After a decade of negligible interest rates, savers are finally seeing reasonable returns on their cash accounts. The new Guaranteed Growth Bond from NS&I, for example, is offering a rate of 6.2% for a fixed one-year term.

We have seen challenging market conditions over the last few years. Bonds have suffered considerable volatility, which has particularly affected lower-risk investors. Is it therefore reasonable to consider moving to cash for a risk-free return?

The short answer is no, as while cash has an important part to play in your financial plan, it does not compare to investing in the market. It might remove volatility, but it is certainly not risk-free.

Below, we look at the various reasons for this, and explore the situations where holding cash is a good idea.

Cash and Inflation*

With interest rates of up to 6.2% now available, it’s understandable that investors, nervous following the recent market volatility, may consider this as an alternative to investing in the market.

When constructing a cashflow plan, long-term investment returns of 5%-6% (net of fees) would be a reasonable assumption, certainly over a 10 year plus period (with c. 60% equities or more). If this can be achieved without risk or volatility, why wouldn’t you take this option?

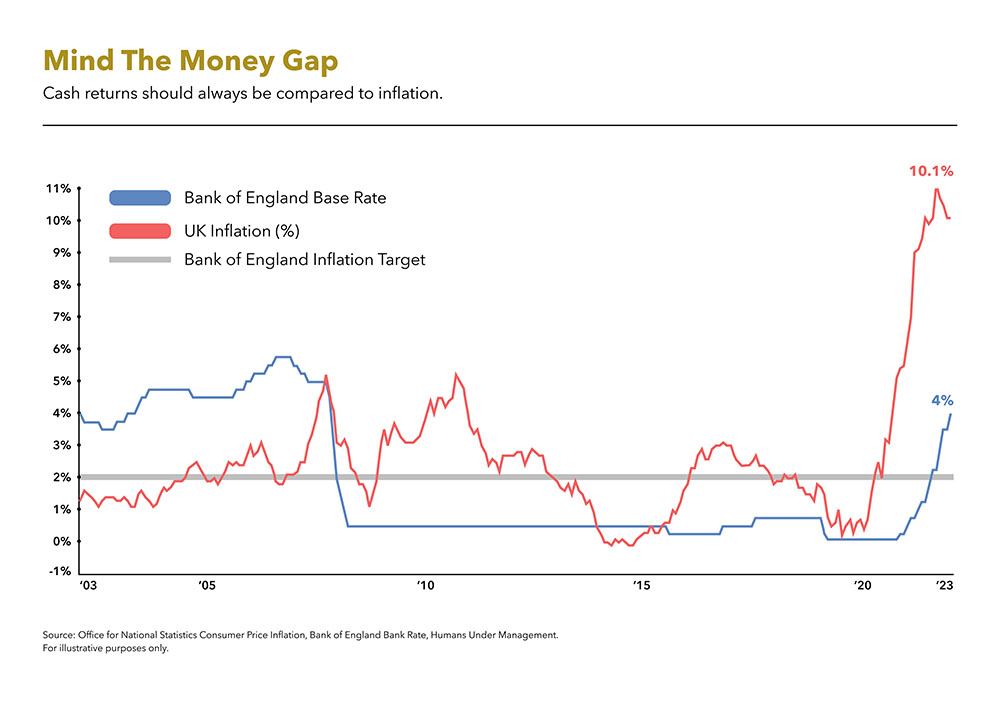

The simple answer is inflation. If the cost of living is rising at 2%-3%, earning 6% on your capital is a win. But when the inflation rate is 6.7%* (or even higher, as it has been for over a year) you are actually losing money in real terms.

History tells us that cash interest will almost always be lower than the rate of inflation. The only way to keep up with the rising cost of living is to invest in the market. See the chart below showing the last 20 years from 2003 to early 2023 when the base rate was 4% and inflation was 10.1%.

Benefits of Diversification

Most people hold cash with just one or two institutions. It is very rare for a bank to fail, and if this did happen, deposits of up to £85,000 per person, per banking group, would be protected by the Financial Services Compensation Scheme (FSCS). However, holding a large balance with a single bank does come with a small risk.

The perception is that investments carry more risk, and in some cases, that is true. But a truly diversified portfolio will have exposure to thousands of individual securities which will behave differently at any given time.

Investing across a range of asset classes, global regions, and sectors means that if a single company or area of the market loses value, your portfolio won’t see the same degree of loss. In fact, by investing in assets which are not correlated with each other, a rising market in one area might compensate for a falling market elsewhere.

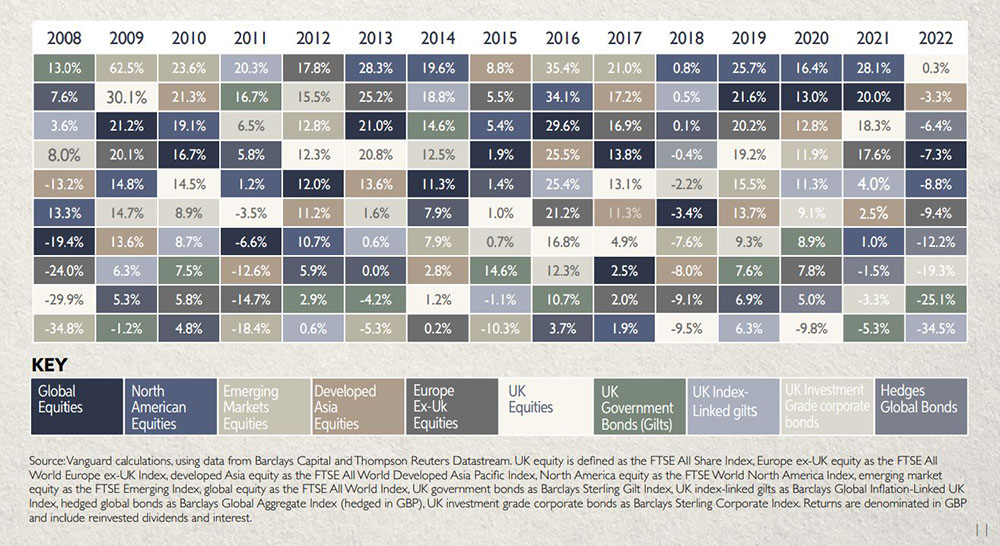

See the ‘jellybean chart’ or ‘patch work quilt’ below as it is called. The fact that the colours year on year are completely variable concludes that since you do not know which asset class will perform best next year, ‘it is wise to diversify and hold lots of different assets (stocks and bonds) via a globally diversified portfolio.

Market Timing

Of course, there are some situations where volatility affects the entire market, in which case even a diversified portfolio will fall in value. This is a feature of investing and should be expected from time to time. For a long-term investor with a diversified portfolio, this is not a major issue. Most fluctuations will smooth out over time, and markets generally rise over any five-year period.

If your investments have lost money, the only way to recoup this is to ride out the storm. Moving investments into cash now would mean selling at a relatively low point and missing out on the recovery.

Cash might offer a predictable return, but it is highly likely that taking into account inflation, you would be worse off in the longer term.

Tax Implications

Cash is not a tax-free investment, and unless you hold the money in an ISA, or the interest is within your savings allowances, there is a good chance that you will need to pay some tax on your cash.

‘This means that interest of 6% might only be worth 3.3% – 4.8% depending on your tax band. This is before even factoring in inflation.’

Of course, other investments can incur tax as well, but using a suitable wrapper, such as an ISA, pension, or investment bond can help to control this. By investing in a range of different wrappers, you also have more options for making use of tax benefits, such as your capital gains exemption and dividend allowance.

3 Good Reasons to Hold Cash

Of course, cash still has a place in your financial plan, and you should not invest any money that you are likely to need in the next five years.

The main reasons to hold cash include:

- Retaining an emergency fund to deal with unforeseen costs.

- To cover any planned spending you may have in the next 3-5 years.

- If you are withdrawing money from your portfolio, it’s a good idea to hold 6-12 months’ worth of withdrawals in cash. This means that if the market takes a downturn, you have a replacement income source.

Additionally, if you have debt, reducing this might be a better use of your cash.

Everyone’s situation is different. The amount of cash you need to keep aside and the level of investment risk you should take will depend on multiple factors, including your life stage, income, and level of wealth.

Please don’t hesitate to contact your Tandem adviser if you would like to discuss any of the topics covered.

*The BOE Base rate was 5.25% at the time of writing this article. Consumer Price Inflation was at 6.7% in August 2023. Retail Price Inflation was 9.1% in August 2023.