The last few years have been eventful to say the least. Between a global pandemic, war, energy crisis, and rising inflation, financial markets have seen considerable ups and downs. Some stability seems to have returned, but the ‘fight or flight’ instinct has already been triggered for many investors. At this point, it is human nature to look for the next opportunity or threat and do something, rather than let the market take its natural course.

So how can we channel this energy and what should we do?

Why Business is Like Surfing

Just like business (and by extension, the entire equity market), surfing relies on ups and downs. You can try and surf in calm seas, without taking any risks, but you won’t get very far. To feel the high of mastering the biggest waves, you need to be prepared to take a dip sometimes. You do this knowing you can’t control the tide, only your own actions.

Just like high and low waves are a feature of surfing, volatility is a feature of investing, not a flaw. If you hold all of your money in cash, you might escape volatility, but you won’t see much growth and your returns will be eroded by inflation. This is fine for money you need in the short term but can be damaging over a longer time horizon. Equity investing includes volatility as standard, but you are more likely to see inflation-beating returns over the longer term.

With all this in mind, it is imperative to note that:

- Investing means 10 years plus.

- Investing in equities outperforms cash over the medium to long term, always.

- Investing is a mindset and requires patience and belief.

What Happens When You Chase Quick Wins?

The media is full of noise about what you should invest in, whether this is a hot stock, a new theme/trend, or a celebrity-endorsed cryptocurrency.

Firstly, if an investment is heavily advertised on social media, at best, it is unlikely to live up to its promises, and at worst, may even be a scam. You should always check that an investment has the proper regulatory permissions and seek advice if necessary.

But even genuine investments are not immune to the damage caused by people chasing quick wins. Shares are affected by supply and demand, which means the price rises and falls depending on how many people are buying and selling it. Prices can become artificially inflated just because they are popular, and not because of the underlying value of the company. We saw this happen naturally during the tech boom (and subsequent crisis) of the early 2000s. With social media, it is even easier for stock prices to be manipulated, for example, the rise of ‘meme stocks’ such as GameStop in 2021.

Some of the tips are well-intentioned, for example, suggesting that people invest in oil and gas, gold, pharmaceuticals, or artificial intelligence depending on the market conditions at the time. The problem is, market conditions are temporary, and we never know when the tide will turn. It is far more effective to buy into the whole market as you can benefit from growth while smoothing out some of the more concentrated volatility. It just takes a bit longer.

Why Does the Marathon Approach Work?

Investing is not about making as much as you can within a short space of time. This can lead to mistakes and a greater chance that you will lose money.

To really see the benefits of investing, you need to be in it for the long term. This means a minimum of 10 years, although ideally much longer.

Historical market data can tell us a few things:

- The market rises and falls on a daily basis.

- It takes a significant downturn at least every ten years, potentially alongside a recession and other major world events.

- Generally, it recovers fairly quickly afterwards, and the recovery is more sustained than the downturn.

- After the recovery, the market is typically restored to a higher point than before the downturn.

This means that longer term investors experience more growth and are less impacted by volatility.

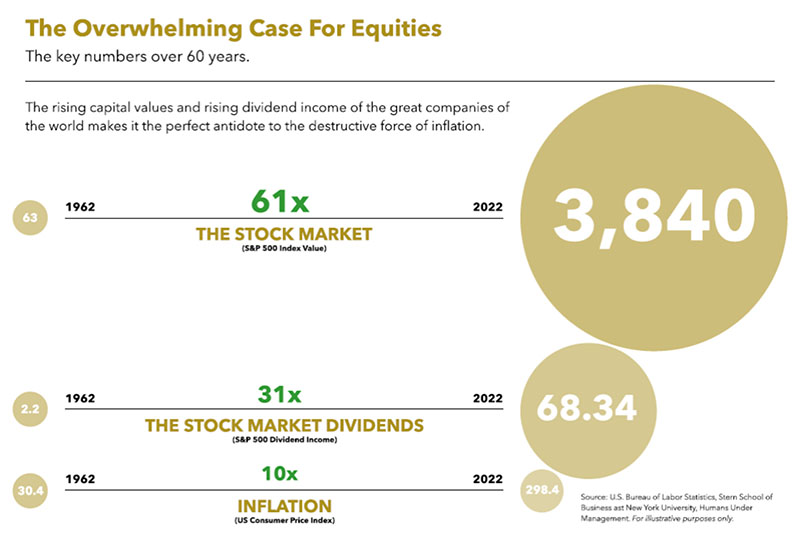

Investing in equities for the long-term also means that your money is less likely to be eroded by inflation, as shown in the infographic below:

Asset allocation is crucial to investing – cash is necessary for liquidity and short-term spending, while bonds and property can offer some stability and diversification against equities in most market conditions. However, successful investors understand that equities (stocks and shares) are the driving force behind growth. Over time, staying invested and compounding your growth can supercharge your returns.

Should You Cut Your Losses?

Trying to avoid further losses can sometimes be just as damaging as chasing quick wins.

It’s natural to get nervous during a downturn, but selling everything to avoid losses is counterproductive. Choppy waters mean that you may experience a dip, but that an upswing will probably follow swiftly. We can’t predict the timings – you need to be in the market to benefit from the ‘ups,’ even if this means suffering the ‘downs’ from time to time.

It’s a good idea to keep a cash buffer to make sure you have enough money to deal with emergencies and any planned spending. Ideally, any money you are likely to need in the next five years should not be invested in the stock market. This can help to reduce stress and the instinct to sell during a downturn.

Remember –

- When your portfolio falls in value, you have not lost any units. It is the price of those units that has fallen. It is the same as when your house falls in value (which most people refuse to believe it seems), you do not lose any bricks in your house!

- It is best not to look at your investments very often. It is so difficult to avoid doing this I know, but it comes down to belief, trust and preserving your sanity!

How To Be A Tortoise, Not A Hare

Below are our top tips for taking a long-term view with your investments:

- Decide on some goals and build your investment plan around them. Knowing what you want to achieve makes decisions much easier.

- If you do not have a plan, or goal in mind, you will never have enough money. If you have a plan and a goal, we can work towards that, together.

- Invest in a diverse range of assets from the whole of the market.

- Make sure the asset allocation is appropriate depending on your tolerance, capacity, and willingness to cope with risk and volatility.

- Avoid trying to time the market or reacting to world events.

- Control what you can, including reducing costs, investing tax-efficiently, spending wisely, and sticking to your plan.

- Take care of your health and spend time on hobbies and with the people you love. Ultimately, this is more important than money and increases the chance of a long and happy life.

Please don’t hesitate to contact a member of the team to find out more about the topics covered.