As Nick Murray once said, there are two doors to retirement. One door leads to your money outliving you. This means you retain independence, choice, and dignity. You can leave a legacy and provide for the next generation, or at the very least cover your own long-term care costs.

The other door leads to you outliving your money (as in your money runs out). This means you risk losing independence, choice and dignity and become reliant on others, including the state.

Financial planning has many facets, but the simplest, and most important goal for many people is getting to door number one. This is a choice you make not only at retirement, but every day throughout your financial planning journey.

Below, we look at some of the key questions to consider when planning your retirement, and how you can ensure that you don’t outlive your money.

How Long Are You Likely to Live?

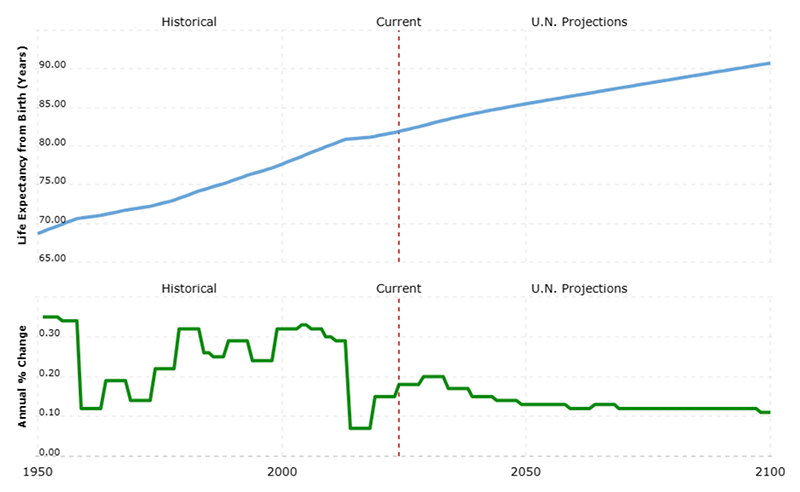

‘People live longer. You must invest accordingly. Advances in medicine have moved the average lifespan into the 80s, with many people living into the 90s. Where will it be over the next few decades? You’re left with two options — work longer and/or invest in assets that outgrow inflation’.

Life expectancy is still on the rise, as illustrated in the chart below:

U.K. Life Expectancy 1950-2024 | MacroTrends

The current life expectancy in the UK is 81.92, a small increase from last year.

But remember, this is only an average, and takes into account people who do not survive to retirement age. If you are retiring in good health, there is a strong chance that you will live to 90, 100, or even beyond. This means relying on your retirement pot for over a third of your life.

Many people do not plan for this and either don’t save enough, don’t invest appropriately to beat inflation, or erode their pensions and savings in the early years. This can lead to financial hardship later in life or even running out of money altogether.

When planning for retirement, it’s a good idea to assume a life expectancy of much longer than average and build your strategy around this.

How Much Money Do You Need?

‘How much you need for retirement = Income/withdrawal rate’

Even with the sophisticated modelling tools and calculators we have available, a simple rule of thumb can help to make sense of complicated ideas.

Retirement decisions can be overwhelming, not least of which is deciding how much money is enough. One method is to determine the ‘safe withdrawal rate.’

We typically recommend a safe withdrawal rate of 4% per annum, although this can potentially be increased to 4.5% if you are over age 65. This means that if you spend £30,000 per year in retirement, you will need to build up a pot of around £750,000.

The safe withdrawal rate also factors into regular reviews after you retire. Inflation, tax, investment fluctuations, and previous withdrawals will all affect your financial situation, and you might be able to draw more or less from your pot and still maintain your income for life. The withdrawal rate should be updated at least annually but typically we review this with you every 6 months.

A detailed cashflow plan can take this a step further and account for fluctuating expenditure, other income streams, and any lump sum requirements. The important point is to regularly review how much you are withdrawing from your pot and ensure this is likely to be sustainable.

A general rule of thumb is to have 10-15% of your invested portfolio in cash, so if you have an investment portfolio of £1,000,000 it is sensible to also have £100,000 to £150,000 in cash. This cash should be thought of as three buckets:

- Bucket one: 6 -12 months of income (£20,000 – £40,000 in this example)

- Emergency Pot: subjective but suggest £50,000 (perhaps premium bonds)

- Known/ unknown capital expenses over the next 3 years (e.g. holidays, refurbishment, new car etc.) This could be £60,000 in this example.

Total is £150,000 cash. This way you differentiate ‘income’ (£40k on £1m) from required capital expenses and you have some further downside risk to your portfolio.

Where Should You Invest?

‘The real long-term risk of equities is not owning them.’

‘Relying on “safe” fixed-income assets – savings accounts, CDs, and bonds – is fatal to your wealth.’

A common strategy when planning for retirement, and the main purpose of pension ‘lifestyle’ funds/ strategies is to transition investments out of equities and into ‘lower risk’ investments such as cash and bonds as you near your chosen retirement age.

There are a couple of flaws with this concept. Firstly, it was designed when the common route to retirement was to use your pension fund to buy an annuity. The idea was to reduce market fluctuations to protect your eventual retirement income. Most people now do not buy an annuity, but instead opt for income drawdown. This means that the fund remains invested and still needs to grow to maintain a reasonable retirement income.

Secondly, bonds and cash are highly unlikely to outperform equities over the longer term and may not hold their value when adjusted for inflation. Additionally, bonds can sometimes be highly volatile, for example, in 2022 when interest rates were rising rapidly.

Providing you keep enough cash to cover your needs over the next 2-3 years (say, 10% – 15% of your portfolio), there is no reason why you can’t continue to invest mainly in equities throughout your retirement. History tells us that equities have consistently beaten inflation and other asset classes when held for the long-term.

‘The key to ‘outperforming’ most other people is simply behaving

more appropriately than they do.’

Investor behaviour is one of the main risks of equity investing. Concentrating too much in one area, selling during a downturn, or trying to time the market are all likely to be detrimental to your portfolio.

The key to successful investing is time in the market. This means investing for long enough that any short-term volatility is effectively smoothed out.

How Should You Take Your Income?

‘Stocks aren’t meant for short-term — under 5 years — goals. Too much uncertainty. Possible returns aren’t guaranteed.’

‘Retiring in 5 years or less doesn’t count as a short-term goal. The under-5-year rule doesn’t apply because retirement is the start of a new goal — not to outlive your money. Retirement income must keep up with inflation for another 2-3 decades.’

The order in which you draw on your assets matters. When you are reliant on your investments to provide you with an income, you are exposed to sequencing risk. This means that if the market crashes in the early years, withdrawing too much can erode your fund and make it very difficult to recover from.

Taxation also needs to be considered, as if you make use of tax allowances and prioritise less tax-efficient investments for withdrawals, this can improve your long-term returns.

A suitable withdrawal strategy will aim to optimise asset allocation and tax-efficiency while reducing sequencing risk. You can find out more about income withdrawal strategies in our Tandem Talks video.

Decumulating (taking money OUT of your portfolio) is something we at Tandem are very adept at doing. When done correctly it means the you the client receive the income you need in the most tax-efficient way and as a consequence, you don’t need to worry about anything other than getting on with living your best life. Offering this peace of mind we feel is one of the greatest benefits of working with a good adviser.

Please don’t hesitate to contact your Tandem adviser if you would like to discuss any of the topics covered.

The quotes in this article are from Nick Murray’s book, Simple, Inevitable Wealth