Most investors understand that they should diversify their investments and hold a range of assets appropriate for their chosen risk level. It’s also generally accepted that the market will experience volatility from time to time.

What is volatility?

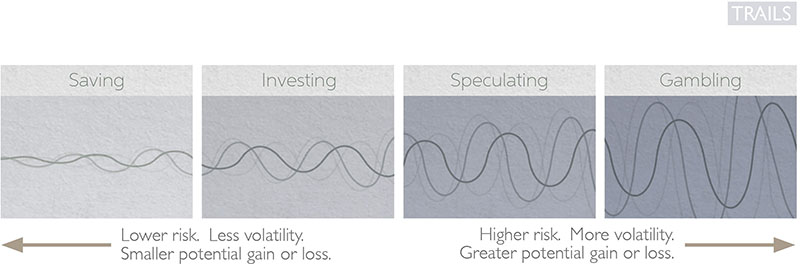

Stock market volatility is arguably one of the most misunderstood concepts in investing. Simply put, volatility is the range of price change a security experiences over a given period of time. If the price stays relatively stable, the security has low volatility. A highly volatile security hits new highs and lows quickly, moves erratically, and has rapid increases and dramatic falls.

Because people tend to experience the pain of loss more acutely than the joy of gain, a volatile stock that moves up as often as it does down may still seem like an unnecessarily risky proposition. However, what seasoned traders know that the average person may not is that market volatility actually provides numerous money-making opportunities for the patient investor.

“Volatility is the price of admission. The prize inside are superior long-term returns. You have to pay the price to get the returns.” Morgan Housel

Diversification

Diversification can help to reduce risk in your portfolio, smooth out some of the volatility, and allow you to capture market returns. By not investing too much in any one area, you avoid having too much exposure if things go wrong.

Our TRAILS™ portfolios are highly diversified. As an example, our Peak District portfolio (broadly suitable for a balanced investor), holds 60% in equities and 40% in bonds. The equity portion includes 12,266 individual shares, while the bond component invests in 15,292 different fixed interest securities. This means that our clients will typically hold over 27,000 different investments within their portfolio.

This is achieved by investing in index funds from well-known investment companies such as Vanguard, Dimensional, and BlackRock. Investors can benefit from market expertise, low costs, and wide diversification, even with fairly modest investment amounts.

But what does this really mean for my investments? How does diversification work in practice, and should I be worried about volatility?

Below, we explain how we manage risk and volatility within our portfolios.

Asset Classes

The main asset classes are:

- Equities – shares in companies

- Bonds – fixed interest securities

- Property – referring to commercial property

- Cash

These asset classes all behave in different ways and serve their own purposes. For example, equities tend to be more volatile, but offer the best chance of long-term returns. Bonds are usually more stable and produce an interest yield.

Mixing asset classes is the first step towards diversifying a portfolio and can also help to balance the risk level.

“The true investor welcomes volatility.” Warren Buffett

Geographical Split

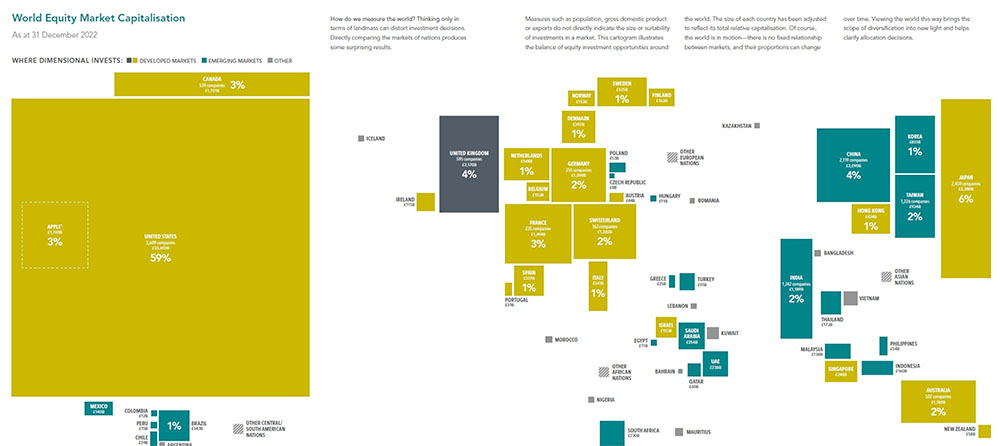

It’s also important to diversify by world region. UK shares don’t always rise and fall at the same time as, for example, US or emerging market shares. Investing globally means spreading your investment across various world markets.

But how can you decide where to invest? Many investors carry a ‘home bias,’ and will invest the majority of their portfolio in their own country. But this is not really based on solid evidence and can actually increase the risk.

The evidence tells us that investing in line with global market capitalisation is likely to produce the best outcome. The map below illustrates how the world market is apportioned between different countries:

Following this logic means investing around 50% – 60% of your equity portfolio in the US, with only around 5% in the UK. This may seem risky, but remember, the top holdings in the US market are global companies, such as Apple, Microsoft, and Amazon.

This means that your portfolio will naturally tilt with the ebbs and flows of the international market. You will benefit from global growth without needing to decide where to invest. This also means that the FTSE 100 is not a proxy for the returns in your portfolio, which are more acutely linked to the MSCI World Index. We want global market return so we must invest globally as per the market cap.

Sector and Company Type

Even within each world region, there is wide variation in the types of company you can invest in.

The shares in your portfolio will be spread across a range of different industries, for example, retail, technology, and infrastructure. While the shares in these sectors may be affected differently during the economic cycle, the majority of companies can be placed in one of two categories:

- Value – companies which are fair-priced, have healthy cashflow and produce steady dividends.

- Growth – companies with strong growth potential but may rely on borrowing and projected future values.

The size of the company is another important consideration. Larger companies are less likely to fail but may have limited growth potential. Smaller companies can be more volatile but have more scope to grow.

Our portfolios invest across a range of sectors and company types, but with a tilt towards value stocks and smaller companies. The evidence suggests that this is likely to optimise growth. We do this largely using Dimensional funds.

Individual Stocks

Our portfolios are diversified across a range of individual stocks, including many household names such as:

- Apple

- Microsoft

- Exxon Mobil

- JP Morgan Chase & Co

- Chevron

Again, the holdings are widely diversified across over 12,000 companies, with no more than 1.5% (usually much less) in any single company.

The reason we invest in such a wide range of assets is that the scope for diversification is so vast.

As it is not possible to time or predict the market, there is little value in tactical trading or stock-picking in our view. Some investors manage to beat the market, but it’s highly unusual to sustain this over the longer term. Investing in the whole of the market means that you benefit from the upside without needing to worry about buying or selling at the right time.

The Difference between Volatility and Risk

Volatility (or standard deviation) is the extent to which a stock or portfolio rises and falls, relative to its average return. The simplest definition of volatility is a reflection of the degree to which price moves, and in the case of investing we refer to the price of the shares or funds.

Volatility is not a risk in itself, as it is simply a standard feature of investing. It does come with risks, as if you sell your investments during a downturn, you may incur losses which are difficult to recoup. It’s also possible to invest in a portfolio with more volatility than you are comfortable with.

But it is not the only risk to be aware of. Investors also need to consider:

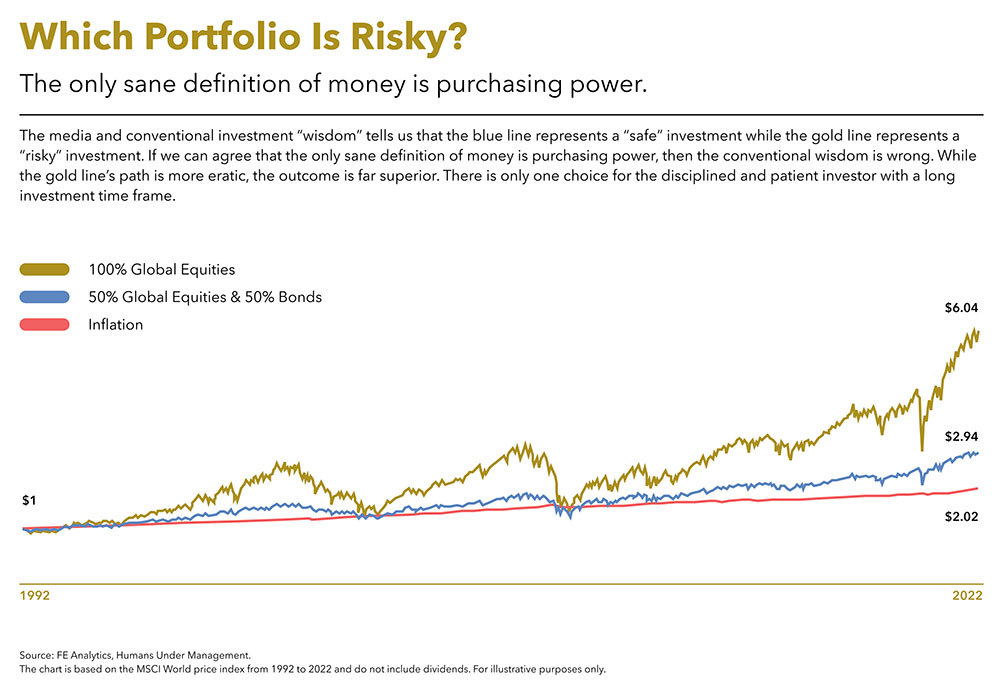

- Inflation risk – keeping your money in cash will reduce its purchasing power over time.

- Concentration risk – having too much exposure in one area.

- The risk that individual companies or investment managers will fail.

- Behaviour and biases that lead to poor investment decisions, for example, selling shares when the market is falling.

Investing in a diversified portfolio with an appropriate level of equities (depending on goals, risk profile, and capacity to cope with volatility) can help to address these risks.

What is risk?

Risk refers to the probability of loss. In terms of investment risk, this loss refers to the loss of capital or receiving lower returns than expected on an investment.

The work ‘risk’ is synonymous for many with the words uncertainty and danger. But risk can also mean adventure and one needs to take risk to achieve portfolio growth and returns above and beyond the safe return of cash.

Risk is a fundamental aspect of any investment decision and is inherent in all forms of investing. Investors face various types of risks, and understanding and managing these risks are crucial to achieving their financial goals.

Proper risk management helps to strike a balance between taking advantage of opportunities and protecting against potential negative outcomes.

Arguably, the two MAIN risks when it comes to investing, are:

- Loss of purchasing power (due to inflation).

- Running out of money.

The way you protect against these two main risks are:

- Invest in global equities (investing means 7-10 years plus)

- Have a withdrawal strategy when it comes to decumulation.

Why We Need Volatility

The fact that the market rises and falls, sometimes to an extreme, is the reason we have a market in the first place. If growth was slow and steady, fewer people would invest and returns would be limited.

Investors can benefit from both the highs and the lows. For example, if investing monthly, a low point in the market can mean buying more shares at a reduced price. This is known as ‘pound cost averaging.’

Generally, when the market falls, a recovery follows shortly afterwards. The recovery is usually more sustained and robust than the drop, and leaves investors better off than before. As we can’t predict the timing of the ups and downs, the key is simply ‘time in’ the market.

Cash looks attractive at present with interest rates at 5% and instant access cash accounts paying c. 4% with fixed term deposits paying closer to 6%. However, these returns are still less than the headline rate of inflation so the money is losing its purchasing power remaining in cash.

This doesn’t mean one shouldn’t enjoy some cash returns. As a rule of thumb, if approaching or in retirement, having 10-15% of one’s investment portfolio in cash can be sensible. This comprises cash for emergencies, known and unknown capital costs over the next 3 years plus 6-12 months of income.

But if returns we better in cash, no one would invest. It is about getting the right balance.

Please don’t hesitate to contact your Tandem adviser if you would like to discuss any of the topics covered.