What comes to mind when you hear the word “risk”? For most, it is inherently negative and conjures images of disaster or worst-case scenarios (such as losing money). However, is risk truly “real” in the sense we often think it is? Can it have a positive role in your financial plan?

In many cases, the perception of risk is the real risk to thriving financially. “Real” risk is the measurable likelihood of harm, or losing money on an investment. It can often be statistically calculated. Perceived risk is based on our own values and experiences, which may be wrong.

At Tandem, we believe that understanding the true nature of risk is vital for making confident financial decisions. Risk isn’t something to fear; it’s something to understand and work with.

Let’s unpack what risk really means and how to reframe the conversation for your financial plan, increasing your chances of better outcomes.

What is risk, really?

We take risks every day. They cannot be avoided. We cross the road. Get into a car. Choose a life job or life partner. Move into a particular property to live in. And so on.

Sometimes, these decisions work out for the best. Other times, things go wrong, despite our best efforts. Life is full of uncertainty, and we manage it through planning, precaution and personal experience.

In the financial world, “risk” is often simplified to the chance of losing money. But this is only one part of the story. However, the concept is broader than that. It gets at the idea of divergence – i.e. the gap between what you expect and what actually happens.

Sometimes, that means losses. But it also means gains. In fact, the possibility of higher returns only exists because of risk.

Risk & reward, ying & yang

If I asked you, as a financial planner: “Would you like a high return or a low return?”, what would you say? You might say, “Yes, I’d like a high return”, and I’d say, “Okay, great”.

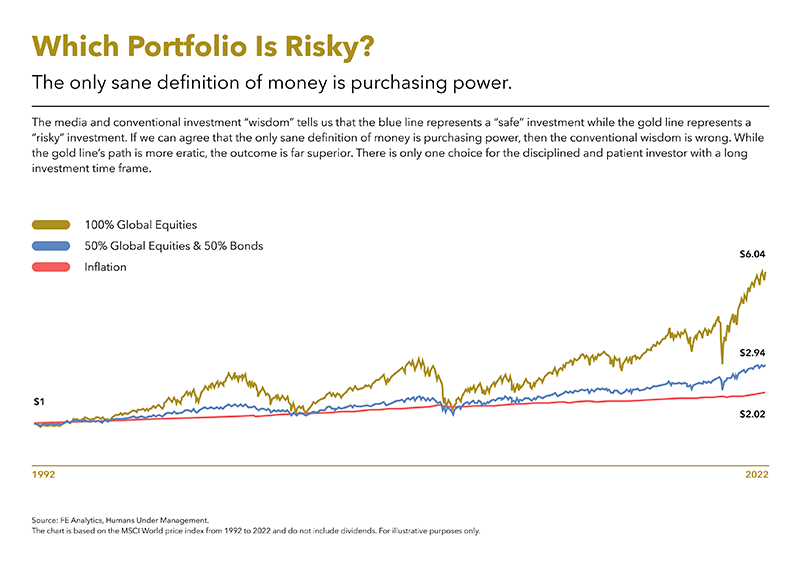

This means leaning towards options such as equities in your portfolio (stocks and shares), and less towards bonds, possibly avoiding them completely. However, this means accepting a higher likelihood of volatility than, say, a 70:30 model (70% Equities and 30% Bonds).

This is the heart of investing. The more return you want, the more variability (i.e., risk) you must be willing to accept. Put another way: if you want your money to work harder, it needs to do more than sit quietly in a savings account, it needs to grow. And to achieve growth you must buy growth assets, aka ‘equities’ or stocks and shares. They are the lifeblood of investing. They are the what is meant by ‘investing.’ You get both the dividend income from them and the capital appreciation of the share or unit price. Equities drive long-term growth in your portfolio. They are the like an engine, they can be volatile, but are essential for forward momentum, specially to outpace inflation.

In economics, a maxim says: “There are no ‘solutions’, only trade-offs”. Similarly, in investing, every financial decision involves a balance between competing outcomes, typically between risk and reward.

From my experience, there is a common problem when financial advisers ask: “What is your attitude to risk?” Very few investors (other than highly experienced ones) would know what this meant, and fewer would reply: “Oh yes, give me a high-risk portfolio!”

The framing is all wrong. When people are asked about “risk tolerance,” many instinctively gravitate to the middle. They don’t want to be reckless, but they’re not totally risk-averse either.

The problem with terms like high risk, low risk or even moderately adventurous is that they’re subjective. One person’s “cautious” might be another’s “aggressive.”

When people hear “high risk,” they think: gambling. When they hear “low risk,” they think: safe. It’s misleading. Instead, a better question might be:

“Would you like a high return or a low return?”

This opens the door to a clearer conversation. We might then explain: “To target higher returns, your portfolio needs more [XYZ investments]. These offer greater growth potential, but they also come with more volatility. Let me show you what that looks like…”

Now the conversation becomes real – less about abstract labels, and more about actual outcomes over decades.

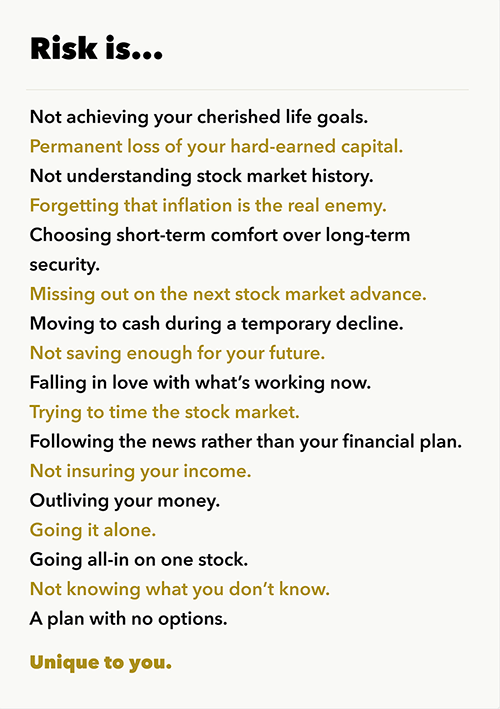

Clearing up the risks that matter

So, what do we mean when we talk about “risk” here at Tandem?

One of the most overlooked areas is “shortfall risk” – that is, not taking enough risk. This is recognised as a national problem in the UK right now. Around £2 trillion is currently held in cash by Brits, and not enough people are investing to grow their net worth.

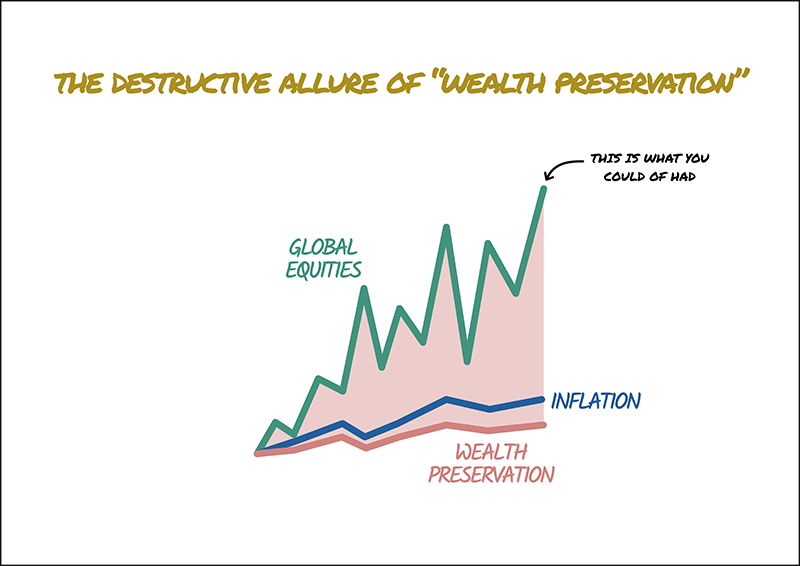

It is wise to have a cash buffer but keeping too much in cash or low-yield bonds (to avoid loss) is likely to hamstring your wealth growth and potentially undermine your future needs.

This comes into sharper focus when we remind Tandem clients about inflation risk. Often called the “silent thief,” inflation reduces your purchasing power over time. If inflation runs at 3% per year, your money loses around 26% of its value in just 10 years.

Then there is emotional or behavioural risk. The real danger is often you (the investor), reacting emotionally to market events, like selling in a panic. This can crystallise losses and derail your long-term goals.

So, what’s the right approach?

Investing isn’t just about numbers; it’s about mindset. Rather than obsessing over risk labels, start with your goals. What do you want to achieve? Retirement at 60? Helping the kids with a house deposit? Building wealth over 20 years?

These goals determine the investment strategy, not arbitrary risk categories.

A financial planner can then step in to help demystify risk – e.g. showing historical data and charts. Explaining what a “bad year” might look like, and what a recovery could resemble.

From here, “risk” can be reframed as an opportunity. It is an “engine of returns”, moving your money forward. The aim isn’t to avoid it, but to manage it through diversification, discipline and realistic expectations.

If you are yet to do so, we invite you to experience the Tandem difference. For those we currently serve, I hope these thoughts have helped and inspired you.

Until next time!

Your capital is at risk. Investments can go down as well as up. Past performance is not a reliable indicator of future results. Financial plans can be affected by inflation, market downturns and tax changes. The content of this article is for information only and does not constitute financial advice. Always seek independent financial advice.