What role should money play in your life? Most of us know the old saying: “Money doesn’t make you happy.” Yet, there is an undeniable link between money and happiness, especially at the lower end of the pay scale. What is the nature of that link, exactly?

We cannot avoid money, whether or not we hold a lot of it. Anxieties about finances are all too common, even amongst the wealthy. Below, I share some of my experiences and thoughts as a financial adviser.

Having spoken to countless clients on this topic over the years, here is my penny’s worth on how to build a healthy relationship between money and meaning.

Money: The Purpose Facilitator

Most likely, you know (at least in the abstract) that “living for money” will not produce happiness. Money can ruin you if you let it rule you. Obsessing over wealth – and tying your identity to it – damages your relationships and health.

Yet, money matters confront us every day. We have bills to pay and aspirations we want to fulfil (requiring financial means). Some have told us that money is the “root of all evil”, but we need it to fund our basic needs – like food and shelter.

There is a way forward. Interestingly, the above quote comes from The Bible, (1 Timothy 6:10) and is more accurately translated as “the love of money is the root of all evil”. In short, money itself is not evil. It is a neutral medium of exchange. It is only when greed enters that things go wrong.

I find this old wisdom helpful, as it suggests there is a healthy way to integrate money into your life. For me, this is the “money-as-purpose-facilitator model”. In short:

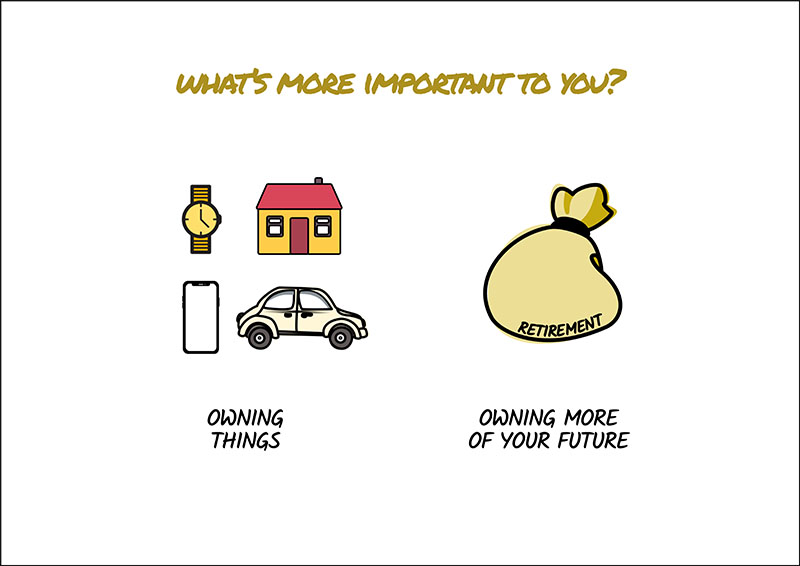

Money is not an end in itself. Rather, money provides the freedom to pursue meaningful goals, such as travelling, supporting your family, or engaging in philanthropic efforts. It also gives you choices and options. Money is finite for most people. It is what we do with it that is important. Save it, spend it, invest it, buy ‘stuff’ or buy experiences? Live for the now or live for the future? I firmly believe that it is about getting the balance right.

Building a Tool for Meaning

Excessive focus on acquiring money can lead to emptiness if it overshadows relationships, personal growth, or inner fulfilment. We know this, but it is hard to resist, especially when the media is telling is we ‘need’ the latest car, or TV or gadget or piece of clothing.

A case in point is Lifestyle Inflation. As income increases, people tend to adapt to a new (higher) standard of living. Unfortunately, the rise typically produces diminishing returns on happiness.

(By the way, prices today are c.20% higher than they were just 3 years ago and they are between 25-35% higher than 5 years ago pre-pandemic (depending on which metric you use CPI or RPI). This BBC article in mid-Jan 2025 explains inflation clearly, what it is, how it is measured etc.)

Sadly, Western culture is still prone to make us believe otherwise, with its emphasis on personal achievement and financial independence. The result can be excessive materialism, which disconnects us from intrinsic meaning.

Fortunately, with the right insight, motivation and help, it is possible to use money as a tool for meaning rather than an end in itself. You can regain a sense of control right now.

Ask yourself: “What truly matters to me?” Consider what you value most in life. Is it creativity, relationships, health, personal growth, or something else?

Then consider: how does money currently align—or misalign—with these values? There is another famous saying: “Follow the money.” When you examine your spending habits, what do they reveal about your attitudes, habits and (perhaps) biases about money?

For practical steps on retaking control over money, start by building a plan. Set a clear budget to ensure you’re intentional about how money flows in and out of your life.

Consider how to live within your means. Eliminate needless purchases or habits that don’t bring you joy. Be intentional about your expenses.

If necessary, practice financial “minimalism” for a season. For some people, it helps to start from a “blank slate” by focusing on what they need rather than what they want.

Know thyself (Nosce te ipsum)

This famous maxim is inscribed on the Temple of Apollo in Delphi, Greece. It is an invitation to introspection to understand your own emotions, strengths, limits, and biases.

How deeply do you “know yourself” when it comes to money? How is your financial identity shaped by culture and language, for instance? How has your upbringing and family influenced your attitudes and values? What about your own personal experiences?

When it comes to making decisions (especially financial ones), we are not as “in control” or as rational as we think we are. However, there is power in recognising our limitations and healthily working within them. With the right knowledge and determination, we could even expand them.

I’ll give one example of this in closing: the Gratitude Mindset. How much do you appreciate the people in your life and the things you do? Do you focus on the opportunities available in all areas of your life, or are you fixated on the negatives?

There are so many reasons why various people lie across all parts of this spectrum. Yet, all of us can practice a Gratitude Mindset if we want to. The benefits can include better health, mood and overall life satisfaction. It can also transform our relationship with money.

For instance, being grateful for what you have helps to guard against Lifestyle Inflation and its associated dangers. By focusing on the opportunities ahead of you (e.g. for relationships and personal growth), you empower yourself to use money as a Purpose Facilitator to help realise those opportunities.

I hope these thoughts have helped and inspired you. Until next time!