When you hear the word “retirement”, your mind may drift to the idea of no longer working. But the word retirement has negative connotations. It also means to withdraw, stopping, ceasing, leaving and seclusion. At Tandem Financial, we prefer the term “financial independence,” which means having enough income to decide whether to work or not.

However, how much is “enough” to achieve this goal? Can you rely on the State Pension to cover your needs in later life? This is unlikely. So, how much more income and capital is needed?

Defining “Enough”

In the context of determining how much is enough – a good rule of thumb is to assume you will need to achieve 50-66% (1/2th to 2/3rds) of your current net income in retirement. This does not give you a definitive figure, but it gives you a starting point from which to work.

For instance, suppose your after-tax income is currently £5,000 per month. In this case, you might need £2,500 – £3,333 per month in retirement.

However, the calculations quickly become very complex due to the variables and unknowns involved. For instance, we don’t know exactly how long we will live or how taxes might change over time. Will our spending habits change? What will inflation be? How will our investment performance pan out? When will the next downturn in markets be?

When we think of the word “enough” in this discussion, we typically think about a target number or capital amount, that we want to achieve (e.g. £500,000 in savings/ investments). However, the above variables make arriving at a determinate number difficult.

“Enough” – A Broader Perspective

Does this make the whole exercise pointless? Of course not. Rather, to account for the uncertainties, it can help to think of a “target number range” rather than a single firm number.

Let’s take inflation as an example. Inflation naturally raises the cost of goods and services over time. As such, £1 buys fewer items with each passing year.

Suppose inflation rises at 2% annually between now and your “financial independence date” (2% is the Bank of England’s target). If this transpires, then your savings should grow by at least 2% per year to retain their spending power.

However, what if inflation averages at 3% per year between now and your retirement? In this scenario, your total retirement fund (and/or investment performance) will likely need to be greater to achieve the same living standards under the 2% scenario.

The benefit of this kind of “contingency planning” is that you can approach your later years with your eyes wide open. Instead of blindly saving and hoping it is enough to cover your retirement needs, you have a realistic “ballpark” to aim for.

At Tandem, we use a rate of 3% for inflation to forecast in our financial projections. This is because the long term average (1989 – 2024) inflation rate is 2.83% and it means our projected figures are both realistic and a little pessimistic.

We also use growth rates of between 4-6% per annum, depending on which of our TRAILS™ risk models you are invested in. The net of charges annualised return is at least this for all of our models as you can see HERE: https://bit.ly/4flKJEM

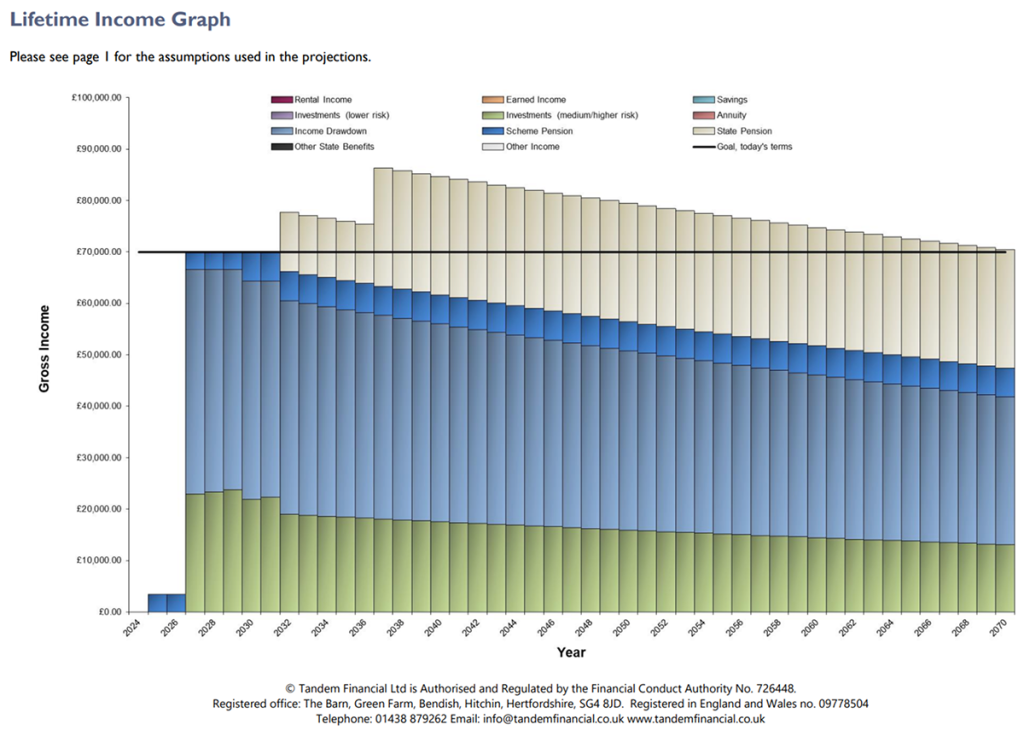

Below is an example of a Lifetime Income Graph showing the various forms of income a client has in today’s terms based on a required income of £70,000 per annum.

Drilling down to a number

This is all well and good. Yet, doubtless, many readers will still wonder: “How much is enough to retire comfortably?” To help with this, it might help to look at an example.

Suppose John and Linda, currently aged 40 and 38, want to achieve financial independence at age 60. What kind of number – or ballpark of numbers – should they aim for?

A good starting point is to check John and Linda’s other future expected incomes, such as any expected rental income they may have from buy-to-lets they own, any defined benefit pensions they may have (which may kick in from age 60 or 65 typically) and to calculate their State Pensions which they would receive in this example at age 67. After all, under the rules in 2024-25, this can provide £221.20 a week (£11,502.40 per year) each, which is just a smidge over £23,000 gross collectively. When they reach State Pension age, the income is indefinite until each of them die. It also rises each year by at least 2.5%.

Could you “live well” on just £23,000 gross income in today’s terms? If your mortgage was paid off to zero, and you had few costly hobbies and didn’t want many or any holidays, then perhaps, but more than likely, this would only just cover the basics, like food, council tax and bills.

Moreover, this is from age 67 for John and Linda, and they achieve State Pension Age two years apart. More importantly, their objective is to achieve financial independence at age 60! So, they require other forms of income and capital to cover the difference.

Making up the Shortfall

John and Linda consider £1,917 per month (£23,000 p.a. – their combined state pensions) insufficient for their desired lifestyle. They would like £3,000 net, joint, per month, sufficient to enjoy the occasional holiday, meal out, and other comforts in later life.

Neither person in this example has any other “guaranteed” income source besides the State Pension. For instance, they have no final salary pensions and do not own any rental properties.

As such, they must make up the £1,083 monthly shortfall in other ways. Here, a useful exercise is multiplying the annual required figure (£12,996) by 25 to account for their total plausible time of financial independence, or to multiply the monthly amount of £1,083 by 300 (to arrive at the same figure).

This gives them a figure of £324,900, which could help John and Linda supplement their guaranteed income streams indefinitely if they do not withdraw funds excessively in the future.

However, what about tax? (The £324,900 figure is pre-tax). Let us assume that the monthly shortfall of £1,083 would be taxed at a 20% marginal rate. If we divide this figure by 0.8, we get the gross figure of £1,353.75.

Multiply the figure by 12 (for the year) and then by 25, and we now have a “target number” of £406,125. This provides more of a “worst-case scenario” for tax.

John and Linda are not done. They also need to consider inflation. If the price level rises by 2% per year until they reach age 67, then the £406,125 figure rises to £693,209.

If inflation rises by 3% in this period, the figure increases even more to £902,121!

So, realistically, John and Sarah have a “target range” of between £693,209 and £902,121 to “safely” achieve financial independence.

BUT, if John and Linda wish to achieve £3,000 per month (£36,000 per annum) from age 60, they would need an extra c. £375,000 in future terms on top of the above amount.

Forging a plan ahead

Are you feeling overwhelmed or discouraged so far? Please don’t be.

Although we are only scratching the surface of the calculations involved in the “enough” question, the reality is that you are unlikely starting from scratch in your journey to financial independence.

Perhaps you already have assets in ISAs, regular savings, and pension schemes which give you a strong foundation to move toward your target numbers. If you are saving monthly into ISAs and pensions, you are on the right track!

Additionally, perhaps the tax burden will not be as heavy as the “worst-case scenario”. If you are smart with various tax breaks (e.g. using tax relief on pension contributions), then the target number could fall significantly.

All of this is EXACTLY why a FINANCIAL PLAN is required, that is specific to you. It is the strategy, the roadmap to achieving financial independence! It should be reviewed annually to make sure you remain on track to achieve your goals.

In episode 7 of The Finance Geeks, Warren and I discuss the concept of ‘enough’ and we cover off many of these points above.

https://open.spotify.com/episode/1Hny1nJ5jatWb69k3VVV4L?si=52187fb743a54d3c

Please don’t hesitate to contact Tandem to find out more about the topics covered.