Interest rates have risen four times in a row since December 2021, with further increases possible before the end of the year. After over a decade of very low interest rates, this is likely to have a wide-reaching impact on investments and the economy in general.

We have prepared this guide to explain what you can expect and how you can prepare.

What Happens When Interest Rates Rise?

When interest rates rise, this can make it less attractive to borrow and spend, and more appealing to save.

Mortgage costs increase (for those on variable rates), which in turn, impacts the housing market. It may become more difficult to access credit, which can curb businesses’ cashflow and reduce the amount consumers have available to spend.

Conversely, returns on savings increase, which can mean investors are more likely to keep money in the bank rather than spend or invest it.

Equities are affected, first of all because profits can be impacted by reduced consumer spending and lower prices. But higher interest rates can also mean that investors are more inclined to seek out safer investments such as cash, bonds, and steady dividend-yielding shares.

All of these factors mean less money is circulating in the economy, which can cause demand for goods and services to reduce. Prices drop, which can help to curb inflation, but can also restrict economic growth.

Interest Rates in Context

Interest rates have, of course, been much higher in the past. We are used to low rates, but these have only been considered the norm in very recent history.

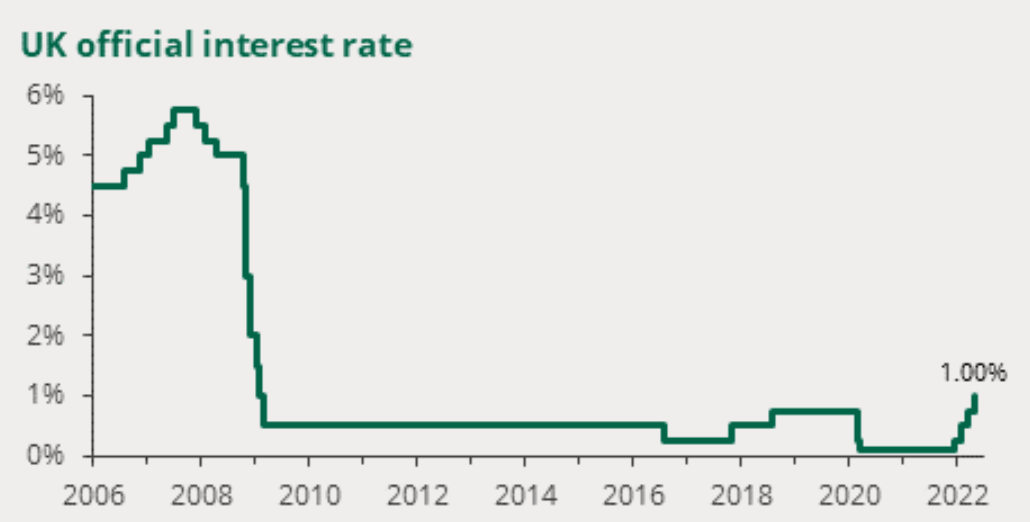

If we look back over the last 16 years, as demonstrated in the chart below from Bank of England, interest rates peaked at almost 6%.

Going back further, UK interest rates reached a high point of 17% in 1979, which puts current increases into perspective. And in fact, other countries are experiencing higher rates even now. In Argentina, the current rate is 44.5%, which still falls behind their current rate of inflation. Zimbabwe has the highest interest rates in the world at 80%.

Even if the UK interest rate rises to 5% or 6%, this is still well within the realms of normal.

Why Are They Increasing Now?

As mentioned above, increasing interest rates is part of the Bank of England’s strategy to keep inflation under control. The average target for inflation is 2%, although some fluctuation is normal. Moderate inflation signals a thriving economy.

However, when inflation gets too high, wages and benefits cannot always keep up with the rising cost of living. Businesses face increased costs and a more pressured workforce, which can mean that they, in turn, must raise prices or accept reduced profits. This can create economic slowdown, job losses, and even a recession.

Inflation has reached 7% in 2022 and may even increase as high as 10% later this year. There are many reasons for this. The Covid19 pandemic and Brexit have both contributed, causing disruption to supply chains and workforces. This makes it more difficult and costly to meet consumer demand. The energy crisis, exacerbated by the Russian invasion of Ukraine, has had a significant impact. With supplies interrupted and a reduced number of providers in the market, energy costs have risen significantly. This means that any business that relies on energy (i.e. all of them) will have higher costs. At least some of these costs will be passed on to the consumer.

Given the multiple factors leading to inflationary pressures and the impact this could have on the economy, interest rates are rising to help keep inflation to a manageable level.

Should You Still Hold Bonds?

Bonds are relevant to most investors’ investment portfolios as they provide an income yield and offset some of the volatility experienced by equities.

However, bonds are sensitive to interest rate increases and inflationary pressures. When interest rates increase, newly issued bonds must offer higher interest rates to encourage investment. Typically, longer-dated bonds offer higher yields than bonds with an earlier maturity date. But rising interest rates can lead to a flattening of this ‘yield curve.’

Higher bond yields can also lead to falling bond prices, as yields are fixed relative to the original price. This means that if you already hold bonds in your portfolio, the value may drop. Bonds have seen significant volatility in recent months and have underperformed when compared to equities.

But this doesn’t mean that you should avoid holding bonds, and certainly shouldn’t sell existing bonds at depressed prices. A diversified portfolio is intended to work in all markets, remembering that investing means 10 years plus. Some investments will rise while others will fall. Over the long-term your portfolio will benefit from holding a wide range of assets and bonds can form a key part of the strategy.

What Should You Do?

There may be some volatile times ahead, but to give your financial plan the best chance of success, there are a number of things you can do:

- Keep your spending under control. Prices may be rising, but adjustments to your budget can reduce the impact on your household.

- Hold an emergency fund of at least 6 months’ expenditure. This can help to deal with any unexpected bills or even short periods out of work.

- Aim to pay off any expensive debt and shop around for the best rate on your mortgage.

- Continue with any regular contributions to your pensions and investments.

- Invest across a wide range of assets and avoid trying to time the market. Don’t be tempted to take money out when values fall, as peaks and troughs are to be expected.

- Accept that interest rates and inflation fluctuate, and that this is part of the economic cycle. Things may be difficult for a while, but balance should eventually be restored.

Please do not hesitate to contact a member of the team to find out more about how changes in interest rates and inflation affect you, and if you wish to review your risk profile.