The start of 2022 has been turbulent to say the least. Between the aftermath of the pandemic, the Russian invasion of Ukraine, the growing energy crisis and inflationary pressures, financial markets have been highly volatile.

We could go into the reasons behind the invasion and various economic forces at work. But a key part of financial planning is to understand that we can’t control everything and to focus on the areas that impact our own lives.

The human race has seen crisis after crisis but has proven remarkably resilient. The markets rise and fall, and world events can mean that some periods are more volatile than others. The key to successful investing is not trying to time or avoid the volatility, but to accept that it will occur and be prepared to ride it out.

Our tips for staying calm during a falling market are below.

Look Long-Term

When you invest, you need to be prepared to stay in the market for at least five years. This is usually enough time to iron out any short-term volatility. It would be very unusual for the market not to rise within any given five-year period.

To get the best out of your investments, ideally you want to invest for ten years or more. This is usually enough time to not only smooth out the bumps, but also to benefit from the upside.

Over a lifetime, investing is the best way to ensure your money holds its value when inflation takes effect.

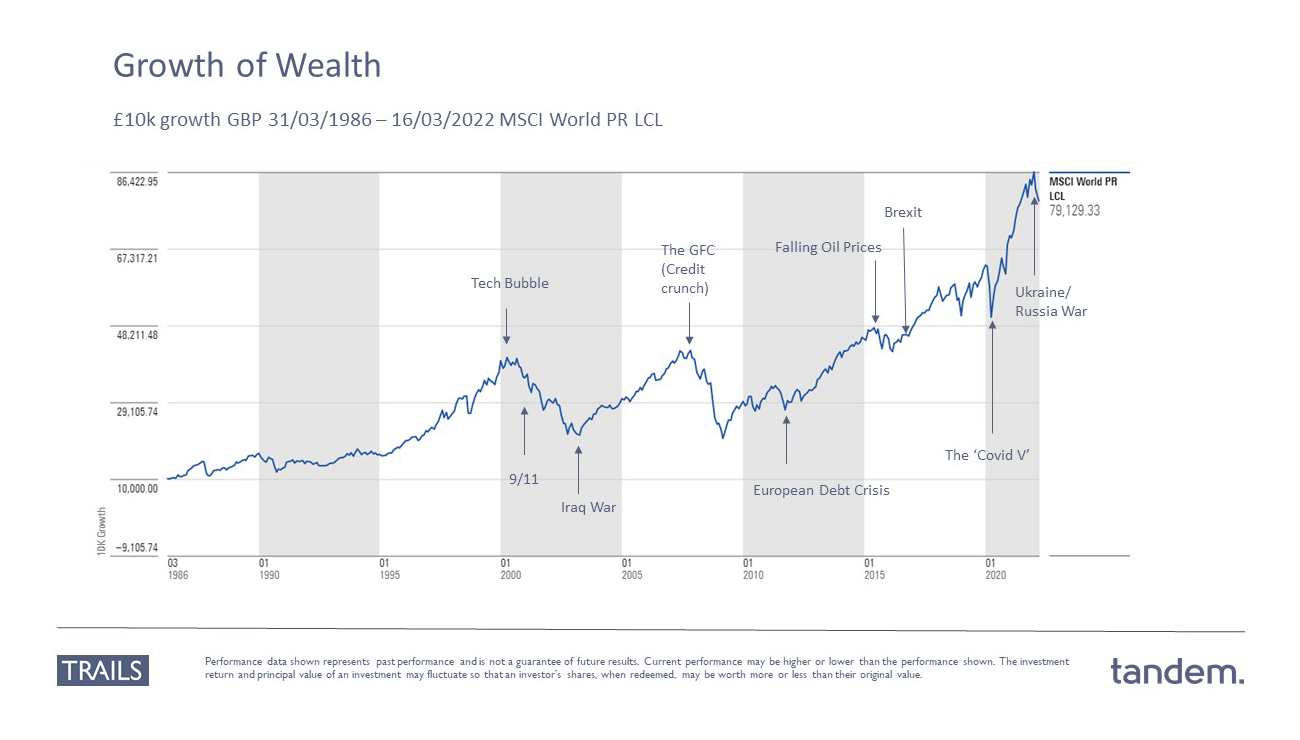

The chart below shows the performance of the MSCI World Index over a period of almost 36 years. This indicates how global markets have performed. While there are many other indices to choose from, most have moved in broadly the same direction.

As you can see, there have been various ups and downs, punctuated by major world events.

There are a few observations to be taken from this:

- The market generally moves in an upwards direction.

- Despite the ups and downs, the market has always recovered to a stronger point than before.

- Usually, the best trading periods quickly follow the worst.

- At least in recent years, the recovery time has reduced with each crisis. Following the volatility caused by Covid in early 2020, the market jumped to an all-time high within the year.

Remember, much of the volatility is caused by investor behaviour. If investors are taking money out or moving around their holdings, this can cause prices to drop. Trading usually returns to normal when the situation becomes more settled.

Don’t Panic

Many investors find that their instinct is to take money out when the market is falling. They reason that they don’t want to see further losses, and at least their cash will be safe in the bank.

There are several reasons why this is not a good idea:

- If you sell your investments during a low point, you turn a market fluctuation into a real monetary loss.

- If the market recovers quickly, it’s likely you will miss out on this. Equity investments can’t be expected to provide a steady annual return – those peaks and troughs are key to the long-term performance.

- It’s impossible to time the market and all known information is priced in at any given time. It’s not only a case of knowing when to sell, but also when to buy back in.

In fact, periods of volatility can be a good time to invest more. With prices depressed, you can buy more shares for your money. You should certainly keep up with any monthly investments, as this allows you to benefit from both the highs and the lows. Maintaining discipline is a key fundamental when building wealth.

You should always make sure you have a reasonable cash reserve to deal with any emergencies or short-term spending. This can help avoid the need to dip into your investments at a low point.

Diversify

Judging what to buy and sell is just as challenging as getting the timing right. We don’t know what will happen in the world, when these events will occur, and how they will affect different asset classes and business sectors.

We mitigate this by investing in a wide variety of assets. At any given time, some will rise and some will fall. Some will be volatile, but can boost returns, while others form a cushion of stability.

If you invest in one company, your financial future is staked entirely on that business. If it fails, chances are you will lose everything.

Our portfolios encompass around 27,500 individual stocks and bonds, which are allocated based on market capitalisation. The components, and their proportions, vary depending on how much risk you are prepared to take. The portfolios will still rise and fall, but spreading the risk (diversification) helps to protect your money from the worst of any volatility.

Constructing Your Portfolio

It has never been easier to run your own portfolio. You can buy and sell shares at the touch of a button, and with reasonable trading costs.

A platform can help you keep track of your investments, as well as providing various planning tools, such as giving you access to various tax wrappers (e.g. ISA, Pension, Offshore Bond etc.). Additionally, your assets will be ring-fenced in a client nominee account (or trust), so that if the platform fails, you don’t lose your money.

But buying and selling direct shares is time-consuming, and not always profitable. Using a collective investment, run by a reputable fund manager, allows you to invest in a wide segment of the market. The heavy lifting of research, analysis, and trading is taken care of for you.

Passive, index-tracking funds are not only an inexpensive way of buying into the market, but they also remove the prospect of judgement error. No attempt is made to time the market or seek out favourable stocks. The fund will simply buy and sell the components of a given index and will naturally tilt towards the best performing companies as these make up a larger share.

It is important to select a well-established, financially strong fund manager. We prefer Vanguard, Dimensional and iShares (Blackrock). While there are no guarantees, this offers an extra layer of reassurance.

With your money in good hands, do not underestimate the importance of discipline and financial coaching. While you may understand that you should not take money out in a falling market, sometimes it can be helpful to have someone to talk you through the crisis. A financial planner can help you to align your investments to your goals and objectives.

Please do not hesitate to contact a member of the Tandem team to find out more about investing and financial planning.