When reflecting on achieving financial success, it is easy to get caught up in grandiose plans and ideas – such as amassing wealth or retiring early.

However, long-term growth and progress are not simply achieved by making a single dramatic decision. Rather, they come from small, consistent actions repeated over time.

Below, we show how intentional habits, such as automated savings and periodic spending reviews, can establish the foundation for financial stability and prosperity.

Automated Savings

Many people view savings as an afterthought. After receiving their paycheque and spending on bills and discretionary items, some money might be set aside (if any is left).

The problem with this approach is that savings are often neglected. Our immediate finances feel more “real” and pressing. The future seems far away and less important. Yet, your present and future should be balanced in a healthy way.

One way to do this is to “pay yourself first.” When you get paid at the start of the month, set up an automatic transfer to your savings account. This helps remove the temptation to spend money and builds a habit of seeing savings as a priority, not an “optional extra.”

“Do not save what is left after spending, but spend what is left after saving.” – Warren Buffett

Even modest contributions, like £100 per month, could grow significantly over time if saved (or invested) wisely. This is due to the power of compounding, which acts as “interest on interest”.

Periodic Spending Reviews

Most people recognise the benefits of setting a budget. By taking stock of your income and expenses, you help yourself stay in control of your monthly finances.

However, your earnings and spending may change over time, often without your noticing. This can lead to unpleasant surprises when you look at your bank statements.

To mitigate this, consider scheduling a regular spending review, perhaps monthly, quarterly or even weekly. If money is leaking (e.g. due to unused digital subscriptions), you can spot the issues more quickly and “plug the holes.”

Many are frustrated that their financial habits do not align with their values and priorities. By conducting regular spending reviews, you can encourage mindfulness and prioritise putting money towards your goals – e.g. debt repayment, an emergency fund or investments.

Setting and Reviewing Short-Term Financial Goals

Financial goals can be divided into different durations. A Long-term goal might be saving for retirement, while a short-term goal might include saving for a holiday or a new gadget.

By establishing a habit of saving for specific goals like these (e.g. making a monthly contribution to a holiday fund), you can stay focused and build a sense of accomplishment.

Indeed, by building momentum and achieving financial milestones in the short term, you put yourself in a better mindset to do this for longer-term goals – like building a nest egg.

By experiencing the satisfaction of “winning” with a smaller, “easier” goal in the short term, you know that the sense of accomplishment will be even greater in the future after years of focus and disciplined saving.

Scheduled Investment Check-Ins

Regular reviews are especially important when investing. Assets like shares and bonds often fluctuate over time, and without careful attention, your asset allocation can become out of balance.

By working with an adviser to conduct periodic investment “check-ins” (e.g. semi-annually or annually), you can review your performance and take steps to steer your portfolio back towards your goals.

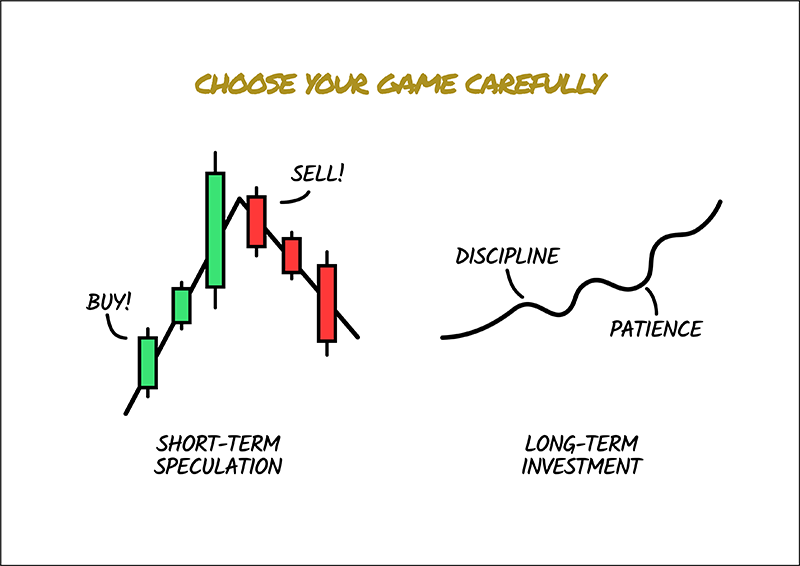

Be careful not to confuse these reviews with “timing the market.” This approach involves trying to “outguess” the market—i.e., buying assets before they rise in price and selling them before they fall. It is notoriously difficult and time-consuming for most people to do.

Rather, check-ins help align your portfolio with your overall investment strategy and goals. For instance, suppose you are a “moderate” investor who wants to follow a 60:40 split between equities and bonds. Over time, this chosen allocation could veer off course without regular reviews. Perhaps your equities overperform, and your bonds underperform—or vice versa.

If this results in a 65:35 split, your portfolio no longer reflects your plan or strategy. It may be necessary to sell and buy certain assets to rebalance it. An adviser can guide you through the best steps to achieve this. At Tandem we encourage and advise annually re-balancing your portfolio in February of each year after our Winter Bulletin in late January.

The Power of Small, Consistent Actions

While these habits may seem small or inconsequential in isolation, their cumulative impact is profound.

They help to forge a sense of control and predictability in your financial life, reducing stress and increasing confidence.

The great news is that once you start these habits, they typically require minimal effort to maintain. Remember, with financial planning, the journey often matters as much as the destination.

With small, consistent actions, you not only stand to benefit from tangible results, but you can also foster a disciplined mindset which can be applied to other areas of your life.

These decisions reinforce neural pathways in your brain, often making it easier to build healthy habits elsewhere, such as regular exercise, eating a balanced diet or productivity at work.

If you want to ensure you’re taking the right steps to safeguard your financial future, please get in touch.