The economy is an intricate machine with many moving parts. Generally it ticks along in a cyclical fashion, expanding and contracting over a period of several years.

News articles about the economy tend to focus on a particular issue and turn it into a story that will capture the interest of their readers.

Understanding the facts can help you approach the news with a critical eye and avoid worrying unnecessarily.

This guide looks at some of the economic factors that are currently in focus.

The Budget Deficit

The Budget Deficit is the difference between government revenue and spending. In a given year, the government takes in money through taxes and other methods, and spends on public services, healthcare, and benefits.

As the government cannot simply stop spending on essential services, they must borrow to make up the difference.

The pandemic has hit both tax revenues and public expenditure. Economic activity has reduced, which means that more people are out of work or in lower paid jobs. They are also spending less on discretionary products and services. Personal tax, VAT and corporation tax revenues are all impacted.

Additionally, public spending has significantly increased, between support for individuals and businesses, increased pressure on the NHS, and rolling out the vaccine.

As a result, the Budget Deficit is now at a peacetime record high. In 2021, government revenue was £793 billion, while spending was £1,093 billion1. The resulting Budget Deficit is therefore £300 billion. This is effectively an overdraft of £4,500 for every person in the UK.

The Deficit is currently equivalent to 14.3% of the UK’s Gross Domestic Product (GDP) or total economic output.

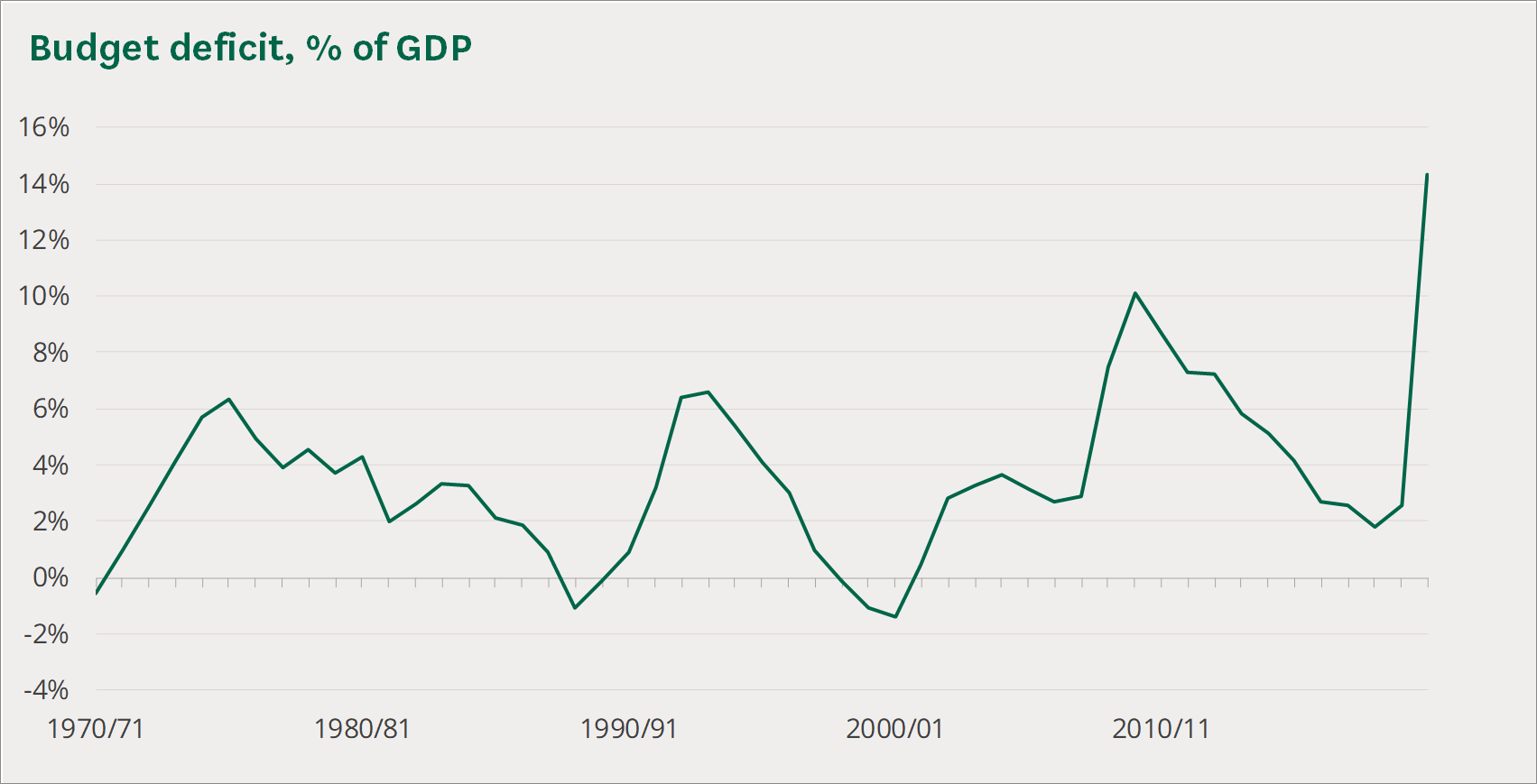

To put this into perspective, the Budget Deficit over time, as a percentage of GDP, is shown in the chart below:

While the Deficit is currently at a high level, there have been peaks and troughs throughout history. The Budget Deficit alone is not a reason to worry, although it remains to be seen how it will develop as we emerge from the pandemic.

The National Debt

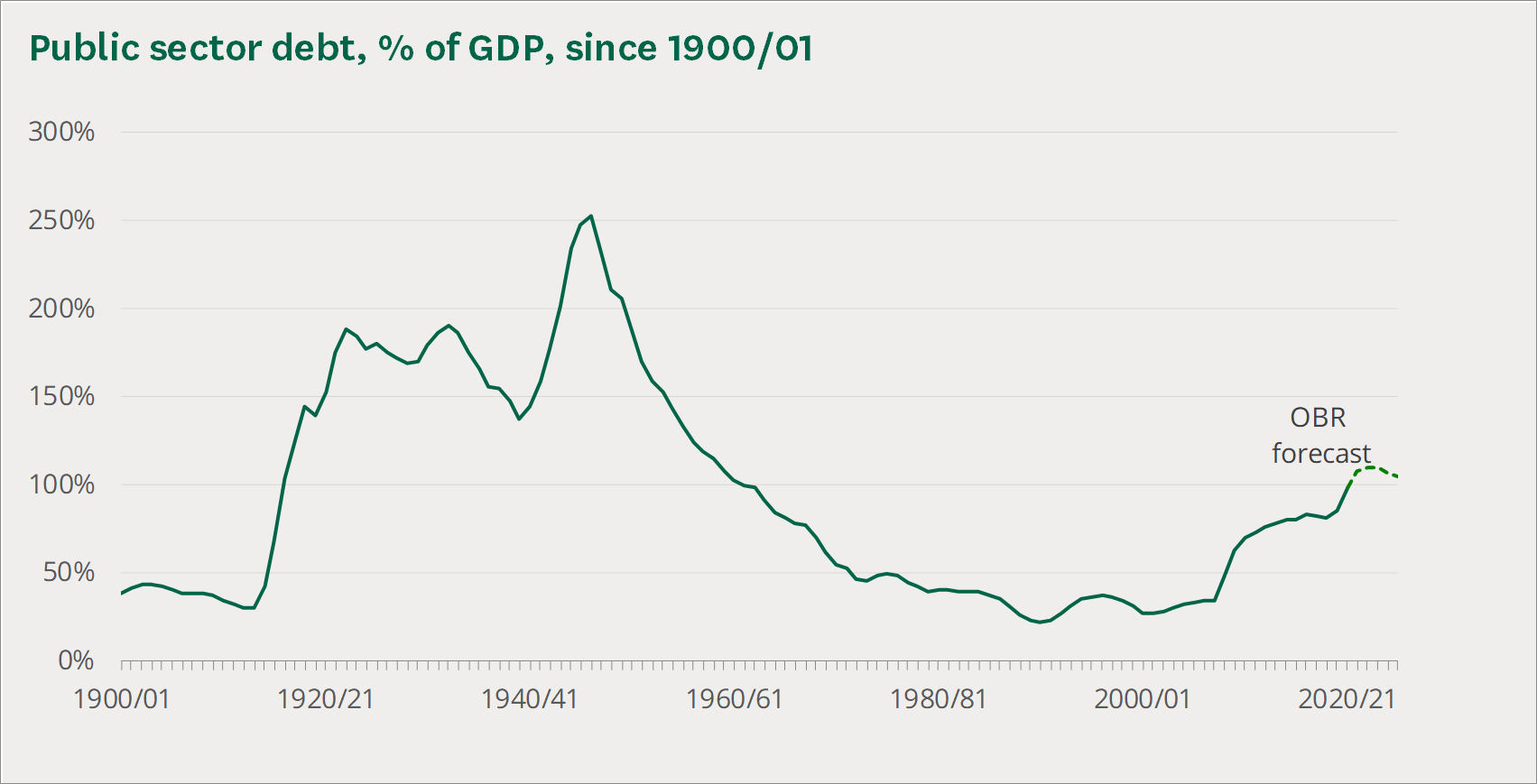

This is another important metric when considering the UK’s financial position. It refers to not only the amount borrowed in a single year, but the cumulative total that has built up. A continual deficit in the Budget means that this amount is increasing all the time, and accruing interest.

Public sector debt is now around £2.1 trillion, or £32,000 per person in the UK population.

This figure is equal to around 97% of GDP, and is increasing.

The good news is that interest rates are at an all-time low point, which makes it cheaper than ever to borrow. Still, in 2020/2021, the net interest paid on public sector debt was £22 billion.

You can find out more about the Budget Deficit and Public Sector debt here.

Quantitative Easing

Quantitative easing is one of several measures taken by central banks (as well as controlling interest rates) to keep the economy stable and curb excessive inflation.

Put simply, this is the mechanism that allows central banks to inject money into the economy to stimulate spending and growth. It is sometimes referred to as ‘printing money,’ but today, the process happens electronically rather than by issuing additional bank notes.

The capital is then used to buy government bonds (gilts) on the second-hand market. This has several implications:

- Investors selling their gilts have more money available to spend or invest in equities, increasing demand.

- The price of the gilts goes up, which means that the relative income yield goes down.

- Borrowing becomes cheaper as interest rates as lower.

- Inflation increases as more money is circulating in the economy.

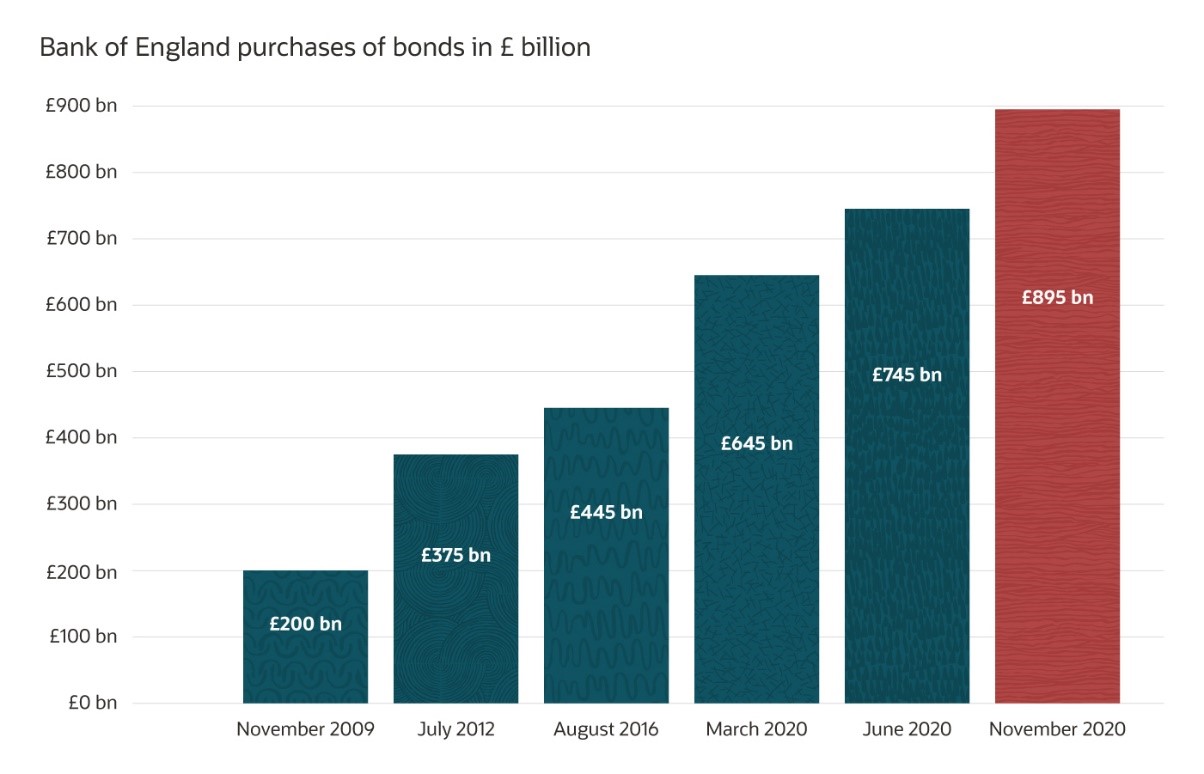

The level of quantitative easing (total bonds purchased) has been steadily increasing since the financial crisis, as shown in the chart below2:

This raises questions over the extent to which our economy relies on quantitative easing and how sustainable it is.

You can find out more about quantitative easing here.

The Furlough Scheme

The furlough scheme was introduced to protect workers from the worst financial impacts of the pandemic.

But clearly, this is not sustainable for the long-term, and a balance must be struck between public health and the economy. This is not as simple as it sounds, as the two factors are inextricably linked.

The furlough scheme is winding down, with employers now being asked to pay an increasing contribution towards their employees’ wages.

For industries such as hospitality, which suffered significantly during the pandemic and are now slowly starting to recover, this makes sense.

However, for some employers, the furlough scheme may have simply delayed the inevitable redundancies that were already on the cards. This may be due to the businesses being unable to recover, for example, certain high street retailers.

It is likely that we will see job losses in the coming months, but even throughout the pandemic, some industries thrived. Technology, financial services, home deliveries, and healthcare were all in more demand than ever, a trend that is likely to continue.

This may mean that we are not looking at a net job shortage, but a sideways shift in labour markets. The impact of this will depend on how the jobs are distributed across the UK and how easy it is to ‘upskill’ into a new industry.

Property Prices

The property market has been booming in recent months as buyers aim to take advantage of the stamp duty holiday introduced in 2020. But the relief was reduced at the end of June, with the usual stamp duty threshold of £125,000 being reinstated from the beginning of October.

Moving is not a decision taken lightly, but the stamp duty holiday may have condensed years’ worth of property market activity into a few short months. This led to an artificial spike in demand for homes.

Predictably, prices are now falling, but are still, on average, higher than they were last year. You can find out more here.

Looking to the Future

The 2021 Budget was notably lightweight. Tax increases were expected in the wake of the pandemic, but these were minimal. However, future changes cannot be ruled out, particularly at current debt levels and the general economic outlook for the UK.

Some potential areas of focus for future budgets could be:

- Increasing the rates of Capital Gains Tax and removing some of the exemptions.

- Removing certain Inheritance Tax reliefs.

- Increasing income tax rates.

- Reducing the tax relief available on pensions.

- Increasing the levels of tax paid by businesses.

- Cracking down further on tax avoidance methods.

- Cutting public spending including benefits.

- Or increasing public spending on the creation of new jobs, ultimately increasing longer term tax revenue and boosting the economy.

What Can You Do?

We cannot control the markets or the economy. Nor can we necessarily predict how it is going to behave or the impact on different investment types.

Instead, we must focus on what we can control. For example:

- Staying informed about the issues while taking sensationalist headlines with a pinch of salt.

- Accepting that the world and the economy are always changing. A good financial plan should be designed around this, and not be dependent on particular market conditions.

- Stick to the plan. Stay invested for the long-term and continue to make contributions towards your goals.

Invest tax-efficiently, taking advantage of reliefs as far as possible. - Clear debt so that you are in a financially stronger position.

- Look after your health, spend time outdoors, and make time for family and friends. Ultimately these things will have a greater impact on your future than world events outside your control.

Please don’t hesitate to contact a member of the team if you would like to discuss any of the issues covered.

1 https://commonslibrary.parliament.uk/research-briefings/sn06167/

2 https://www.bankofengland.co.uk/monetary-policy/quantitative-easing