Many people seek financial advice at the point of a major event or a lifestyle change, but financial planning is a lifelong process, whether or not you choose to work with an adviser. While there is a cost involved in obtaining financial advice, research has shown that prudent advice can add around 3% per year (on average) to investors’ net returns.

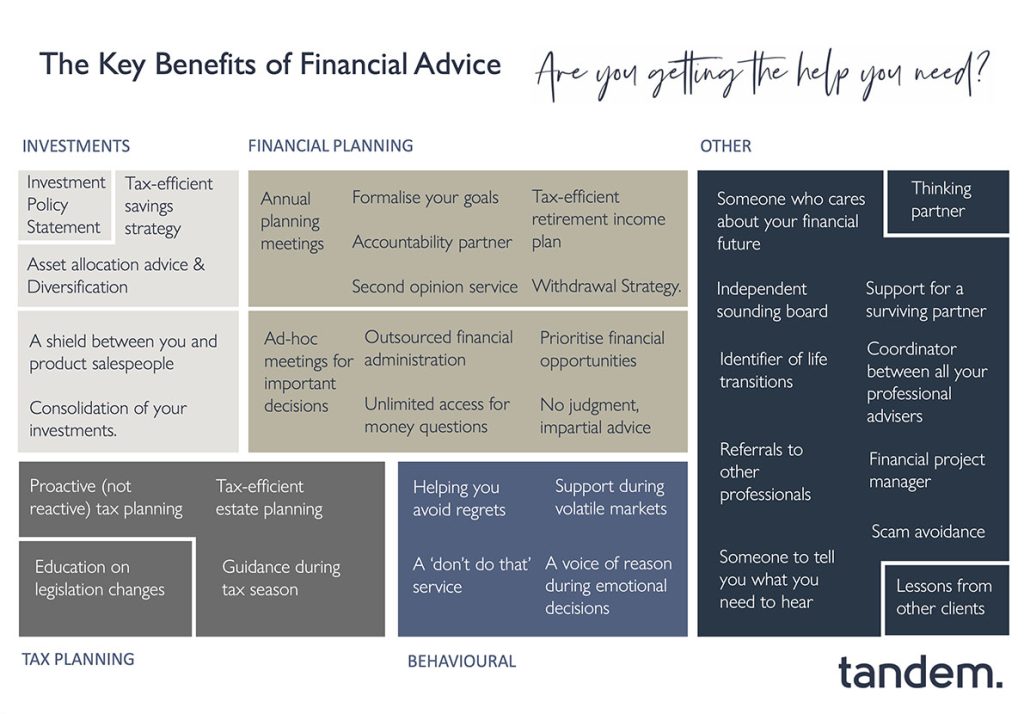

So, what does a financial adviser actually do? The graphic below gives a brief snapshot of some of the areas an adviser can help you with:

Additionally, in our short Tandem Talks video, we explain how we use our OAP (Organise, Advice, and Peace of Mind) process to help clients make sense of their finances, make good decisions, and ultimately achieve their goals.

Some of the key benefits of working with a financial adviser are explained in more detail below.

Prioritising Your Goals

Everyone has something they want to achieve in life, but for many of us, vague ideas and half-formed plans are as far as it goes.

To give you the best chance of success, goals should be ‘SMART’ – Specific, Measurable, Achievable, Relevant, and Time-Bound.

Whether you are looking to achieve your ideal retirement lifestyle or build a house in the country, a financial adviser can help you to flesh out your ideas and set you on a path towards achieving your goals. By keeping your goals at the forefront, this will make your future financial decisions easier.

Proactive Planning

Many people keep the same bank account throughout their entire life and collect multiple pension pots through successive employment. Around 34% of people in the UK have less than £1,000 in savings, and while more people are starting to invest, many do so without a clear plan or tax strategy.

A financial adviser can help you to manage your finances proactively and take advantage of opportunities. For example:

- Investing tax-efficiently, for example, by using your allowances and exemptions each year and prioritising pension and ISA funding.

- Ensuring your investments offer value for money and that you aren’t paying unnecessary charges.

- Adapting your plan as your circumstances, goals, and legislation changes.

Investment Discipline

Investing always comes with risks, but by following some key principles, you will have a better chance of long-term success. A financial adviser can help keep you on track by:

- Creating a sensible asset allocation which aligns with your goals and risk profile.

- Ensuring you hold a diversified portfolio, encompassing a range of asset classes, world regions, and sectors. For example, our TRAILSTM portfolios hold at least 12,000 individual stocks.

- Letting you know if your investment plan is drifting off-track and what you need to do about it. This may include making adjustments to your spending during volatile markets.

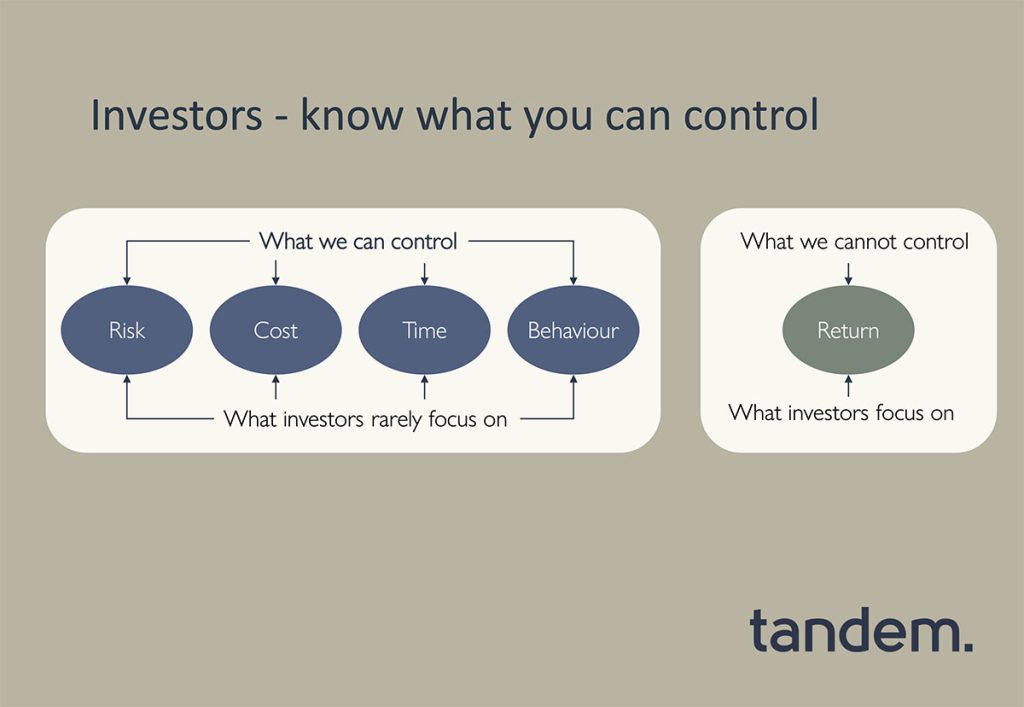

- Focusing on what you can control rather than worrying about what you can’t:

If your investment plan is linked to your goals, this can help you to see things more clearly and make better decisions.

Filtering the Noise

Between the media, web forums, and self-appointed financial influencers, it is easy to find opinions on what you should invest in at any given time. This is not to mention product providers and salespeople competing for your money.

Just because something is working now and seems to be foolproof, this does not mean this will always be the case. For example, while some people have made money with cryptocurrency in recent years, far more invested on the upside and eventually lost money. Similar trends crop up every few years. (For the record cryptocurrency is NOT investing, it is just gambling!)

An adviser can help you not only by filtering out gimmicks and scams, but also by researching the whole of the market and selecting the investment strategy which best aligns with your goals.

Voice of Reason

A financial adviser can act as a sounding board and help you make good decisions with your money. For example:

- Supporting and guiding you through volatile markets.

- Vetting any financial or business opportunities you are offered.

- Helping you make important decisions around your career and family by highlighting the financial implications.

- Offering impartial advice, without judgement, on a range of different topics.

- Telling you the truth, even if it is difficult.

Over time, a good financial adviser can become a trusted confidante with whom you can be comfortable discussing the important things in your life.

Financial Co-Ordination

Financial advisers do not work in isolation. There are many different parts to your financial plan, and the ability to bring it all together is one of the key skills of a good adviser.

Your adviser can liaise with the following professionals on your behalf:

- Investment and pension product providers

- Solicitor

- Accountant

- Mortgage adviser

- Will writer

This can help to ensure your finances are co-ordinated and that your professional advisers co-operate for your benefit. But more importantly, it frees up your time and energy so you can spend time on the things that are more important to you. Learn to delegate financial tasks to those you trust.

Accountability

Many people can manage their own financial affairs if they choose to. They can set goals, research investments, and even gain an understanding of behavioural finance.

But having a trusted professional to advise you and hold you accountable is not something you can replicate on your own. Who else will make sure you review your financial plan at least annually and not only tell you what actions you need to take, but make it as easy as possible for you to implement?

This can help lead to peace of mind that you are on track to achieve your goals and create the future you desire.

Please don’t hesitate to contact your Tandem adviser if you would like to discuss any of the topics covered.