In a recent study surveying over 4,000 Americans, it was established that 64% valued money more than time. Given the ‘hustle culture’ prevalent across the Atlantic, this is not really surprising. But interestingly, those who valued time more than money were actually happier.

Now, there could be many reasons for this. People who value time more than money may not have to worry about bills or where their next meal is coming from. Having a baseline of financial security can have a significant impact on whether you are happy or not.

The link between time, money and health has been long-established. Poverty can lead to poor mental and physical health, which in turn, impacts the ability to make money or plan for the future. But valuing money too highly can also lead to overwork, stress, and not making time for loved ones and other interests.

Our society is built on the assumption that we will spend our best years working as hard as possible to accumulate enough wealth to support us when we get older. There is an element of sense to this, as we can’t always rely on a safety net and being self-sufficient in old age is a reasonable goal. But working too hard and neglecting health and relationships throughout life can lead to a retirement that is not as fulfilling as you hoped, regardless of how much money you have.

Time, Health and Money – these are the three of the crucial elements that we require as we go through life.

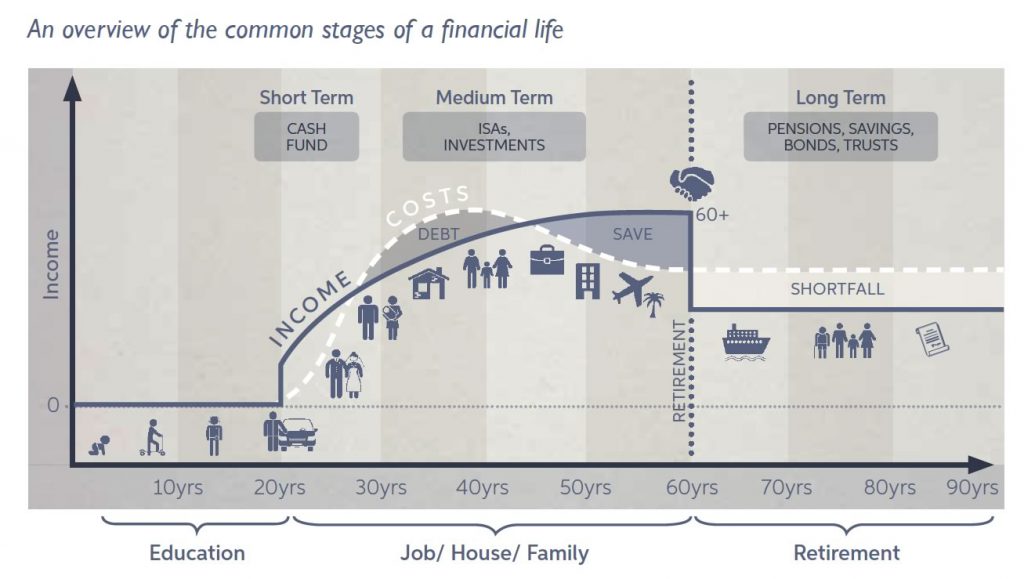

When we are young, we are generally in good health and have lots of time on our hands. As we progress to middle age, we would generally have more money and (hopefully) health is still good. In old age, being our retirement years, we have lots of time on our hands (although some of my clients would state they have never been busier, whether it be grandchildren, holidaying, projects or charitable causes!), and we would generally have sufficient monies, but we may be poor in health terms.

Having the optimal amount of Time (to spend with the people we love and on the things that bring us joy), being in optimal health (sometimes due to good fortune or genes, but largely to do with lifestyle choices) and having sufficient monies to cover our lifestyle costs, is the trifecta, the ideal situation.

Without good health, the wealth and time that you have, is of no use. And you end up spending all the time and wealth you possess only to regain or to get back the health that you have lost; not to enjoy the life you have. This is the situation in everyone’s life in the present world. You can instantly create wealth through various sources, but you can’t instantly fix your health.

The Dalai Lama has some wide words on this matter:

Below, we offer some tips for balancing time, money, and health at each stage of your life.

Early Career

- This stage is all about proving yourself and you may find yourself working long hours and neglecting other areas of life. This is probably the life stage where you will have the most energy, so it’s worth directing it wisely.

- Working smarter can yield better results. Consider building on your qualifications or professional network as this can help you to stand out in the job market.

Explore ‘life hacks’ online for maintaining your health with a busy lifestyle, for example, condensed home workouts or meal prepping. - Start regular contributions to an ISA and keep them going increasing the amount incrementally. Ignore them, don’t look. Just stick to the plan!

- Join your workplace pension scheme and start to build up a savings pot if you can.

- Keeping on top of your budget and avoiding expensive debt can improve financial security throughout your life.

- You should also aim to build up your credit to make it easier to apply for a mortgage.

Established Career and Family

- Consider the type of career that best suits your family situation. It may be a good time to think about flexible working or even starting your own business.

- Spend time with your family. Time spent with your children when they are young will form the basis for your relationship throughout their lives.

- Establish healthy routines and an active lifestyle – this can be a great way to spend quality time with your family as well as maintaining your own health.

- With increasing demands on your time (and money) remember to take care of your mental health. Take some time out for you. Even if this is just 10 minutes per day. Meditation, yoga, mindfulness or even just talking with a friend can help with stress.

- Make sure you have enough financial protection and enough savings to deal with emergencies. Aim to keep up with your pension/investment contributions if you can, even during tough times.

- Spend money on areas that will improve your life, whether this is to save you time (for example gadgets or paid help at home) or create memorable experiences (e.g. holidays and activities).

Retirement and Beyond

- Think about your retirement goals and whether any adjustments are required to make sure you stay on track. You may be able to do this yourself using spreadsheets or online calculators, or a financial adviser can help.

- Consider whether you would prefer to retire fully or transition gradually. Sometimes a phased retirement can work well as it allows you more free time without a sudden drop in income. It can also ease the transition and keep your brain active.

- Don’t feel guilty if you want (or need) to step back from work earlier than planned, whether this is for the benefit of your health or happiness. This could mean moving to a less demanding role, reducing hours, or doing something else entirely.

- If you are financially secure, it may be a good time to think about helping your children. Younger generations today are generally worse off financially than their parents and grandparents. Helping with a property deposit or car can ease pressure and help them to achieve their own financial goals.

- This might also be a good time to focus on estate planning, for example, writing your Will, setting up Powers of Attorney, and taking steps to reduce Inheritance Tax (IHT). This is not simply about saving tax, but thinking carefully about your legacy and where you would like your money to go.

- Prioritise your health by staying active and don’t delay seeing the doctor if you think something is wrong.

- It’s worth considering options for later-life care sooner rather than later. Getting older and becoming less independent can be daunting to think about. But making healthy choices throughout your life can help to improve your quality of life in later years.

Of course, your own life may not fit into this pattern. Perhaps you started a business in your twenties or decided to travel the world rather than settling down. Many people don’t have a typical ‘career’ and not everyone has children.

We all have competing responsibilities throughout our lives and a finite amount of time. Keeping a sense of balance can improve your chances of living a happy, healthy, and prosperous life.

Please don’t hesitate to contact your Tandem adviser if you would like to discuss any of the topics covered.