Diversification is a crucial aspect of investing. It helps investors spread out their risk and access new opportunities for growth. Yet, how does it work, and what are the best ways to diversify a portfolio?

A delicate balance needs to be struck. Indeed, “under-diversifying” can expose a portfolio to capital risk. Conversely, “over-diversification” can dilute an investor’s returns and needlessly complicate their portfolio.

The best approach lies somewhere in between, with the precise blend of investments tailored to each investor’s unique needs, goals and values.

The Basics of Diversification

Investors have a wide range of potential investments to choose from in today’s world. Indeed, in 2024, there are over 4,000 funds for sale in the UK. Clearly, buying all of them would be excessive and impossible to manage.

On the other hand, simply putting all of your money into one stock is not the answer either. If the company fails, you could lose your entire investment. So, what can you do?

Some people may gravitate towards the “safety” of cash. After all, the value of cash savings does not rise or fall like the stock market does. There is also the peace of mind that comes with knowing up to £85,000 is covered by the Financial Services Compensation Scheme (FSCS).

However, whilst cash can be useful for short-term capital requirements (e.g. an emergency pot), it is underwhelming for building long-term wealth. This is because interest rates typically fall under inflation, reducing the spending power of each £1 saved over time.

Investing typically offers much higher growth potential (with the right strategy). Diversification is key to integrating different asset classes, sectors, markets, regions and business types into a portfolio.

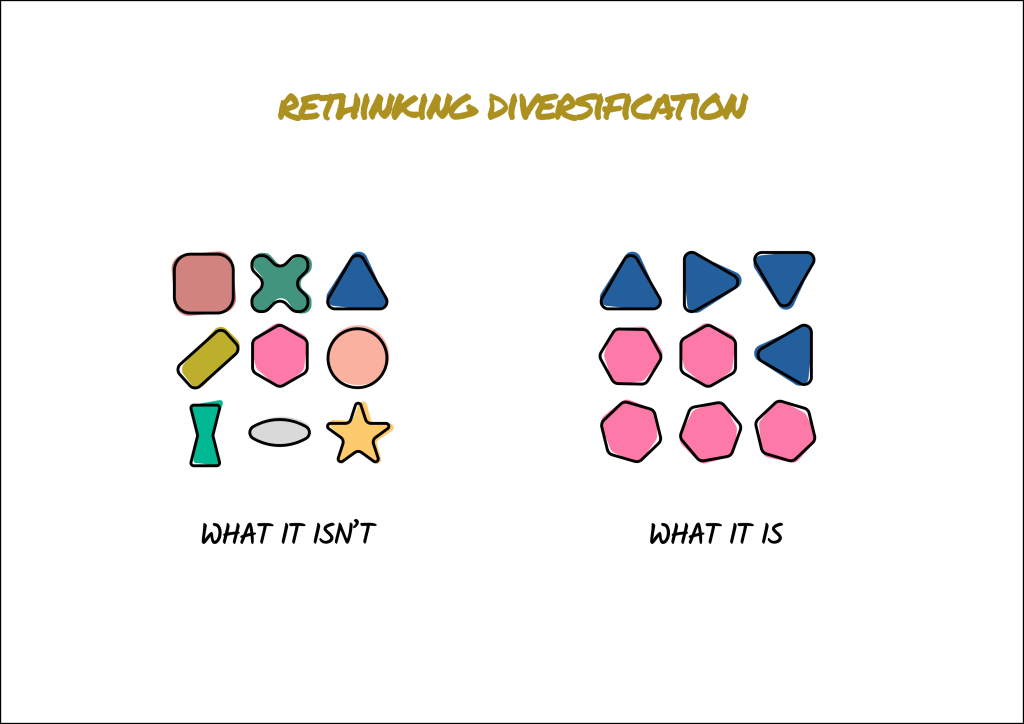

What Diversification is Not

Some people assume that diversification is another word for “complicated.” However, being diversified does not mean having 5x pensions with 5x different life insurance providers.

Nor does it mean holding too many asset types such as gold (or other commodities), structured products, non-fungible tokens (NFTs), Crypto, direct stocks, a commercial property fund and lots more.

These kinds of portfolios can actually increase problems. Not only are they a management nightmare for the investor (how can you possibly track everything properly?), but they can intensify liquidity risk, volatility risk, default risk and more.

Another common misconception of diversification is that you need dozens of funds in a single pension or ISA. Whilst your investments might appear spread out, a deeper look under the hood often reveals a lot of overlap.

For example, perhaps 5 funds out of your 35 have their biggest holding in the same stock. This is over-diversified and runs into the same problems above.

A final point on this specific subtopic. Diversification does not mean regularly buying and selling investments. A high amount of “churn” or trading activity is typically counterproductive, adding needless fees with each transaction (e.g. commissions), which eat into your returns.

What Diversification IS

If we could summarise our approach to diversification here at Tandem Financial, it would likely be as follows: focus on what you can control and let markets work for you.

There are some crucial components to our investment philosophy. Firstly, investing should be viewed from a long-term perspective, i.e. 7-10 years, or more.

This means taking a “buy and hold” approach (sometimes called Strategic Asset Allocation), spending time in the markets rather than trying to out-guess them. As Jack Bogle says:

“Don’t look for the needle in the haystack. Just buy the haystack”.

A diversified portfolio does not need a wide range of asset classes. For most people, two will suffice – equities and bonds. The two are inversely correlated (when one goes up, the other tends to go down), providing a “smoothing out effect” to your investment journey even if the markets are volatile.

Another crucial aspect of this style of investing is cost control. As in other areas of life, why overpay for something? In the investment world, active funds tend to be costlier than passive (index) funds. Yet, the former rarely outperforms the latter.

Building a diversified portfolio focused on passive funds can help you keep more of your hard-earned returns. It still gives you access to a wide range of sectors, such as:

- Utilities

- Communication

- Construction

- Real Estate

- IT

- Energy

- Healthcare

- Industrials

- Insurance

- Banking, and more.

You can also keep costs under control by limiting portfolio rebalancing to once a year (to realign your investments to your chosen asset allocation). It is also a good idea to explore ideas to make your portfolio more tax-efficient using ISAs, pensions and other “vehicles” to maximise your growth potential.

Diversification and Investor Mindset

Once you have built your diversified portfolio, what comes next? The next step is to stay disciplined. If you have committed to regular monthly payments, for instance, then keep them going through thick and thin.

Try to develop a long-term mindset with your investments. When markets fall, many investors start to worry or even panic. Others view these times as perfect opportunities for their monthly contributions to buy valuable assets “on the cheap”.

Even a diversified portfolio will still experience volatility. This is just the nature of investing. Before committing large sums, you need to be honest with yourself about what you are comfortable with.

A financial adviser can help you explore different asset allocation models to determine which approach would be most appropriate for your needs and profile.

As time passes, occasional rebalancing may be necessary. Different assets are likely to perform differently over time, throwing off course your chosen ratio of equities-to-bonds. Here, again, a financial adviser can provide valuable guidance about how to make a prudent correction.

Please don’t hesitate to contact your Tandem adviser to find out more about the topics covered.