On “Liberation Day” (2 April 2025), US President Donald Trump unveils a set of global tariffs on around 90 countries and regional blocs, including China and the EU.

The news sends shockwaves across the media landscape, with many commentators now predicting a high chance of worldwide economic contraction – and possibly a recession.

What is going on exactly? Should you be worried, and what does this all mean for your money? We try to explain what is happening, offer some analysis, some perspective, and some advice below.

What Are Tariffs?

Tariffs are taxes placed on goods imported from abroad. Governments use them to make foreign products more expensive, giving an advantage to domestic producers.

Say the UK imposes a 25% tariff on imported steel. If a British company imports £100,000 worth of steel from abroad, it now has to pay £125,000. That extra £25,000 goes to the government.

So, Who Pays for Tariffs?

Well, it is NOT the exporting country that pays the tariff. It is importers in the country imposing the tariff who foot the bill. And they often pass that cost on to consumers in the form of higher prices.

So while some politicians, like US President Donald Trump, insist that countries like China should be paying tariffs, the reality is that American businesses and consumers pay more for goods like electronics, clothing, and food as a result.

Who Benefits—and Who Suffers?

Domestic producers may benefit in the short term, as foreign competitors become more expensive. Consumers usually lose, paying more for goods that were once cheaper. Exporters (in the targeted country) can suffer if demand for their now more expensive goods drops.

But it is not always straightforward. If the foreign exporter decides to lower their prices to absorb some of the tariff cost, the pain is shared. Or, if domestic suppliers can’t meet demand, businesses and consumers are left with fewer choices and higher prices.

Here are a few historical and current examples:

- The Smoot-Hawley Tariff Act (1930) – In an attempt to protect American jobs during the Great Depression, the US imposes steep tariffs on thousands of imports. Other countries retaliate, global trade slows, and the Depression deepens. Economists still cite it as a cautionary tale.

- In 1987, Ronald Reagan imposed tariffs on Japan. Listen to his excellent speech on this matter in his radio address to the nation on Free and Fair Trade from Camp David. President Reagan explains the reasons for them and the result of protectionist tariffs, and how they are NOT a good idea, resulting in a drop in world trade and lost jobs. https://youtu.be/gFMyB8WMuDU?si=SKpYt37ygNbmLKuI

- Post-Brexit UK Tariffs – Following Brexit, the UK adjusts its own tariff regime. One example: UK consumers see the cost of some EU foods rise due to new import duties and friction at the border—costs that trickle down through the supply chain.

- The US-China Trade War (2018–2020) – Under President Trump, the US imposes tariffs on hundreds of billions of dollars worth of Chinese goods. China retaliates. Studies find that US companies and consumers bear most of the cost—not China. For example, American farmers are hit hard when China stops buying soybeans, leading to billions in government subsidies to support them. This period also resulted in a fall in equity markets.

Why has Donald Trump introduced tariffs globally in early April 2025?

Donald Trump introduced widespread trade tariffs primarily under the banner of “America First” — a strategic shift aimed at reshaping the global trading system to benefit the U.S. more directly. The reasons are a mix of economic strategy, political messaging, and geopolitical posturing. Here’s a clear summary of the key motives:

1. To Address Trade Imbalances (Especially with China)

Trump views large trade deficits — particularly with countries like China, Germany, and Mexico — as a sign that the U.S. is being taken advantage of. Tariffs are used as a tool to punish countries with significant trade surpluses and push for more “reciprocal” trade relationships.

2. To Boost American Manufacturing and Domestic Production

Tariffs on steel, aluminium, solar panels, and more form part of a strategy to make imported goods more expensive and thus give a competitive edge to U.S. manufacturers. The goal is to reinvigorate domestic industries and bring back jobs lost to offshoring and globalisation.

3. To Pressure Other Countries into Trade Negotiations

Tariffs serve as leverage — a negotiating tactic to bring countries to the table and extract concessions, like better trade terms or intellectual property protections. The tariffs are not just punishment, but bargaining chips.

4. To Challenge China’s Trade Practices and Global Rise

A significant focus is countering China’s state-led economic model, which Trump officials argue involves unfair subsidies, forced tech transfers, and intellectual property theft. Tariffs become part of a broader strategic rivalry with China, not just economic.

5. To Demonstrate Strength and Shift Global Perception

There is an undeniable element of posturing — Trump often speaks about not being “laughed at” by other countries anymore. Tariffs allow him to signal toughness and reassert U.S. dominance on the world stage.

6. This is Not Primarily About Reducing U.S. Debt

While tariffs bring in some revenue, reducing the national debt is not a primary goal — and in fact, the national debt has risen during Trump’s current presidency due to increased spending and tax cuts.

In Summary:

Trump’s tariffs are meant to be strategic, albeit controversial. They aim to reshape global trade, reduce trade deficits, protect U.S. industries, and put America in a stronger negotiating position. While some see it as bullying or isolationism, others view it as a long-overdue correction to an unfair system. The results are mixed — some industries benefit, but tariffs also lead to higher prices, trade tensions, and retaliatory measures, as well as volatile equity markets, bond markets and strains on the US dollar as the world’s reserve currency.

What does this mean for investors? What does this mean for you?

Tariffs affect more than just the price of imported goods. They influence inflation, supply chains, corporate profits, and consumer spending. In an interconnected global economy, tariff decisions — made with political intentions — have ripple effects across industries, borders, and portfolios. This is exactly what is happening right now. The global economy is adjusting.

If you’re investing globally or considering how trade policy might impact your finances, it’s worth remembering that the headlines don’t always reflect the underlying economic truth. Tariffs may sound like they’re aimed at foreign nations, but more often than not, it’s local businesses and consumers who end up footing the bill.

Has it worked? What has happened recently?

On 9th April 2025, President Donald Trump announces a 90-day pause on most global tariffs, temporarily reducing them to a baseline rate of 10%. This move marks a notable shift from his previously aggressive tariff stance and is driven by several key factors.

First, financial markets experience significant volatility, with bond yields spiking and concerns growing over potential economic fallout. President Trump’s decision to implement a 90-day pause on most tariffs in April 2025 is primarily driven by turmoil in the U.S. bond market, which signals a loss of investor confidence in response to his aggressive tariff policies. The pause is seen as a way to calm investors’ nerves and avoid worsening the situation.

Second, more than 75 countries signal a willingness to negotiate new trade terms with the U.S. The 90-day reprieve is intended to create space for dialogue and potential agreements, rather than immediate escalation.

Third, both domestic industries and international partners express concern over the widespread tariff hikes, prompting a reassessment to reduce economic strain and diplomatic tension.

That said, the administration takes a different approach with China, increasing tariffs on Chinese imports to 125%, citing ongoing grievances about intellectual property theft and unbalanced trade practices.

In short, while the tariff reprieve is a tactical pause for many countries, Trump doubles down on pressure where he sees strategic necessity — particularly in U.S.-China trade relations.

Why is the media panicking?

This description of tariffs might seem relatively sensible and benign. After all, isn’t the President just looking out for domestic jobs and protecting the industrial base?

One issue with tariffs is that they can cause other countries to retaliate. Indeed, in response to the Liberation Day tariffs on 2 April, China quickly responds with a new 34% tariff on goods imported from the US.

The end result is that goods often become more expensive. Clothes, food, cars, footwear and other items get pricier. Meanwhile, wages may not rise to keep up with rising costs. The result can be higher inflation and eroded real incomes.

Higher prices can lead to less consumer spending in an economy. Firms may struggle to sell as many goods, and the lower revenues can lead to cost cutting (e.g. shedding staff, contributing to more unemployment). The end result? Lower growth.

Indeed, this logic underpins much of the recent media melancholy about the UK. Since the US imposes its new 10% tariff on our country (lower than the 20% put on the EU), think tanks like Oxford Economics downgrade the UK’s economic growth forecast to below 1% in 2025.

Should I be worried?

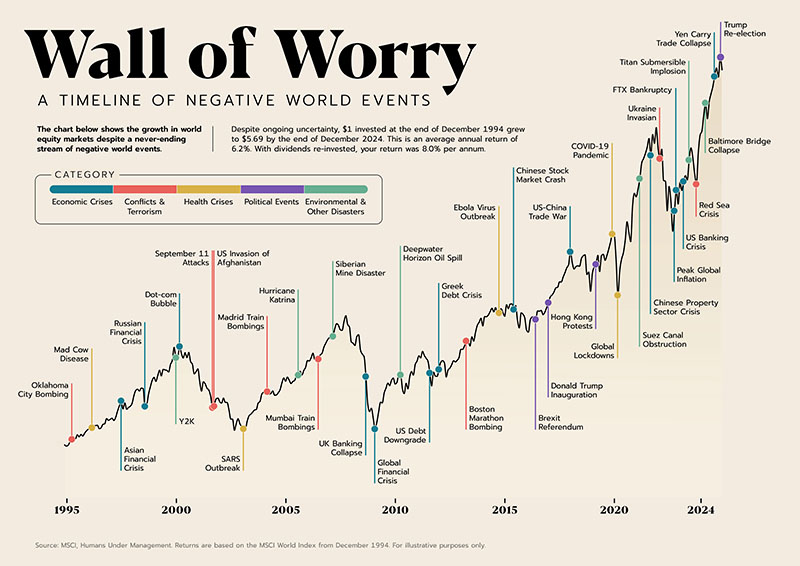

If you have held investments over the last 30 years, there will be some points at which you feel very nervous. See the ‘Wall of Worry Chart’ here for all the negative things that happen over this period.

But the markets march on, and the 2008 financial crisis (and various other major world events) barely registers a blip on an otherwise upward trajectory. There is no reason to think that the Trump Tariffs will be any different. Great companies do not suddenly become terrible companies. Great companies find a way to make money, to pivot, to adapt, to grow.

It is possible that the markets (and media) are overstating the impact of the Trump Tariffs on the UK. US exports account for 2.2% of UK GDP. This is much lower than the EU’s 3% average and Germany’s 4%.

In response to Liberation Day, Jaguar Land Rover announced it would suspend shipments to the US for at least two weeks as it decided what to do.

From the UK’s perspective, the broader threat comes from the US and eurozone possibly falling into recession. This is not a certainty. Moreover, the UK government’s commitment not to raise retaliatory tariffs on the US hopefully means the impact on inflation this year should be minimal.

Much of the current activity in the market is driven by fear or greed, causing investors to buy and sell at the wrong times. The best strategy is to stick with the plan and weather the storm.

Investor sentiment causes the markets to rise and fall, but ultimately, a sound investment strategy, held for the long term, is unlikely to fail.

What should I do?

In a recent analysis, Lewis Goodall, a British journalist on LBC, argues that President Trump’s decision to pause global tariffs indicates a lack of a coherent strategy. This move suggests that the administration’s trade policies may be more reactive than planned. For investors, this underscores the importance of maintaining a long-term perspective amidst short-term political fluctuations. Staying the course and not reacting impulsively to such developments is crucial.

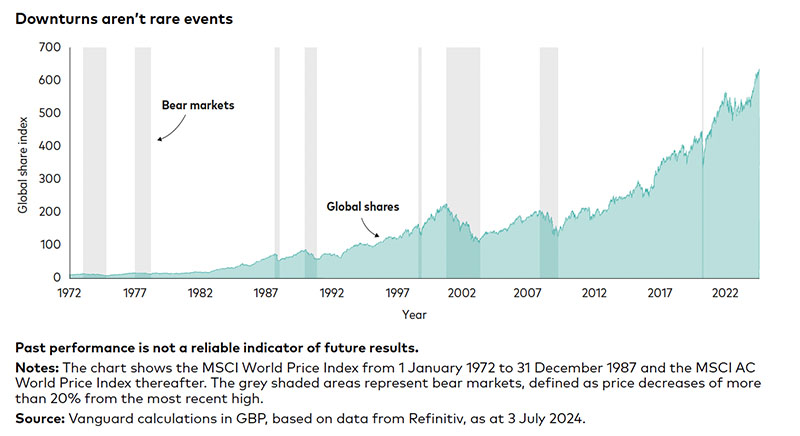

Just look at what happens on 9th April in US markets! The S&P is up over 9% in one day and the Nasdaq up over 12%. On 10th April, the UK markets are up over 3%. Both of these examples confirm the importance of staying in your seat, remaining invested and letting markets do their thing. It is clearly not over yet and so expect more volatility, but staying invested is the absolute best strategy — as the Vanguard document below illustrates.

In the short term, examine your budget and ensure your income can cover essential spending — even if costs rise overall.

Practical tips:

- Keep a strong emergency fund in case of harmful unforeseen events, such as job loss (e.g. 3–6 months’ worth of living costs). If you are drawing an income from your portfolio, you likely already have cash set aside. If you need to sell down more units, either reduce your drawdown, or stop altogether if possible — using other cash reserves until markets recover.

- Make sure your investment strategy and asset allocation remain in line with your time horizons, goals, and risk appetite. It is never sound advice to alter your risk profile during periods of market stress.

- Resist the desire to follow the herd. Investor biases like loss aversion are powerful and often work against your best interests. They can be exacerbated by negative headlines and social media. If the investor herd seems to be flocking in one direction, resist the urge to simply follow.

- Keep your focus on the long term. Remember, markets do eventually recover — even if they are volatile in the short term. Stay disciplined and focused on your goals.

- If you have spare cash, consider investing it or increasing your regular contributions. As Warren Buffett says, “Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble.” Buffett encourages acting decisively when assets are ‘on sale’ due to temporary fear or panic.

Time will tell how the new tariffs affect economies and markets. We are living in uncertain times, and the world economic order is arguably shifting in fundamental ways. But as we always say, market declines are temporary — and many of you have experienced this before in 2008, 2015, 2020, and 2022. This is just part of the journey. This (time) too shall pass.

If you are concerned, please know that our team is here to help and guide you. Bear in mind that the Trump Tariffs do not alter the fundamentals of good financial planning. We are always happy to help, so get in touch if you wish to discuss anything.