During times of market volatility, investors often focus on what they could be doing differently. This is simply human nature, as most people are loss-averse to some extent. Doing ‘something’ is sometimes easier than doing nothing when things are not going well. Take advice from the legend that is Jack Bogle, the father of indexing and founder of Vanguard:

“Just stay the course. Don’t do something, just stand there.”

Of course, this is a play on the traditional phrase ‘Don’t just stand there, do something’. Bogle believed in strategic asset allocation (buy and hold) and time has corroborated this statement.

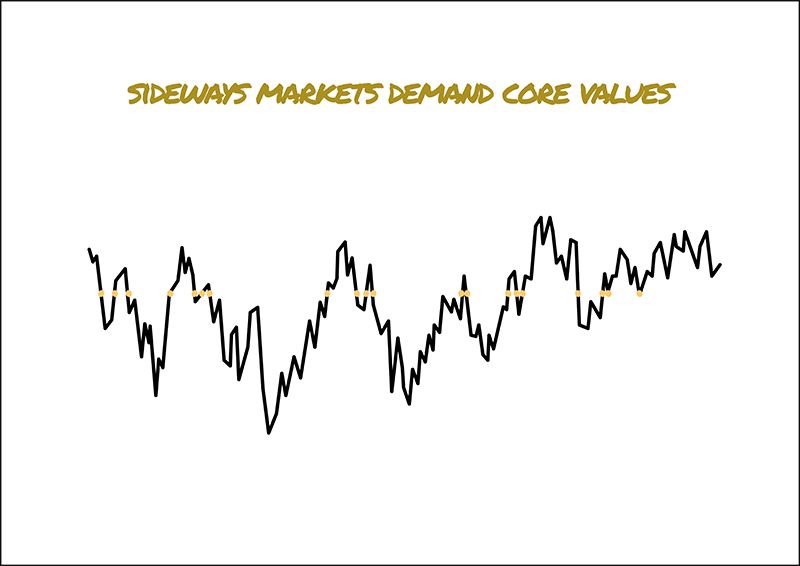

It is important to keep a sense of perspective and remember we have seen market volatility before. The tech crash of the early 2000s, the financial crisis of 2008 and beyond, and the recent pandemic have all had an impact on the markets.

We have emerged from all these situations with the market not only having recovered, but flourishing. The ups and downs create uncertainty, naturally, but this is how the market works. The lows drive the highs, and without some degree of volatility, there would be no market.

Panic selling or buying gimmicky investment products is not the answer. Instead, we must remind ourselves that there is something to be said for conventional wisdom and doing what has always worked. This means owning the whole market, diversifying, keeping costs low and letting the portfolio do its thing.

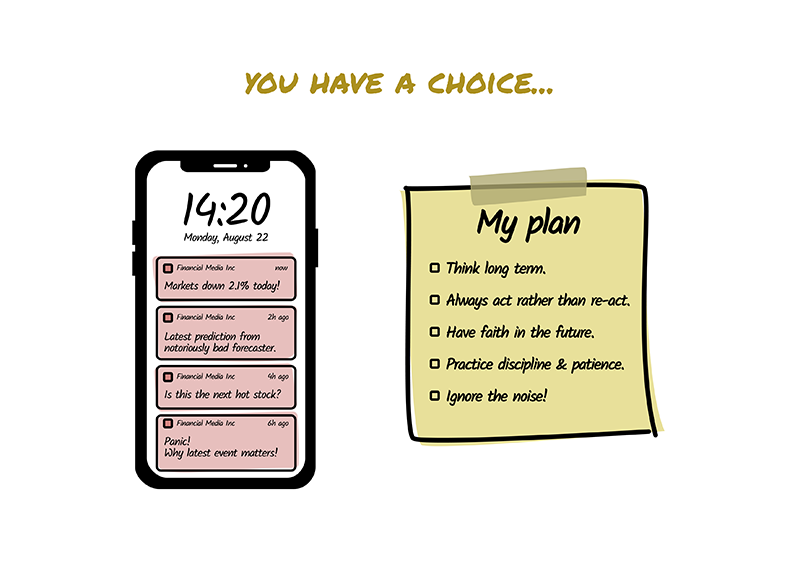

Focus on Your Goals and Avoid the Noise

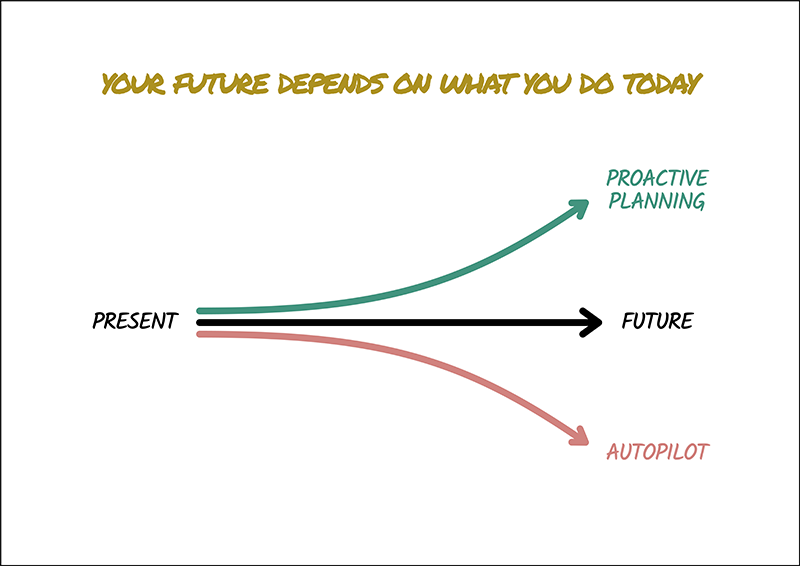

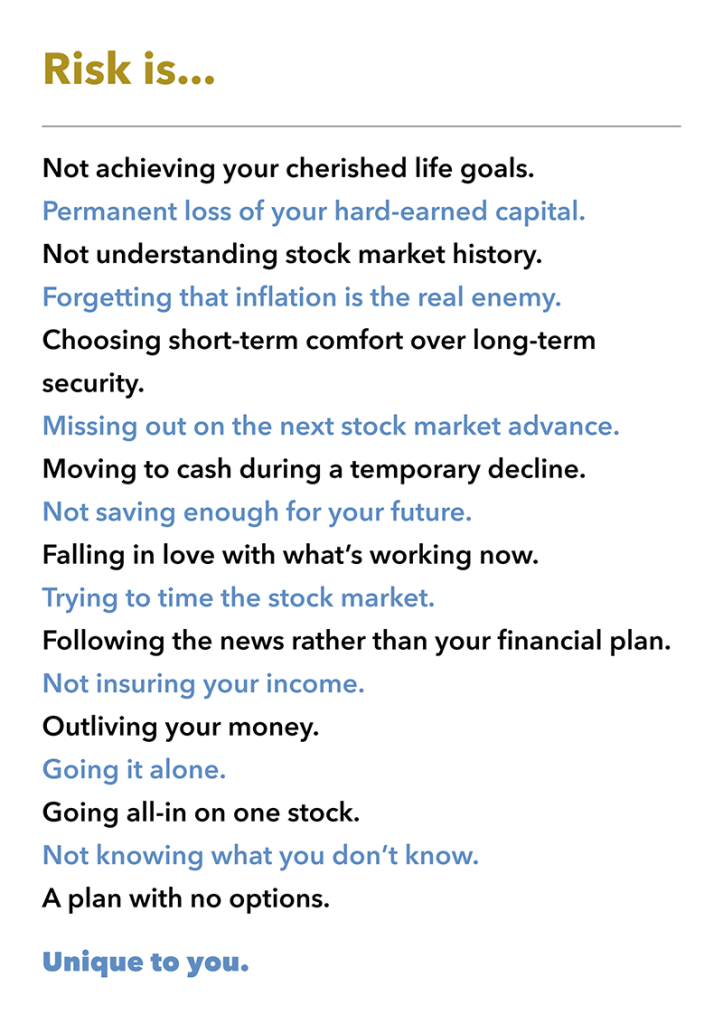

The purpose of a financial plan is to help you achieve financial independence, via a road map or strategy but above all, it should give you peace of mind. Investment growth and tax-efficiency play a part, but these are simply tools which serve a larger purpose.

Rather than thinking about the daily ups and downs in the market, think about your goals. What would you like to achieve, and what do you need to do to get there?

An investor who is focused on the present may panic when the market takes a downturn as all they see is a loss. An investor who is focused on their goals, on the other hand, is better equipped to take a long-term view.

There is a good chance that market volatility in the present won’t even have an impact on your goals ten or twenty years in the future. This is because growth doesn’t happen in a straight line, and historically a dip in the market is usually followed by an even more robust recovery.

The media is full of opinions on what you should buy and sell, and when. But this is simply a distraction. If you focus on the long-term and filter out the noise, you will have a better chance of achieving your goals.

Budgeting and Cash Management

Cash has an important role in financial planning, especially in times of uncertainty.

It’s worth keeping an eye on your budget and avoiding impulse spending. Keeping separate bank accounts for different purposes (e.g. bills, spending, and saving) can help with this. In general, look to have all bills come out of the same account and ideally a joint account if married. Having separate bank accounts can be healthy as well for a little independence.

It’s generally recommended that you keep an accessible cash reserve of at least 6 months’ expenditure. This means that if you are faced with an unexpected bill or are temporarily out of work, you don’t need to rely on debt or investments to support you.

Additionally, if you have any planned spending in the next few years, it’s a good idea to keep the required amount in cash. If you are retired, this can also mean holding enough cash to top up your income. This helps to keep control over when you take withdrawals from your investments so you are not forced to sell during a downturn.

If you wish to discuss what we consider the ‘best’ cash savings accounts or how you can allocate your cash, then do get in touch.

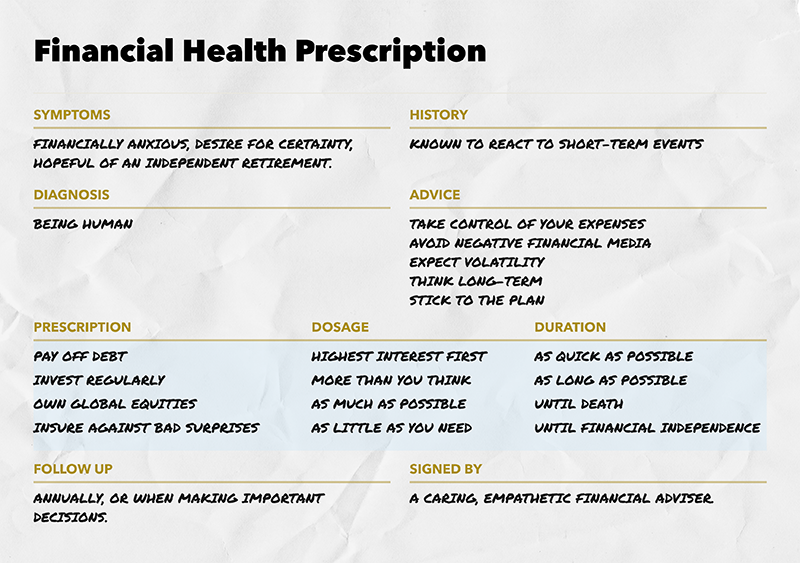

Plan for Debt

Debt has a purpose, but it can also quickly derail your plans.

In general, debt can be a good thing if:

- It allows you to add value, for example by buying a home or rental property, improving your existing property, or investing in your education.

- The interest rate is reasonable, and you can afford the repayments.

Mortgages and student loans are often essential, although depending on your situation, repaying them early could save on interest, especially at present with interest rates ‘back to the norm’ so to speak.

Credit cards also have a place as they allow you to build up a credit rating and offer some protection on your purchases. Of course, they should only be used if you can repay the balance quickly and won’t spiral into debt.

Most expensive consumer debt is best avoided. Not only can this incur significant amounts of interest, but it also takes up resources that could be used towards furthering your goals.

If you wish to overpay your mortgage and want to work out how much interest you will save, get in touch. It can make sense to do this if you interest rate is high but not to the detriment of any long term saving, especially pension savings given the tax relief you can receive.

Sensible Tax Planning

Avoiding tax is not a goal in itself. But sensible tax planning can help you to achieve your goals more quickly.

Some ways in which you can use tax planning to further your goals include:

- Making use of your ISA allowance every year for tax-free growth. The psychological effect is great too as an investment ISA should be seen as a 7-10 year plus wrapper.

- Topping up your pension for tax relief on your contributions and tax-efficient growth within the funds.

- Making use of your capital gains exemption to avoid building up larger, taxable gains in later years.

- Allocating assets between spouses to make use of reliefs, allowances, and exemptions.

- Considering other tax-efficient investments only where this fits in with your wider plan and you have carefully considered the risk/reward potential.

Investing With a Purpose

When you have a financial plan, investing has a different meaning. It is not about following stock tips or making tactical trades to try and beat the market. It has been proven again and again that even professional investors struggle to consistently outperform benchmarks.

The sole reason to invest is to help you achieve your goals. A sensible investor:

- Takes a reasonable amount of risk depending on their goals, timescale, and personal views.

- Keeps up contributions even when markets are difficult. Pound cost averaging means that when prices are high, you benefit from growth, but when prices are low, you can buy more for your money.

- Invests in a wide range of assets from across the market to maximise diversification.

- Avoids trying to time the market or make judgement calls.

- Aims to follow the evidence and avoid investor biases.

- Avoids ‘fads’ as well as ‘what is working now.’

- Remembers that gimmicky products or short-term trends are not the way to build long-term wealth. Just because a product has produced stellar short-term performance doesn’t mean this will continue, and you will often have high fees and significant risks to contend with. If something looks too good to be true, it probably is.

A financial plan is designed to give you the best chance of achieving your goals regardless of what is going on in the market. This will look different for everyone as it depends on what you want to achieve and where you are now. But in general, the best way to deal with a sideways market is to stick with your plan.

If you feel you do not have one, it needs updating or it needs tweaking, then please do not hesitate to get in touch. Contact with us here at Tandem adviser if you would like to discuss any of the topics covered.