Why are headlines so negative? In a recent TED Talk, Julian Treasure says our increasingly noisy world is a key reason.

The media often uses alarmist titles to get our attention. Unfortunately, the consequence is that our heads are filled with negative voices. Everything seems to be going wrong all the time.

For investors, this can be especially damaging. Negativity bias fuels fear, emotional decision-making and short-term thinking. I often notice overhype in the press, with temporary (and small) downturns described as a “crash”, “plunge” or “bloodbath”.

How can you stay grounded in reality as an investor whilst this is happening? Let’s remind ourselves about how we can stay focused on what counts.

Taking Stock

Take a look at the graphic below. When was the last time you saw headlines like these?

They look comical partly because they are so unexpected. This is partly due to our “breaking news” culture. Negative events such as crises, crimes and wars happen suddenly, whilst positive developments such as poverty reduction often happen slowly.

Because the latter occur gradually, they seem less urgent and important. But that surely isn’t true. After all, ask yourself what is more important:

A tech stock falling by 1.5% and then rebounding the next day, or the global extreme child poverty rate falling from 20.7% to 15.9% between 2013 and 2022?

This brings me to another important graphic below.

As a financial planner, I’m all too aware of the dangers of obsessing over technical analysis and market patterns.

It’s certainly important to see what’s happening and manage risk. However, markets can be unpredictable. Even the best chart setups can fail due to external events.

All too often, investors miss the bigger picture and take comfort in a false sense of control. Successful investing is about long-term growth, not engrossing over charts that shift the focus to daily or hourly price movements.

The True Wealth Measure

So, if you shouldn’t obsess over short-time price movements, what should you focus on?

I suggest always remembering why you are invested, if you are ever tempted to anxiously check your portfolio after reading a negative headline.

The media does not have your financial goals or interests in mind. They are thinking about advertising revenue and their profit-loss reports. You need to look out for yourself.

If necessary, take a detox from the media hype. Sensational headlines create panic, and it can help to step back once in a while to regain a sense of perspective.

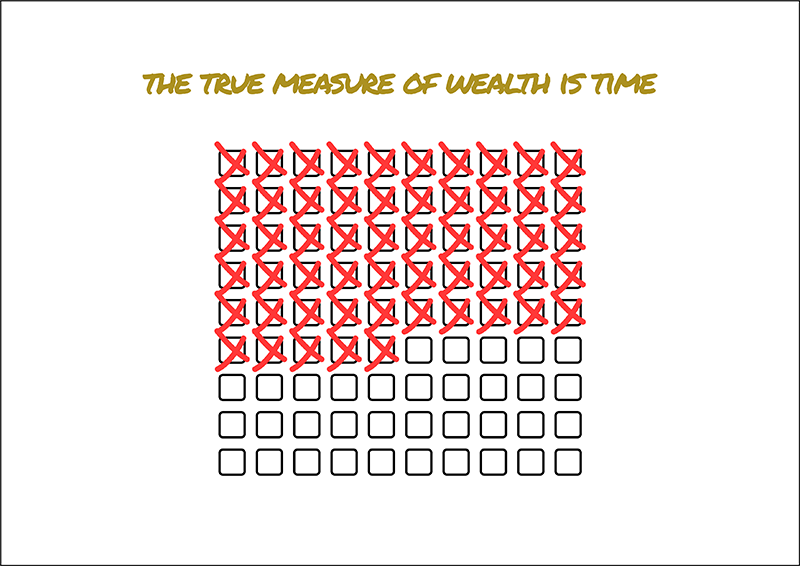

The true path to wealth does not lie in the stress of daily market fluctuations. Rather, it lies in following a consistent strategy over many years:

The key is to think in decades, not days. The market will have ups and downs, but historically, it has trended upward over time.

Having a trusted financial planner working alongside you can be hugely beneficial here.

An expert can remind you about economic cycles and point to historical examples (e.g. market crashes and rebounds) to help you stay calm during downturns.

What Really Matters

We all want our investments to perform well. But, at the end of the day, money is just a tool – not the purpose of life. Investing should not take up too much of your mental space.

Occasionally, take some time to ask yourself what financial freedom means to you. Is it more time with family? Travelling? Pursuing passions? What brings you real joy?

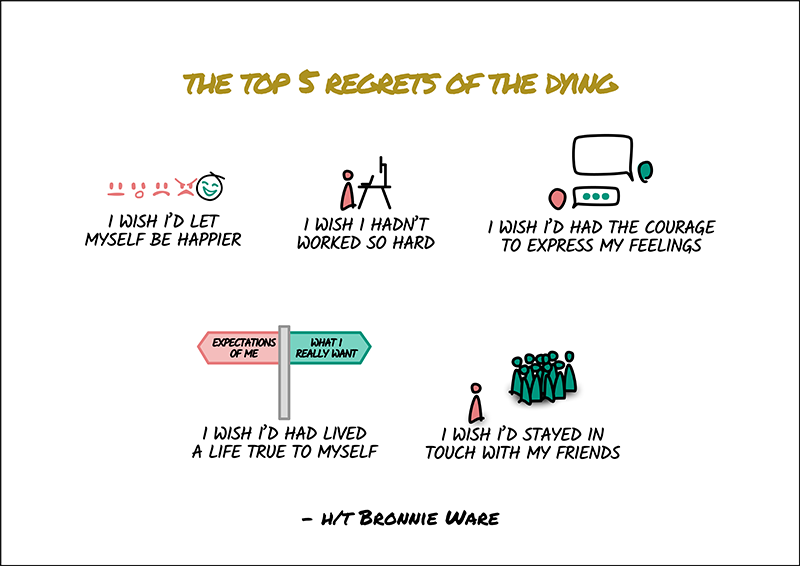

One sobering (but helpful) question to ask is, what might you regret? Take a look below:

Money is great, but it’s not everything. Exercise, sleeping well, and eating right – good health is priceless. Time with family and friends. Real conversations. Being present rather than always on the phone or a stock app. Enjoying the moment. These are the true riches of life.

You can always make more money, but you can’t buy back time. If investing isn’t at the top of your list of priorities (and it arguably shouldn’t be), don’t let it dominate your thoughts.

There are some practical things you can do to help yourself. One option is to take a “set it and forget it” approach with your portfolio.

I.e. Agree on your strategy with your adviser, automate your contributions (e.g. at the start of each month) and limit your check-ins to once a month or even quarterly. Your adviser will keep you posted if anything important happens.

Less time managing investments means more time to live life. Perhaps you could invest in other areas, such as self-improvement, philosophy or creativity.

Maybe you could take up an instrument, start a sport or dive into a passion project. This is why we set up our other website, Planning Your Adventure, to inspire clients with “bucket list ideas” to encourage people to always be asking: “What’s next?”.

I hope these thoughts have helped and inspired you. Until next time!