipline, but that is very easy to say when it is not your own wealth at stake. Money and emotion are intertwined, which can make it difficult to make objective decisions. Some common investment mistakes include:

- Buying stocks at the top of the market due to historical performance.

- Concentrating too much in an area you feel will do well.

- Selling your investments when the market dips, meaning that you miss out on the recovery.

- Being led by opinion and advertising rather than hard data.

- Paying too much for your investments.

A financial adviser can give you an objective view to ensure your decisions are guided by facts and long-term planning.

They Can’t Time the Market

Knowing when to buy and sell is the key to successful investing. If you buy at the lowest point and sell at the highest point, you can’t go wrong. Of course, you need to replicate this across every investment that you hold, as well as continually researching new opportunities. You not only need to understand how the economy works, but also how every world event and micro-trend will affect your investments. You also need to work this out before everyone else does, otherwise any advantage you can gain will be priced out.

Sound complicated? An open secret in the investment world is that even the most successful fund managers in the world cannot time the market. They can make some good guesses and construct robust portfolios, but there is no magic bullet. So focus on the things you can control like keeping costs low, diversification, tax-planning and mindset.

They Can Save You Time and Stress

If you select your own investments, you have a lot of decisions to make. How much risk to take, which tax wrappers to use, and which companies offer the best value for money are all important questions to address before you invest.

You should also regularly review your investments to ensure they are compatible with your plan.

On top of this, you need to keep emotions in check and avoid giving in to investor biases.

If you are serious about your financial plan and investment strategy, delegating some of your decisions to a professional can be a weight off your mind.

They Can’t Predict the Economy

Economic factors will be one of the main variables in your financial plan. World events can cause markets, inflation, and interest rates to rise and fall. Investments are sensitive to these fluctuations, which means that sometimes the value will go down. Changes can impact an entire asset class, sector, or region, which means that selecting one fund over another similar one is unlikely to make much difference. We don’t know when the economy will shift, for how long, and which areas will be most affected.

But what we do know is that the economy moves in cycles. We know that there will be a recession at some point, just as we know that a recovery will eventually follow. The secret is to build a resilient financial plan that works around these events rather than simply planning for the upside.

Financial advisers cannot control the markets or the economy, nor do they have any insider knowledge about what (or when) you should buy and sell. Their expertise lies in analysing the facts, creating a plan that puts your goals first, and giving you the encouragement you need to achieve them.

Please do not hesitate to contact a member of the team to find out more about financial planning.