A period of high inflation has been on the cards for some time now. But due to a convergence of world events, prices are now rising at a concerning rate. Many households will find themselves financially squeezed in the coming months.

In this guide, we look at how inflation works, what’s causing the current situation, and how you can protect your finances in 2022.

A Brief Guide to Inflation

Inflation refers to the rate at which prices increase. This is usually measured by the Consumer Price Index (CPI) which tracks the price of a ‘basket’ of goods and services which are regularly purchased by a typical consumer. The CPI has overtaken the RPI (Retail Price Index) as the primary inflation benchmark. The RPI includes housing costs, and usually tracks higher than the CPI.

Inflation in itself is not a bad thing. It is good for the economy when prices rise at a modest level every year. It indicates that businesses are prosperous, wages are rising, and investing is worthwhile. The Bank of England targets average inflation of 2% per year, although some fluctuation is normal. For example, following a year of little or no inflation (for example, during the peak of the pandemic), we would expect to see a temporary spike as the economy corrects itself.

However, the pandemic is one of many factors influencing the current situation.

The Current Economic Climate

Periods of high inflation are to be expected. The issue at the moment is that so many things have happened within a short space of time, all of which are increasing inflationary pressure.

The pandemic is an obvious contributor. Initially, months of pent-up demand led to a short-term increase in prices. We are also seeing the effects of illness, staff absence, and restrictions on the economy. Without a fully present and healthy workforce, delays occur, supplies can’t get from A to B, and productivity slows down. Essential goods and services become scarce, which pushes up the price.

Brexit has also had a part to play, as without a pool of international workers, businesses have found it more difficult to recruit. The cost of imports and exports has also increased. While this is more of a UK-centric issue, we live in a global economy and ripples throughout the world are to be expected.

Next, came the energy crisis. Our economy is overly reliant on fossil fuels, despite oil and gas being in limited supply. We all witnessed the queues outside petrol stations last year, and several smaller energy suppliers have gone out of business. Many households will find that their energy costs as much as double this year.

The Russian invasion of Ukraine has come at an already precarious time. From an inflationary point of view, the main concern is that Russia is a major supplier of gas to Europe. Any restrictions or disruptions to the supply could push up prices further.

As all businesses use energy, rising prices will have a knock-on impact on the cost of other goods and services.

UK inflation has already exceeded 5% and is expected to rise to at least 7% later this year. Additionally, the items which are most rapidly increasing in price are the essentials, such as food, petrol and heating. This means that the households which spend more of their budget on the basics will be worst affected. Non-essential businesses may suffer as consumers try to cut back.

What Happens When Inflation is High?

High inflation has several implications:

- Businesses face increased costs and either need to put up their prices or make cutbacks.

- Salaries and benefits may not keep up with rising prices.

- Property prices can increase, with more buyers priced out of the market.

- Poverty increases and more businesses fail.

- The economy can then fall into recession.

To curb inflation, the Bank of England will normally increase interest rates. Higher interest rates make it more attractive to save, and less appealing to borrow and spend. We have seen two rate increases since December 2021, with additional raises predicted for 2022. However, the current situation is a tricky balancing act, as it is very difficult to keep inflation under control without also stifling economic growth.

Inflation Over Time

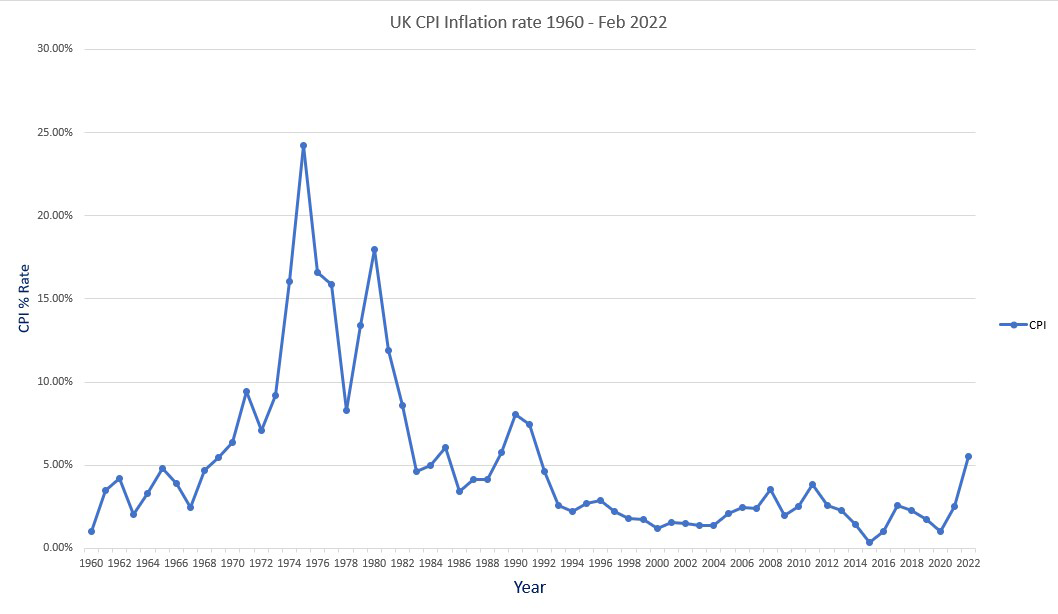

This is not the first time we have experienced high inflation. The graph below shows inflation rates going back to the 1960s, as well as the year-on-year changes:

What Can You Do?

As you can see, inflation has been as high as 24% in the past, with high rates persisting throughout the 1970s and 1980s. This era also saw an oil crisis, the peak of the Cold War, miners’ strikes, and several recessions. We got through it, just as we will the current crisis.

There are a number of things you can do to limit the effects of inflation on your financial plan:

- Make a budget and aim to reduce your expenditure. Food, heat, and petrol are all likely to become more expensive, so start there. Shop around for the best deals and ask yourself if you really need to use the car every day.

- Think of ways to earn more money. Could you ask for a pay increase? This could be a sensitive issue depending on the industry you are in, although many are still thriving despite the challenges.

- Start a side business. Research the niche areas that are likely to be resilient during economic difficulty. People will still need food, childcare, and pet supplies. Wealthy consumers who have the money to spend on luxury goods aren’t going to stop because prices are going up.

- Invest in a diverse range of assets. The past few years have shown that the economy can be unpredictable. Investing across a range of asset classes is the best way to spread your risk and benefit from market returns. While equities are traditionally the most adept at outperforming inflation, bonds can give your portfolio a cushion against volatility.

- Keep investing and don’t take money out of the market. When the market falls, shares become cheaper and you can buy more for your pound. If you sell at a low point, it is more likely that you will miss out on the recovery. Successful investing means embracing both the highs and the lows.

Remember, we can’t control everything, so it’s important to focus on the areas we can and stop worrying about everything else. The economy moves in cycles, and just like any other period of uncertainty, this should eventually pass.

Please don’t hesitate to contact a member of the team to discuss your own circumstances in more detail and see if we can help.

1 https://www.macrotrends.net/countries/GBR/united-kingdom/inflation-rate-cpi and

https://www.ons.gov.uk/economy/inflationandpriceindices/timeseries/l55o/mm23