Everyone should have a financial plan, although not everyone chooses to work with a financial adviser. Given the information and tools available today, using the services of an adviser or planner is entirely optional.

So given the option, why should you choose to work with a financial planner? Where can they truly add value, over and above what you can do for yourself?

Creating a Plan for the Future

We all have aspirations for the future, but at what point do they develop from simple dreams into fully developed goals?

A goal should be SMART – Specific, Measurable, Achievable, Relevant, and Time-Bound. See HERE for more on this. The more detail you can flesh out, the more tangible it will become. If the goal feels relevant and achievable, it will be easier to make your decisions around it.

A financial planner can help you set your goals by asking thought-provoking questions, so that you focus on what is really important to you. Most people don’t take the time to think about what they really want to achieve, so this process can be extremely enlightening.

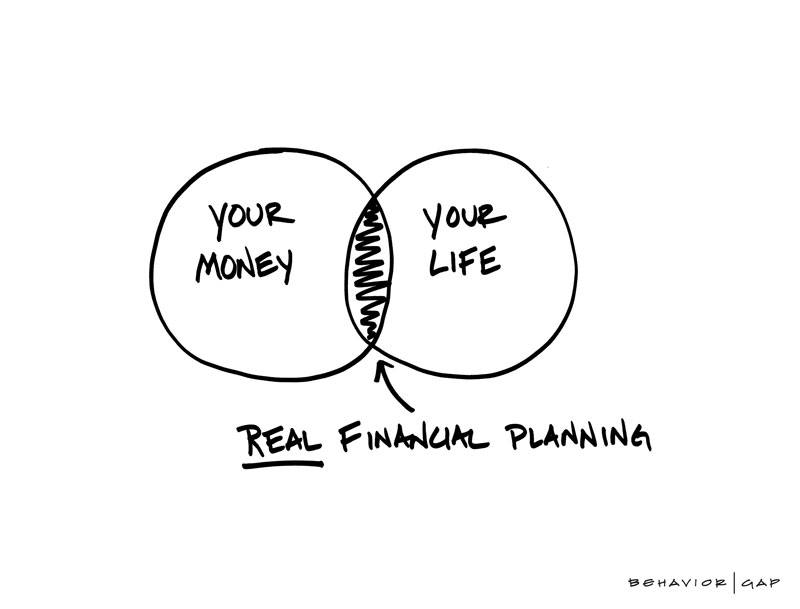

Once you have created your goals, your financial planner will develop a personal strategy for you; effectively a road map to financial independence. The plan will be holistic, taking the entirety of your financial situation into account, rather than simply looking at one area at a time. Additionally, any recommendations made should be impartial, free of bias, and focused only on your interests.

If you follow the plan, and stay on course, you have a much better chance of achieving your goals than if you tried to do everything yourself. Research has shown that as well as the intangible benefits of a relationship with an adviser, such as peace of mind, the ‘adviser alpha’ factor could also be worth up to as much as 3% per year (net returns) in added value!

Helping Your Money Work for You

Financial products are a significant part of financial planning. A planner may recommend ISAs, investment accounts (e.g. a GIA – General Investment Account), Pensions, Onshore or Offshore Bonds, cash term deposits etc., and various insurances to help you achieve your goals and make your plan more efficient. They can also help you navigate the complexities of estate planning and help you deal with debt.

While reducing tax is not the end goal of financial planning, a proactive planner will help you reduce tax (sometimes mitigating it completely) legitimately, by making the most of your allowances and investing tax-efficiently.

A good financial planner aims to strike a balance between educating and empowering you to make important decisions, using their professional expertise to guide you onto the right path. They will take the time to explain the options clearly and ensure you fully understand any recommendations before proceeding. This can save significant time and mental fatigue compared with doing all the research yourself.

Ultimately, real financial planning aims to make use of financial strategies to make your life better, not to invest your money and move on. It is to save you time and hassle too!

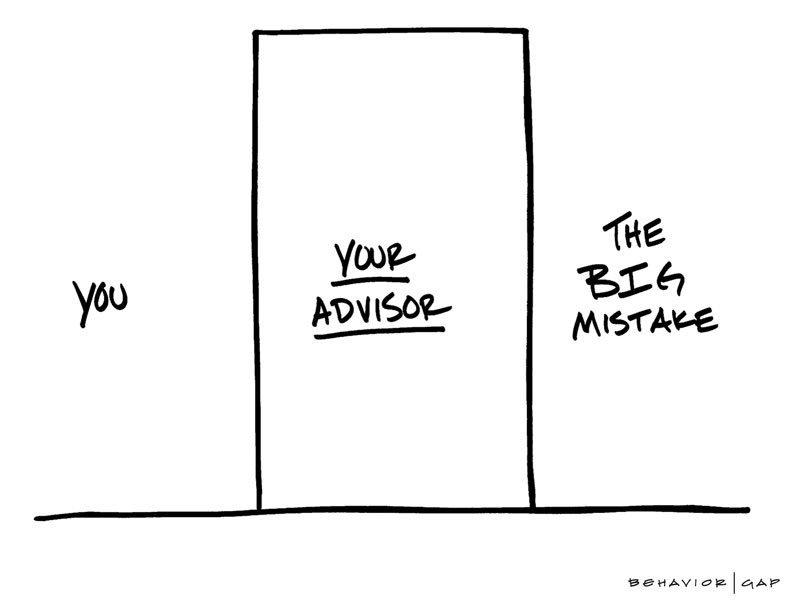

Helping You with Big Decisions

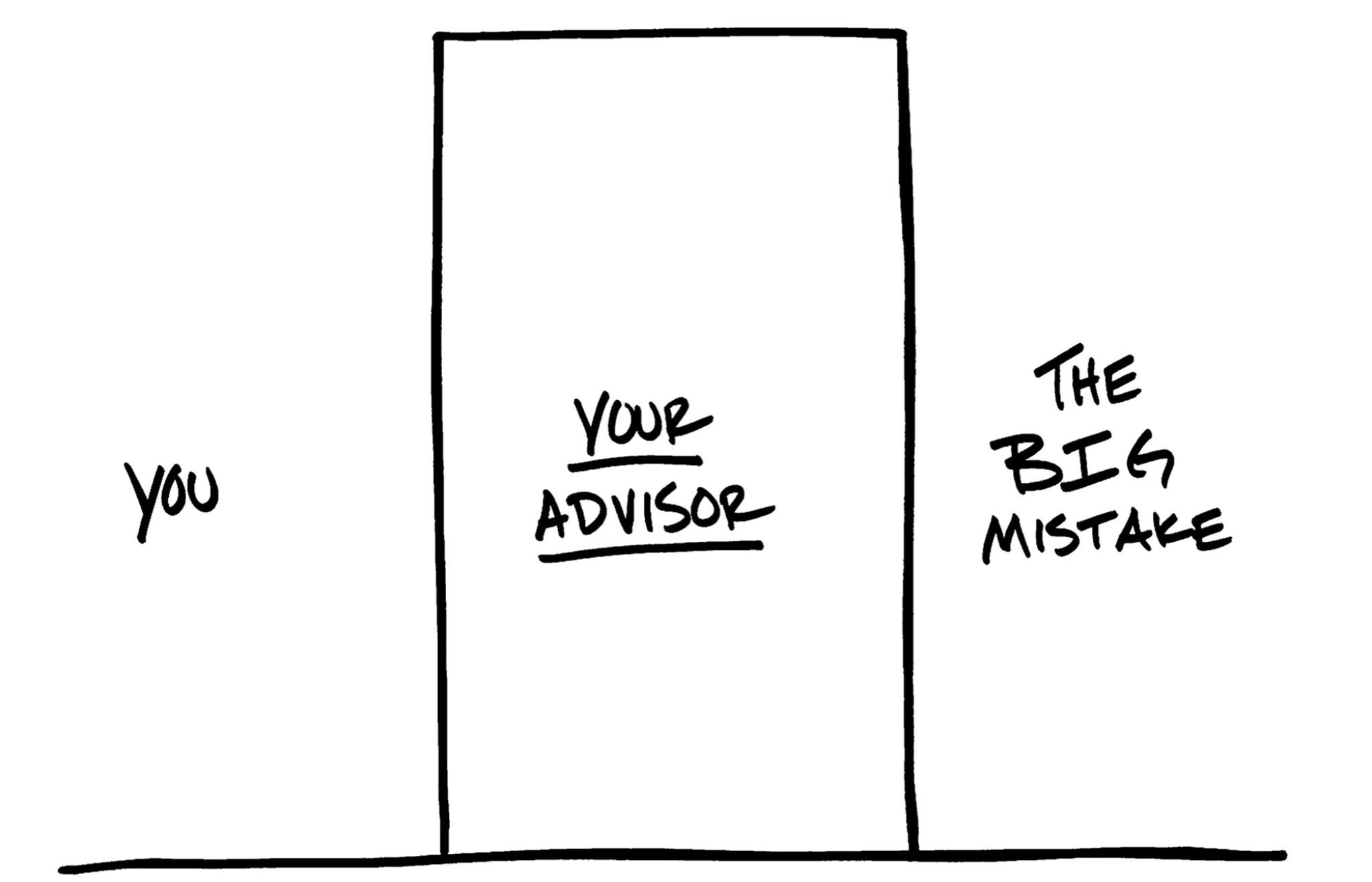

With financial information constantly available at our fingertips, it can be difficult to filter out the noise. At any given time, we are bombarded with stock tips, gimmicks, and unregulated money advice. It is sometimes unclear which actions are worth taking and which are best ignored.

A financial planner can offer a willing ear to discuss any options you are considering and give an impartial second opinion. They can offer advice on how to spot a scam and whether a particular course of action is likely to benefit you or not. This can help to stop you from making expensive mistakes.

Remember, your financial plan is based on a thorough analysis of your goals, objectives, and the financial marketplace. Your adviser has already spent the time and developed the expertise to recommend the most suitable strategies for you. This means you can focus your time on what’s most important to you. You can get on with living your life.

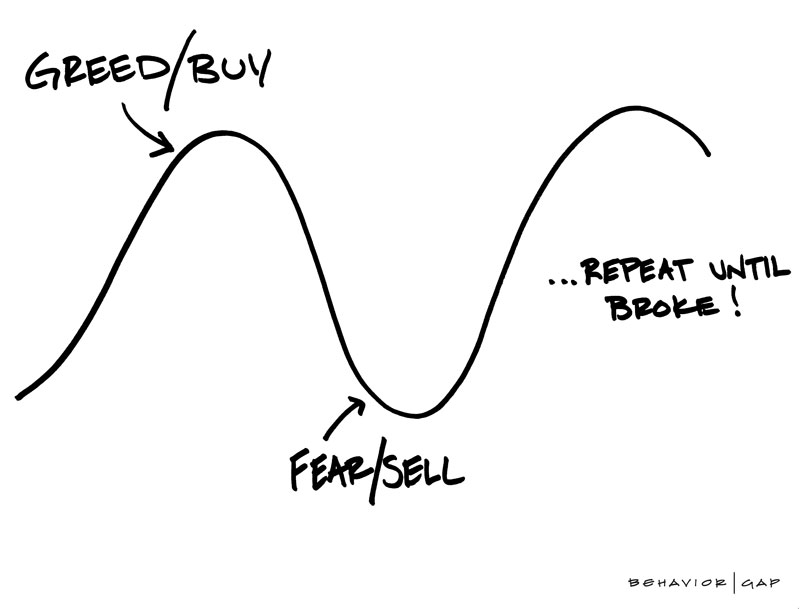

Encouraging Investor Discipline

It is easy to invest but investing well is a little more complicated. There are thousands of investments to choose from, all with different structures, risk levels, and growth potential. Making the connection between what you want to achieve and where to invest your money is one of the biggest challenges for DIY investors.

Firstly, your financial planner will open a conversation about risk and reward, usually with the help of a structured questionnaire. These discussions will cover not only how much risk you are comfortable with (as well as how much volatility you can withstand), but also the returns you need to achieve your goals, and how much you can afford to lose in the short term if the market dips. This is called your ‘capacity for loss.’

Once your risk level is established, your financial planner can use this to recommend an investment portfolio for you.

Essentially a strong investment portfolio has two main features. One, it is well diversified, and holds investments from multiple asset classes, sectors and regions. Two, it offers value for money and does not incur excessive charges.

Once your portfolio is in place, sticking to the strategy and maintaining the risk level is likely to produce the best results. An adviser can coach you to make sensible decisions and avoid allowing emotions to drive your investment strategy. Long term, markets go up. Investing means 10 years plus. Investing is largely about holding your resolve when certain things happen, sticking to the plan and not panicking.

Thinking Long-Term

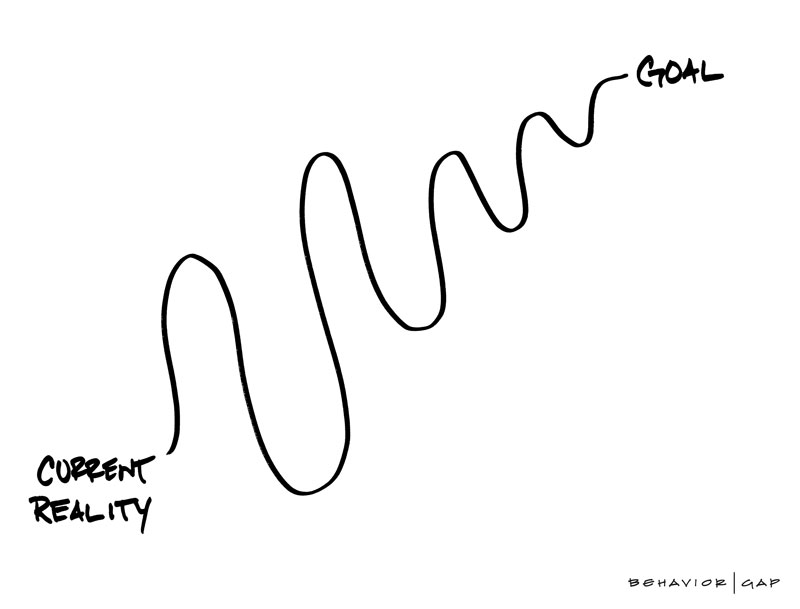

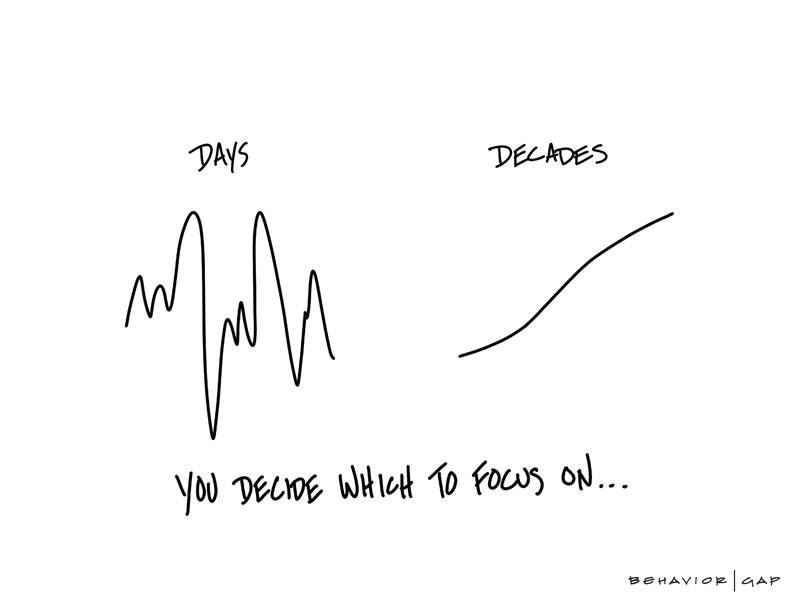

A financial plan is not simply a one-off event. It is a living document that needs to be reviewed and adapted over time. Your circumstances will change, and none of the assumptions made at the beginning will play out exactly as expected. The market will fluctuate, and you need to take a long-term view to see the full benefits of investing.

A financial planner can hold you accountable for reviewing your plan and making small changes as required. As well as the practical benefits this can offer, an ongoing relationship with a trusted professional can offer value beyond a monetary amount.

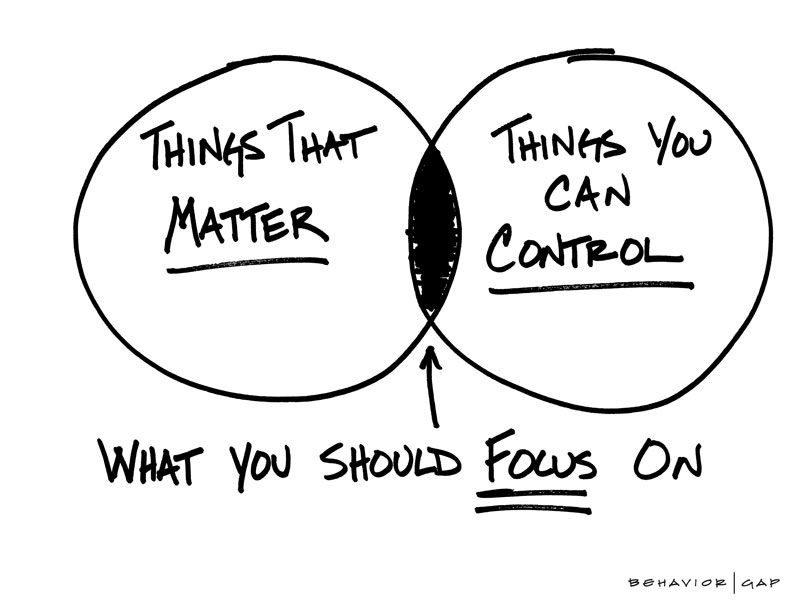

Focusing on What’s Important

There are issues that you can’t control, and nor can your adviser. World events, the global economy, media coverage, and individual stock performance will all affect your financial plan at some point.

The key is not to react to these events in the moment, but to assume they will happen and plan around them. Focus on the important matters that you can control, for example:

- Sticking to your budget

- Addressing risks by having the right protection in place

- Maintaining your discipline throughout the ups and downs

- Taking care of your physical and mental health

- Spending quality time with your loved ones, doing things you enjoy.

A financial planner can help you focus on the parts of your plan that are in your hands. They can also reassure you that despite everything going on in the world, your plans are still on track, even if you have to make some adjustments along the way.