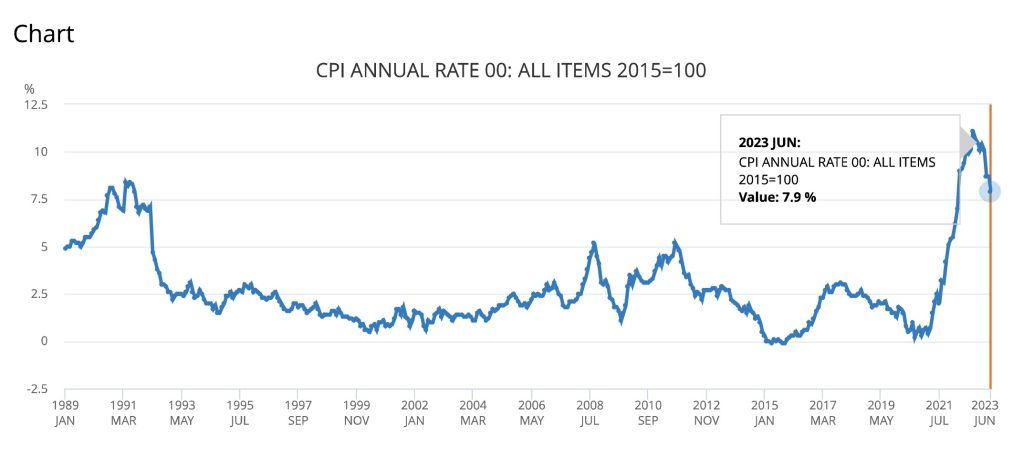

Headline inflation fell to 7.9% in June (from 8.7% in May), but the cost-of-living crisis is still in full swing with RPI still being 10.7%. While we have made some progress in curbing price increases (bearing in mind CPI inflation was 11.1% in October 2022*) costs are still rising at an unsustainable rate. It is important to remember, when the rate of inflation falls, prices are still rising, but just not as quickly.

*https://www.ons.gov.uk/economy/inflationandpriceindices

So why is this happening, and what does it mean for your financial plan? Read on to find out.

What is Inflation and Why Do We Need It?

The Bank of England aims for an average inflation rate of 2%. Modest, steady inflation is good for the economy. It means businesses are profitable, people have enough money to spend, and the supply of goods and services is well matched with demand.

Inflation is generally measured by the Consumer Price Index (CPI) or (less commonly now) the Retail Price Index (RPI). Both indices reflect the rise in cost of a given basket of goods and services. The main difference is that the RPI includes housing costs (including mortgage interest rates) and tends to run slightly higher than the CPI.

If the economy overheats and inflation rises too quickly, prices can become unaffordable. This can lead to businesses failing as their profit margins are being eaten away by rising costs. Unemployment rises, and surging costs push more families into poverty.

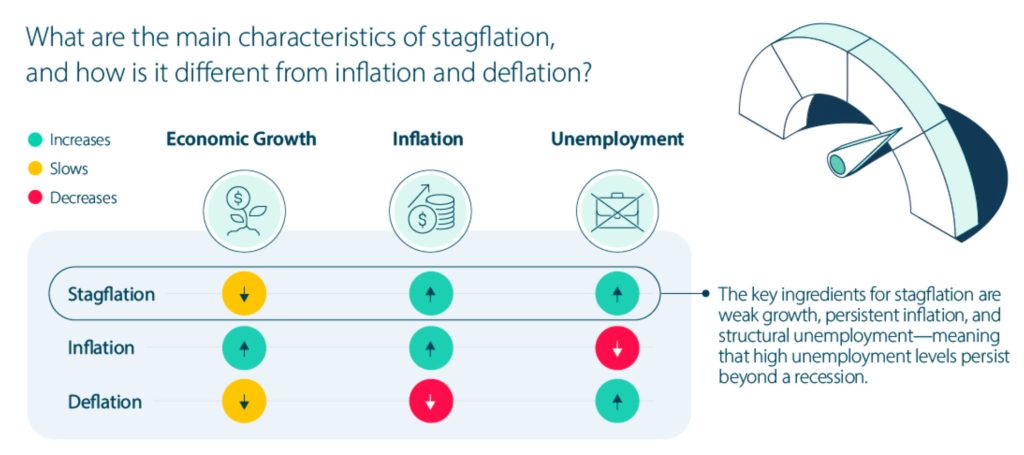

The next stage is ‘stagflation,’ where prices are continuing to rise, but demand stagnates due to high levels of unemployment. Growth is curbed, and the economy can fall into recession. This is what could be happening at present.

Deflation occurs when the economy swings in the other direction and prices fall. This can cause asset values to depreciate and again, can lead to a recession. Most economists and central banks agree that deflation is the worst type!

Source – advisor.visualcapitalist.com

These are all relatively normal parts of the economic cycle. While the ups and downs can create challenges in the short term, the economy will normally correct itself.

The Factors Behind High Inflation

In our March 2022 article on Inflation and Your Financial Plan, we explained the main factors behind the inflationary crisis. Brexit, the Covid pandemic, the Russian invasion of Ukraine, and the energy crisis all played a part in rising costs, pressured labour markets, and squeezed supply chains. Longer-term, many years of cheap borrowing and free-flowing capital meant that a period of high inflation had been on the cards for some time. It is easy to point this out now with hindsight! The confluence of so many economically significant events within a short space of time was simply a catalyst.

More than a year on, these factors are still in play, although energy costs are starting to reduce, and supply-side pressures are beginning to ease.

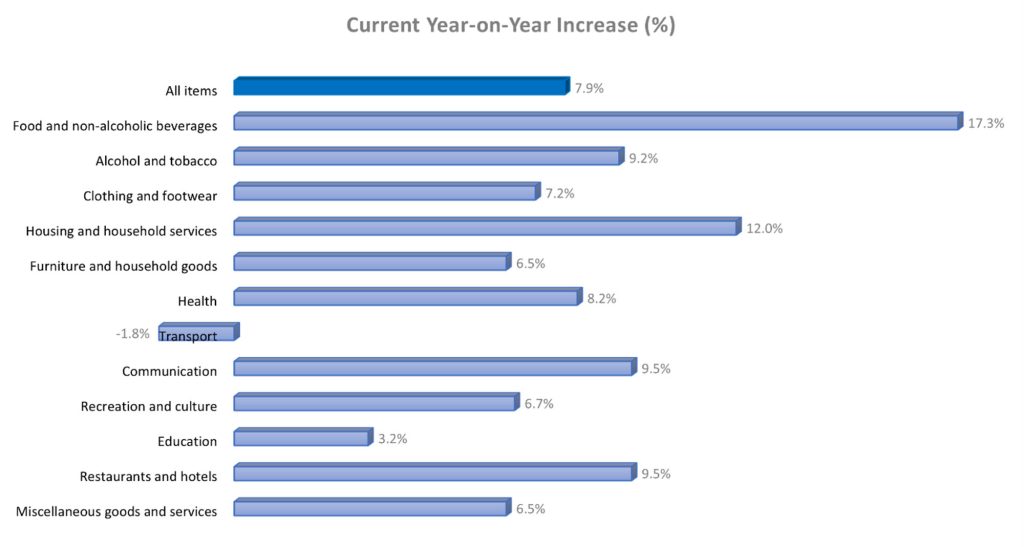

Remember, the rate of inflation is not a single figure – it is a composite of economic activity across a number of different areas. As you can see from the 2022 graph below, housing and household services (which included energy costs*) have taken up more than their fair share of the inflationary basket with a 12% increase year on year to the end of June 2023. Conversely, health, recreation and culture, clothing and footwear and education costs are rising at a more ‘normal’ rate, bringing the average down.

Food prices are a bigger issue in 2023, with more recent statistics showing price increases of 17.3%. This is partly due to some of the issues mentioned above, as well as an unfavourable climate.

*https://www.instituteforgovernment.org.uk/explainer/cost-living-crisis

Why Context Matters

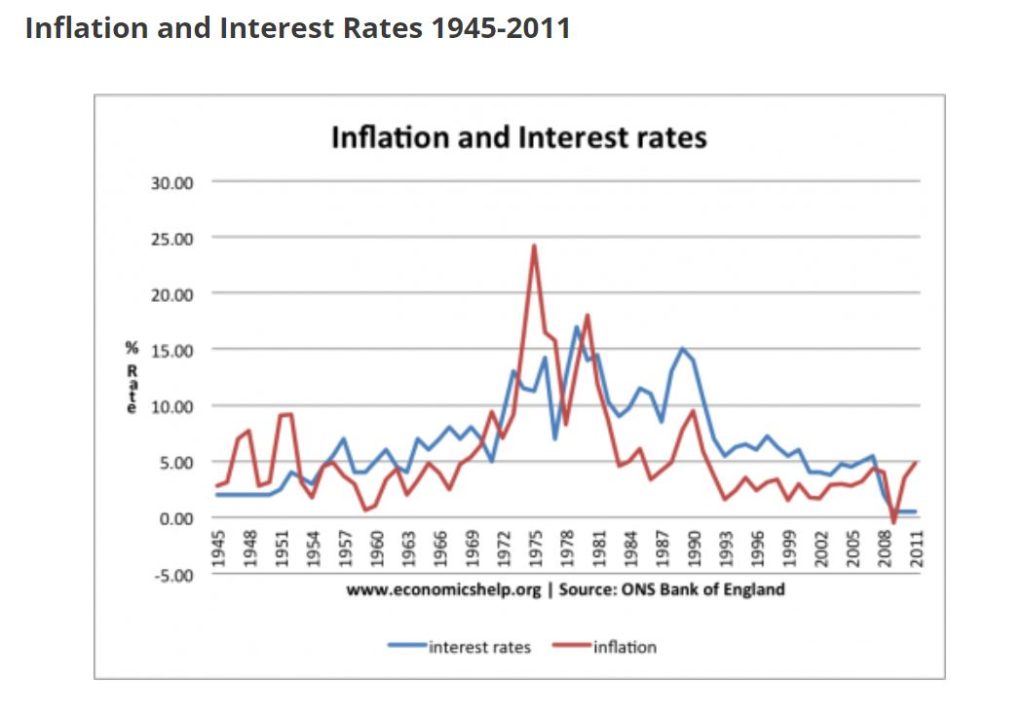

In historical terms, the current situation is not that unusual. Having benefited from more than a decade of low interest rates, it’s easy to forget that over the longer term, interest rates typically hover around the 5% mark, and reached as high as 17% in the 1970s. Of course, this did not have the same impact as it would today, given inflated property values and higher levels of borrowing. The graph below shows how inflation and interest rates have fared between 1945 and 2011. You can see the issues faced in the 1970’s and late 1980s.

Over the past 10 years, the CPI has risen, on average, by around 3% per year, even accounting for the recent ‘extreme’ conditions. But again, over the longer term, the current situation is not that extreme. Inflation peaked at almost 25% in the mid-1970s, and has exceeded 5% at some point in almost every decade (excluding the 2000s) since the 1940s. The UK BOE has increased the Base rate 13 times since 19th March 2020 from 0.1% to 5% on 22nd June 2023. The last time it was 5% was 10th April 2008.

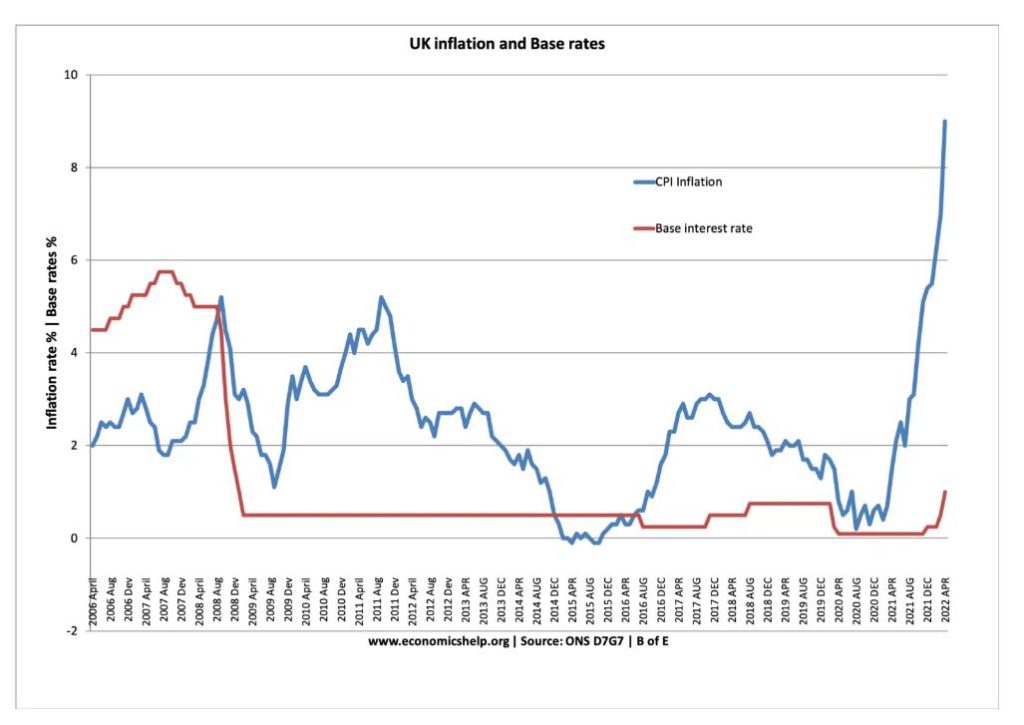

Inflation and Interest rates 2006 – 2022

The graph below shows both inflation and interest rates over the last 16 years. We must not forget how interest rates were next to zero for more than a decade.

On an international scale, UK inflation looks concerning compared to the US (4.5%) and Europe (6.5%). This is mainly down to the UK being an island and therefore less self-sufficient than other western economies. The UK has to import energy, food stuffs, fertilizer and lots more to function. It may also be partly due to BREXIT* and the UK having not secured energy deals with other countries that are favourable.

*https://www.bbc.co.uk/news/business-65962027

Of course, while UK inflation peaked at around 11% in October 2022, several other countries, including Zimbabwe, Lebanon, Argentina, and Turkey, experienced inflation rates in excess of 50%, with some even rising into triple digits. Perhaps we should count ourselves lucky!

The Impact of Rising Interest rates

When inflation rises, interest rates are usually not far behind. Increasing rates can help to cool inflation by reducing the amount of money circulating in the economy. It becomes more attractive to save than to spend or borrow.

This can have a knock-on effect on the property market, as it becomes more difficult for buyers to secure mortgages. Household finances can become stretched as renewing existing mortgage deals becomes more expensive. However, around 52% of properties in the UK are mortgage-free, which means owners will be unaffected unless they need to sell. The situation is still unfolding, and it’s likely that the impact will differ throughout the UK.

House prices have fallen c. 4% since their Aug 2022 peak.* It is impossible to say what might happen in the future as prices are largely governed by supply and demand, but it would be fair to say that rising interest rates (and consequently mortgage rates), a cooling economy and high inflation have hit house price confidence. It would not be surprising if we saw further declines.

*https://www.bbc.co.uk/news/business-65774620

What about my investments?

Investment portfolios are also impacted by rising interest rates. Equities can vary – shares in high-growth companies that rely on credit can reduce in value, while steady dividend-producers become more desirable.

Bonds are highly sensitive to interest rate changes, and experienced significant volatility in 2022 when rates were rising rapidly. Now the position is more settled and yields are attractive, bonds once again represent good value for investors. This suggests it would not be prudent to sell out of bonds despite the recent falls in price over the last 18 months.

We may see further increases to interest rates to 5.75% or higher, although many analysts believe they are almost at a peak. Theoretically, the base rate should start to reduce once inflation is stable, although it’s possible that rates will remain at 4.5% – 5% for some time yet.

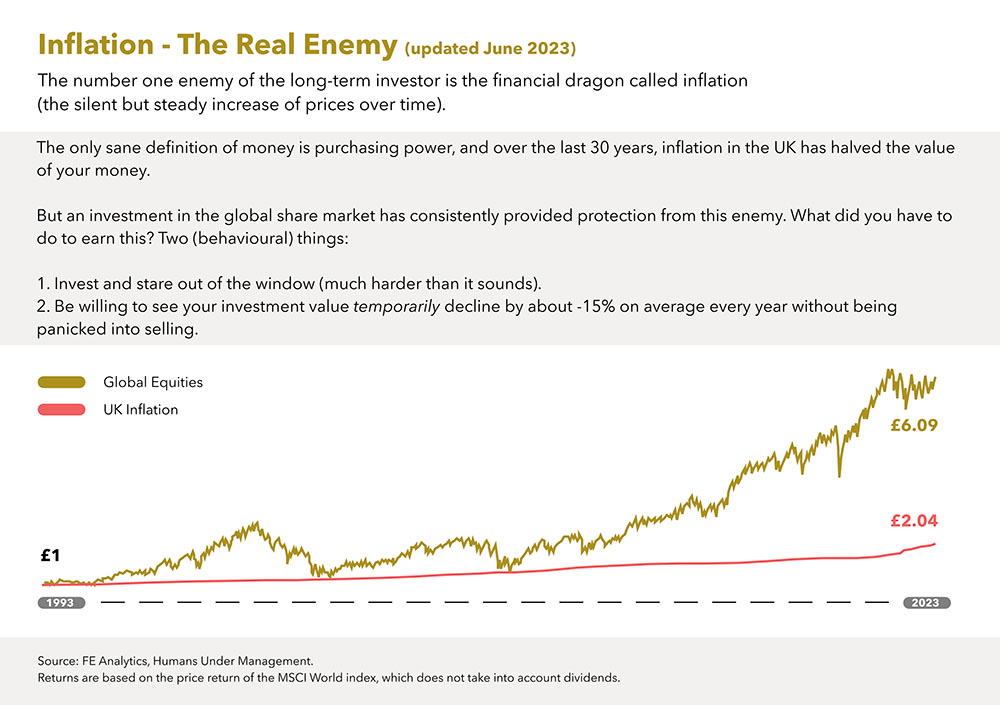

If you want to outpace inflation, buy equities and hold them for 7-10 years. Equities (stocks and shares) outperform inflation over time. Check out the graph below.

Financial Planning in Uncertain Times

The principles of sound financial planning remain the same regardless of where we are in the economic cycle. Below are our tips for staying on track with your plan, even during uncertain times:

- Remember that long-term equity investing is the most reliable way to beat inflation. Try to maintain your regular contributions and even increase them if you can.

Stay invested throughout the ups and downs. Trying to time the market is counterproductive, and taking money out during a downturn can impact your long-term returns. - Make sure you have an adequate emergency fund (at least 6 months’ expenditure) and sufficient financial protection. This can provide a cushion if the unexpected happens.

- Spread large cash balances across multiple banks. Consider both easy access accounts and term deposits to optimise interest and flexibility.

- Consider overpaying your mortgage (check for early redemption penalties) to reduce the impact of rising interest rates.

- Volatility is part of investing. Remember that everything is cyclical, and the current volatility will eventually pass.

- When markets fall (as they always do at some point), the thing to remember is that you have not lost any units in your funds. Only the price has changed. Investing means 7-10 years+. If you leave it to do its thing, a portfolio with a reasonable or high level of equities will outperform cash and inflation.

Please don’t hesitate to contact your Tandem adviser if you would like to discuss any of the topics covered.