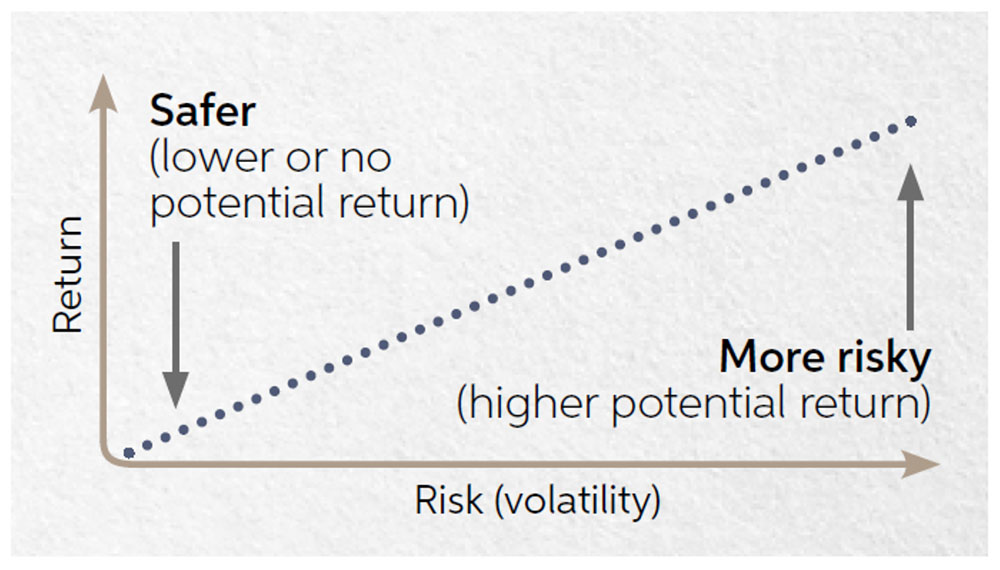

The idea of risk and reward is vital in financial planning. Our perception of risk informs all of our decisions, whether we realise it or not.

But sometimes, our own biases mean that we don’t assess risk accurately. We might overstate one form of risk (such as the possibility of losing money on an investment) while ignoring another (for example, the possibility of not achieving our goals).

Whatever you choose to do with your money, there will be some form of risk involved. This does not necessarily correlate to how helpful the action is in terms of achieving your goals.

Given the recent investment volatility, some investors have been tempted to move money out of the market and into cash now that reasonable interest rates are available. This might feel like a solution to reduce risk, but it is just switching one type of risk for another.

Below, we address 5 common myths and misconceptions around the area of investment risk.

1. All Risk is Bad

Risk means taking a chance. For some people, this means danger or threat. But we take risks every day – this is simply part of life.

Another way of looking at it is to think of risk as opportunity. If we never took risks, this could mean missing out on educational prospects, jobs, or business opportunities, meeting a partner, or starting a family. It’s commonly suggested that the people thought of as ‘lucky’ in life have the same chances as everyone else but are more likely to take measured risks to achieve their goals.

This translates to investing. The market moves up and down – this is why there is a market. If investments were predictable, the scope for growth would be very limited. We need the downturns to fuel the upswings. As we can’t time or predict when this will happen, investing for the long term offers the best chance of success.

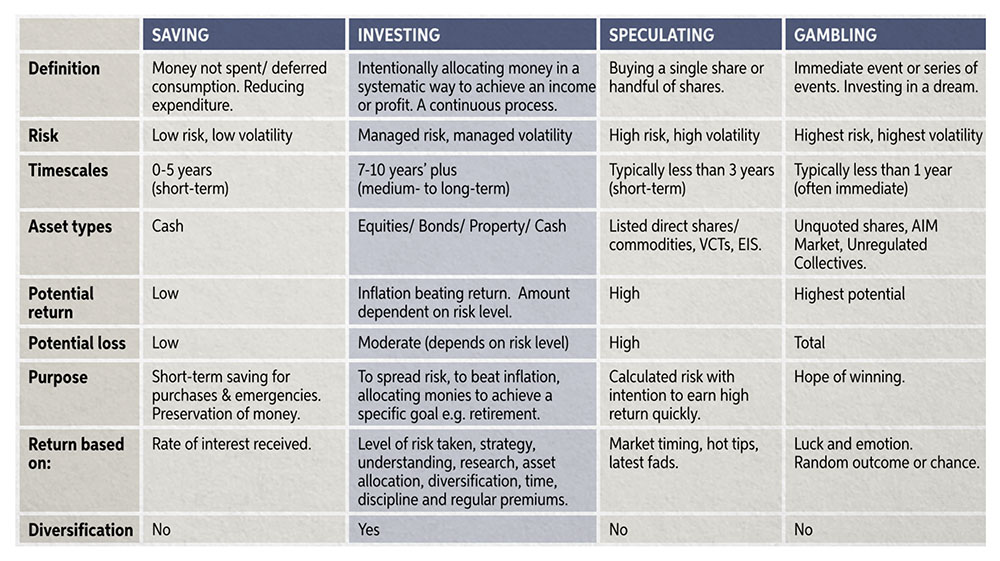

Saving is not the same as investing. Investing does not mean speculating or gambling either. Investing means intentionally allocating money in a systematic way to achieve an income or profit. It involves using various asset classes and diversification, and requires time in the market, discipline and the right mindset. The purpose of investing is to beat inflation and cash. See the table below for more details.

2. Holding Cash is the Only Way to Avoid Risk

Cash might seem like a safe option, particularly if you are earning 5% – 6% in interest.

There are good reasons to hold cash, such as keeping an emergency reserve and covering your short-term spending. It’s also a good idea to reduce risk on your investments as you approach retirement, for example, by switching some of your equity holdings into cash.

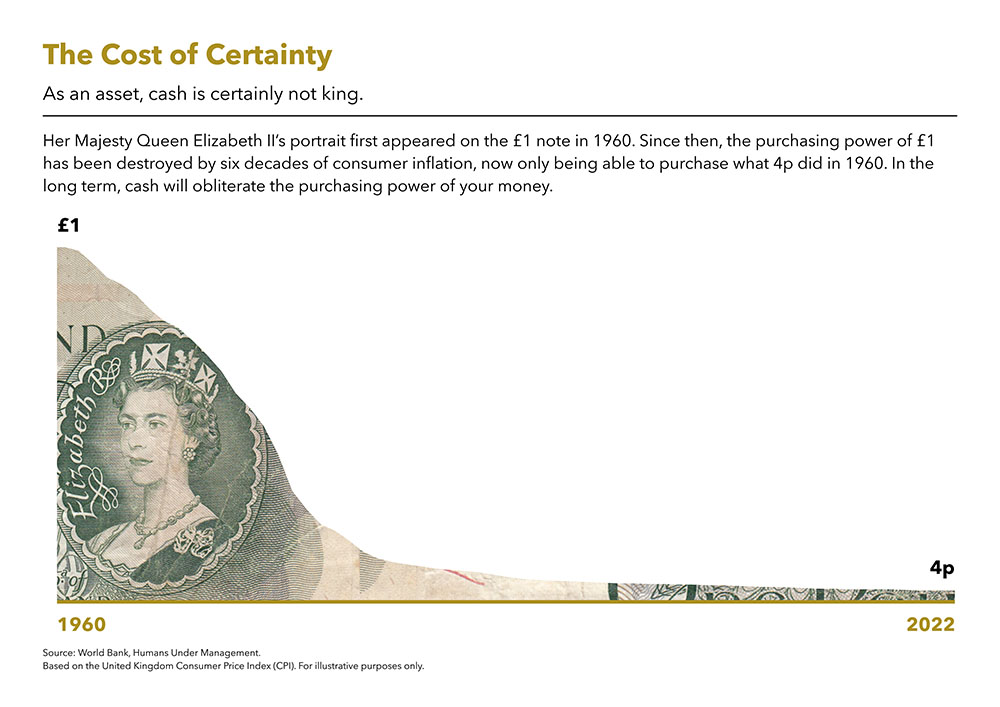

But holding large amounts of cash for the longer term can mean your money is eroded by inflation. Even the market-leading savings account pays less in interest than the current inflation rate.

Holding all of your money in cash means that in a few years, you will actually have lost money in real terms. This is an important risk that many people overlook when thinking about investments versus cash. All the data shows that over time, holding too much cash (compared to other assets, especially equities) will obliterate your purchasing power.

3. Volatility is the Only Kind of Risk

The risk that your investment will go down in value is referred to as volatility risk. However, there are several other risks you will need to consider, for example:

- The risk that your assets won’t keep up with inflation.

- The risk that you won’t achieve your goals.

- Holding too much money in one area or with one institution.

- Bank or institutional failure.

- Political instability or a falling currency in the UK or another country.

- Financial fraud.

Keeping money in cash can remove volatility risk but may increase exposure to other risks.

“The biggest risk is not taking any risk.”

Mark Zuckerberg

4. Its Normal to Lose Money if You Invest in the Market

Of course, it’s normal for the market to fall from time to time. But losing money on investments is statistically unlikely, providing you follow some basic principles:

- Invest for the long-term, which means at least 5 years but ideally 7-10 years. This is usually enough time to smooth out any market volatility. Despite the recent turmoil, all of our TRAILS™ portfolios are showing a positive return over five years or more. The higher the equity content (in theory, the ‘risk’ level), the higher the long-term growth potential, the higher the return.

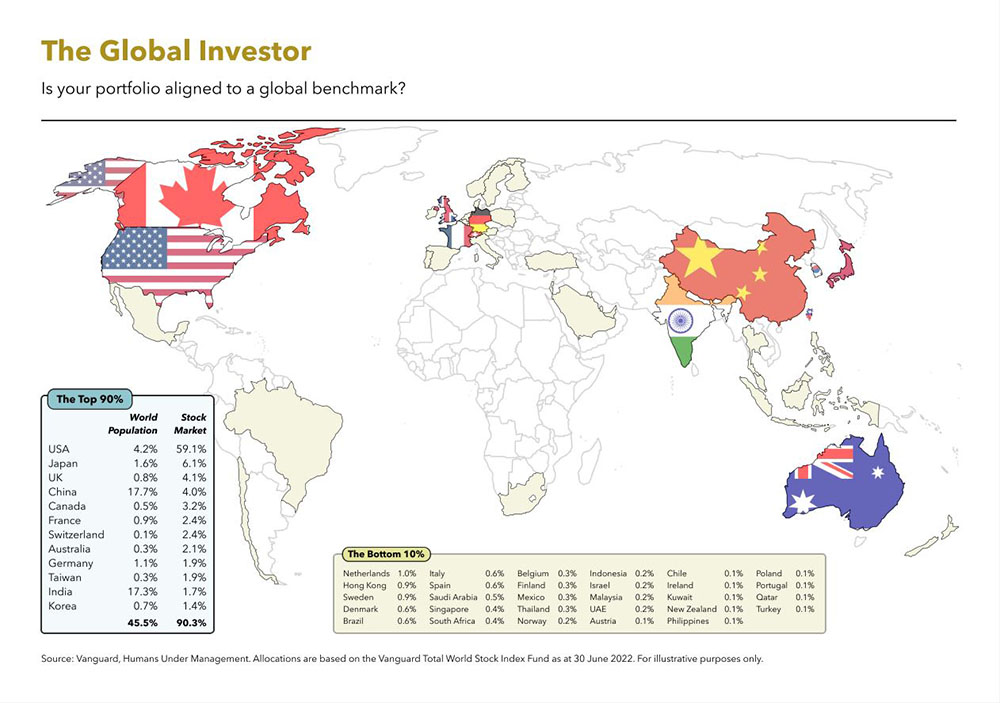

- Hold a diverse selection of assets across a range of world regions and sectors. Our TRAILS™ portfolios, for example, hold at least 12,000 individual stocks. This means that investors are minimally exposed to the risks of any one company. While the equity content (and even the asset allocation) might be the same as an actively managed fund holding less than 1,000 stocks, the actual risk is vastly different.

- Be sceptical of expensive actively managed funds, or any investment solution claiming to consistently beat the market. Evidence suggests that low-cost index funds, invested in line with global market weighting, offer the greatest potential for long-term returns. See the image above for how your investment portfolio should be allocated if aligned with the World Market Cap.

- Avoid making emotional investment decisions based on fear, greed, or overconfidence. This might lead to actions including trying to time the market, selling during a downturn, or buying over-hyped investments.

5. Risk and Reward is the Same for Everyone

The traditional view is that more equities mean more risk, and that a portfolio should also hold a mix of cash and bonds for greater stability and diversification and less volatility. This led to many investors selecting (or being advised to invest in) ‘balanced’ funds with, for example, 50% – 70% in equities. As a middle-of-the-road option, it was considered suitable for any investor who was not overly cautious or adventurous, regardless of their circumstances.

There are a couple of flaws in this logic.

Firstly, equities (meaning stocks and shares) may be more volatile than cash or (in most cases, notwithstanding the last two years) bonds. But, for someone with an investment term of ten years or more, it could be argued that they are taking on more risk by not investing fully in equities. History tells us that equities have consistently outperformed other asset classes over longer periods. As the investor does not require access to their money in the short term, they can afford to withstand any short-term volatility. Volatility can even work in their favour if they are investing monthly, as they buy into the market at low points as well as high. This is called ‘pound cost averaging.’

Someone with a shorter investment timeframe might not be able to cope with the same level of volatility. If a portfolio has the potential to dip by 30% (this is the maximum drawdown of our 100% equity Cairngorms Portfolio over the last 20 years) they may not have time to recoup this before they need to make a withdrawal.

This leads on to the second point, which is that bonds are not always lower-risk than equities, and sometimes they move in the same direction. Additionally, bonds tend to bounce back more slowly than equities.

When investing in passive index funds, an argument could be made for a default position of 100% equities, gradually increasing cash as you approach retirement.

In conclusion, investing in equities does come with risks, but the risks of not investing are potentially greater. Following the basic principles of investing (see the 12 golden rules image) means taking a measured view of all the risks and taking the path which is most likely to help you achieve your goals.

Perception of risk (when it comes to investing in over 12,000 stocks/ companies, via low-cost index funds) is often skewed, especially when judging returns over a very short period of time e.g. less than 5 years. Review the top 12 tips above. Trust the process. Stick to the plan.

Please don’t hesitate to contact your Tandem adviser if you would like to discuss any of the topics covered.