Bonds rarely receive the same level of attention as equities. They don’t offer the excitement of wildly fluctuating prices or rapid growth. Bonds are the more steady, stable cousin of equities, which some investors may consider a little dull.

But bonds are one of four main asset classes, and should be used alongside equities, property, and cash to build a diverse investment portfolio.

In this guide, we look at how bonds are affected by market forces and why you should consider holding them in your portfolio.

A Brief Guide to Bonds

A bond is a type of loan to a company or government. This works as follows:

- You lend the organisation a sum of money.

- You receive a set interest payment, or ‘coupon’ on your investment.

- The bond has a fixed maturity date, at which point you will receive your initial investment back.

This sounds simple enough, but there are a few things to bear in mind:

- There are multiple types of bond, including corporate bonds (in the UK and abroad), Gilts and Treasury Bills. These will all have different levels of risk and reward.

- Some bonds are index-linked, and will produce an income that rises with inflation.

- Bonds are not risk-free. A loan to a stable government is a relatively safe investment, however a bond issued by a small company in an emerging market may be more risky.

- The issuer of the bond will have a credit rating. Just like banks assessing the creditworthiness of individuals, investors can use this information to decide how much risk they want to take.

- Bond holders take priority over shareholders if the company is liquidated. This means that bonds are less risky than shares. However, there is still a chance that the issuer could default on the loan and that investors will lose money.

- The higher the reward potential, the higher the risk.

- Bonds can be issued over a short or a long time period. Longer term bonds tend to be riskier.

- Bonds can be traded on the second-hand market. In the same way as equities, the price will fluctuate in line with supply and demand.

Income Yields

One of the main advantages of a bond is the income it produces. This is set at a fixed level relative to the original purchase price. This means if you buy a bond for £100 and the income yield is 3%, you will receive interest of £3 per year.

When interest rates are low, this can be very appealing compared to leaving your cash in the bank.

Low interest rates usually arise from low inflation. To stop prices from dropping, and inflation turning negative, central banks can reduce interest rates. This makes it more attractive to borrow and spend money rather than keep it in cash.

Central banks can increase interest rates to curb inflation if prices are rising too quickly. This means it is more expensive to borrow, and more appealing to save money.

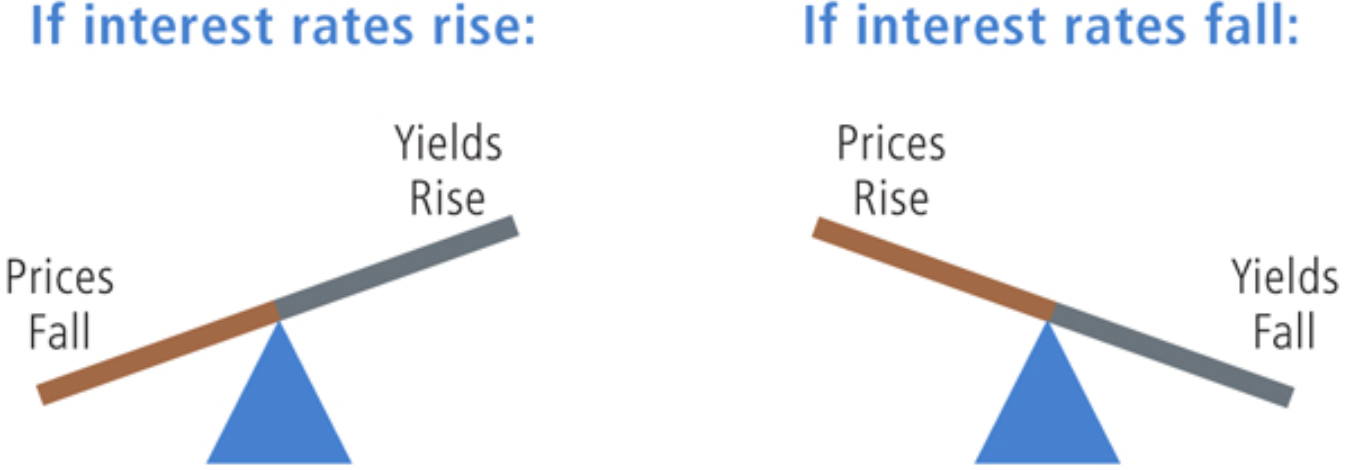

Bond yields are also affected by inflation. When inflation is high or is expected to rise in the future, it means that interest rates may increase, and investors will demand higher yields from bonds to compensate for the risk. Bond issuers need to increase their yield to appeal to investors. This then results in a price reduction of the bond, because Bond Yields and Price affect each other inversely. Think of it like a seesaw – when one goes up, the other comes down.

Price Fluctuation

Bond prices fluctuate according to supply and demand. This can be influenced by the following:

- Demand for bonds tends to increase when interest rates are low, as this can make the yield more attractive.

- However, higher demand means the price increases. This is good news for investors who already hold bonds as their portfolio will increase in value.

- But it also means that buying bonds becomes more expensive. If the price of the bond mentioned previously rises to £200, the yield will still only be £3 per year. This equates to an income of 1.5%, which is much less attractive. This naturally curbs the growth potential of bonds.

- High inflation (and high interest rates) is a different matter. Inflation will erode the ‘real value’ of a bond, as the capital returned at maturity will not have the same purchasing power. This makes bonds a less attractive investment.

- When equity values are increasing, this can also cause bond prices to drop as investors seek higher returns.

- The creditworthiness of the issuer will also affect bond prices. If investors believe there is a lower chance of getting their money back, they will be less inclined to invest.

- But if bond values drop, the yield becomes more valuable. Say the value of bond in the original example reduced to £50. The £3 yield is now worth 6% per year.

If you buy a bond when it is issued and keep it until maturity, fluctuating prices are not a concern, as you will still receive your interest payments and a return of capital. However, if inflation and interest rates rise in the meantime, your investment could be worth less in real terms. There is also a risk of default if the issuer becomes insolvent.

How to Buy Bonds

There are a few different ways of buying bonds:

- Purchasing newly issued bonds.

- Buying bonds on the second-hand market

- Investing in bond funds, which trade bonds behind the scenes. These may be general bond funds, or specialise in a particular area, such as index-linked Gilts, high yield bonds, or global corporate bonds.

- Investing in multi-asset funds, which will hold bonds as part of a diversified portfolio.

- Using a discretionary or managed portfolio service, which will buy bonds along with other investments in line with your requirements and risk appetite.

Why You Should Hold Bonds in Your Portfolio

There are several good reasons to invest in bonds:

- To diversify your portfolio. Traditionally, bonds are more stable than equities and do not always move in the same direction.

- To reduce the level of risk.

- To produce an income.

- To provide some protection against inflation.

Diversification is the key. Holding a wide variety of different assets is the best way of achieving predictable returns and managing risk. Bonds can fit comfortably into this strategy.

Please don’t hesitate to contact a member of the team to find out more about your investment options.