2022 has thrown us a few challenges, including spiralling inflation, interest rate rises, and geopolitical conflict. The financial markets have been understandably volatile, with most investment sectors reporting a loss since the turn of the year.

The basic principles of investing are simple – stay invested, diversify, and take an appropriate amount of risk. It is easy to stick to these principles when things are going well as you can see the pay-off within a short period. It is far more challenging to keep your discipline in a falling market. But ultimately, this is what makes a successful investor, and will be far more rewarding in the long-term.

What Should You Do in a Volatile Market?

The short answer is – not much. A good investment plan is designed to work in all markets. It doesn’t try to avoid volatility but accepts that it will occur because that is how the market operates.

When the markets fluctuate, losses are simply theoretical for long-term investors. However, if you sell your investments during a downturn, this locks in the loss, which can be very difficult to recover from. If you then re-invest, you may have missed out on the recovery, which means you are buying in at a higher price. These actions are detrimental to long-term growth. This is why it’s important to keep an adequate cash reserve, so you don’t need to dip into your investments at short notice.

Regular investors can actually benefit from market downturns, thanks to pound cost averaging. This means that when prices are low, you can buy more for your money. This is why it’s important to keep your regular contributions going, even when it looks like you are losing money.

Share prices are not only based on the real value of an asset, but also on how the market expects it to behave. This means that any world event, news item, or corporate announcement that could potentially affect the value of the company is already reflected in the price. Trying to buy and sell around these events relies heavily on luck and is usually pointless.

Sticking with your plan is the best way to cope with a volatile market.

A History of Market Returns

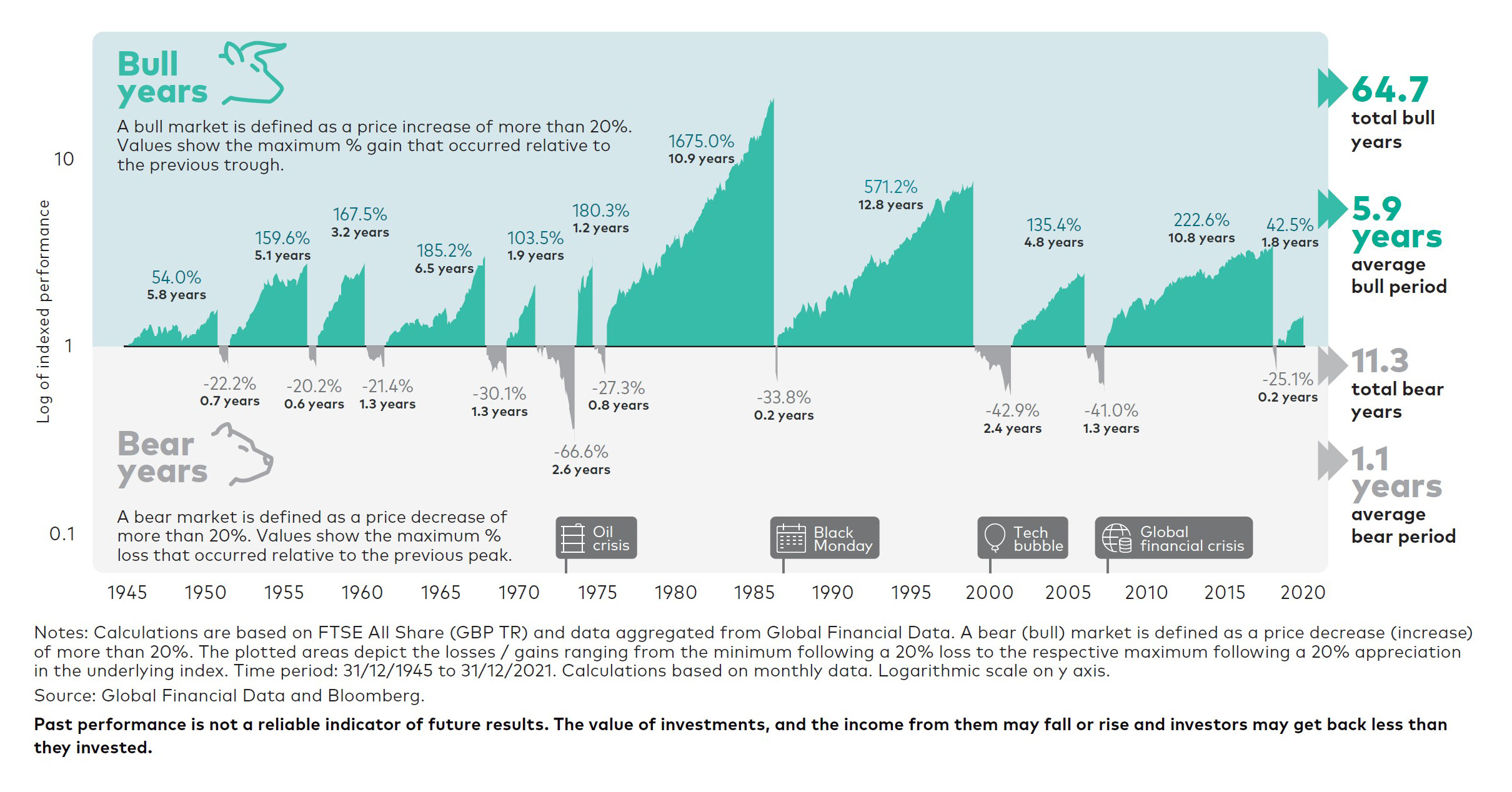

But you don’t need to take our word for it. The chart below shows a history of the global stock market since 1945.

A PDF copy of the document is available here.

You may remember the global financial crisis of 2008, the tech bubble of the early 2000s, and the recession in the late 1980s. These events all felt catastrophic at the time. But as you can see, the actual periods of loss were relatively short, especially when we consider that investments should be held for a minimum of five years, preferably 7-10 years plus.

Even more importantly, the periods of growth were longer, more frequent, and more robust than the downturns. Since 1945 there have been 11.3 ‘bear’ (negative) years and 64.7 ‘bull’ (positive) years. Historically when the market recovers, it grows to an even higher point than before.

In the grand scheme of things, a bear market of a few months or even a couple of years barely registers in the longer-term numbers. Despite the recent volatility, our TRAILSTM Moderate Portfolio (60% Equities, 40% Bonds) has returned 5.23% net of fees in the last two years (at the time of writing). The longer you invest, the more the volatility is smoothed out.

Growth does not happen in a straight line – we assume there will be some bumps along the way, and plan around them.

Key Messages

This article from Vanguard expands on these points along with the data to illustrate their conclusions.

The FIVE key messages, which are outlined in the article and are also backed up by years of research and common sense, are:

1. Tune out the market noise

It’s easy to make poor decisions if you react to news events or check your accounts daily. Stick with your plan and find other things to focus on.

2. Revisit your asset allocation

While you should not change your portfolio based on fluctuations in the market, you should examine how you feel about them. If you are especially worried about the downturn, it might be time to de-risk. If you are keen to invest more and want to maximise the upswing, you may even want to increase your risk level.

3. Control what you can

You can’t control the market, but volatility is not the only thing eroding your fund. Reducing costs and investing tax-efficiently can improve your returns and are within your control.

4. Set realistic expectations

The longer your investment timeframe, the more the volatility is smoothed out. We can’t guarantee anything, but generally, a diversified portfolio held for at least 5 years is likely to increase in value (although 10 years or more is preferable). A short investment timescale means your fund is more at risk from short-term fluctuations and may even lose money.

5. Stay diversified

Bonds, shares, property, and cash all behave differently depending on the market conditions. Even more variation can be seen within these asset classes. For example, equity funds may invest in different world regions, business sectors, and types of company. Holding as wide a range as possible is key to smoothing volatility while capturing market returns. While bonds have recently experienced some volatility, the yield curve tells us that they have probably reached ‘fair value.’ Selling them now would reduce diversification and lock in the losses.

In conclusion, we may still have some challenging times ahead, but history tells us that this will pass. The likelihood is that the market will recover and continue to grow. Stick with your plan and you are unlikely to go wrong.

Please don’t hesitate to contact a member of the team to find out more about investing and financial planning.