Until early 2020, the markets had been on an almost unstoppable upward trajectory since March 2009. There were a few blips along the way, but the majority of investors made money, providing they held their nerve and remained invested through the downturns.

But in early 2020, things changed. The arrival of the pandemic ground many businesses to a halt and incited fear in the financial markets. We were facing massive losses and economic ruin.

A few months later, the tide turned again. While the human cost was high, and many businesses were facing losses, the financial world remained fairly resilient. The majority of pension and investment portfolios have come out of the pandemic unscathed, even reaching new highs.

But does that mean that the threat of a market crash is over? Can we all relax and look forward to another ten years of unimpeded prosperity?

Probably not. There are still several factors at play which mean we could be heading for a fall. Below is a brief explanation of the main issues that could contribute.

Inflation

Moderate inflation is a good thing. It means businesses are prosperous, wages are increasing, and investing is usually worthwhile.

But high inflation can be a problem. It can result in costs spiralling out of control. Wages need to keep up with costs, but realistically can’t because of the increased pressures on employers. More families are pushed into poverty and businesses face insolvency.

Inflation is driven by two main things:

- Consumer demand, which pushes up prices.

- Interest rates. Low interest rates can make it more attractive to spend and borrow money, which in turn, increases demand. High interest rates have the opposite effect.

Having stagnated throughout most of 2020, the Consumer Prices Index rose 3.2% in the 12 months to August 2021, its highest level since 20121. While this rate is still within the realms of normality, remember it includes several months of peak pandemic in which inflation barely moved, or even reduced.

If inflation gets too high, it could lead to a market crash. However, these things are often corrected, either as natural progression, or through the action of central banks.

The Labour Market and Other Shortages

However, the impacts of inflation are compounded when there is a shortage of workers or basic supplies. The demand for goods and services may be there, but if the means to manufacture, supply, and sell them are sparse, prices could rise exponentially without businesses being in a position to profit.

We are currently in the midst of the worst labour market shortage since 19972. This has arisen from increasing demand, as we rush to get our lives back on track following the pandemic.

While Covid may have delayed or obscured some of the consequences of Brexit, these are being felt strongly now. Numbers of workers from overseas have sharply dropped, with industries such as transport, logistics, hospitality, healthcare, and construction facing the worst shortages. Many of these industries kept us afloat during the pandemic and enabled the lifestyles of those able to work from home.

The trend has also spread to higher-paying industries such as finance, IT, and engineering.

Without a willing and able workforce, a market crash is likely.

Hyped Stocks and Accelerated Growth

Since the start of the pandemic, two main investment trends have become apparent:

Strong growth in sectors such as technology and healthcare, which were well-placed to benefit from a post 2020 society.

Over-hyped investments, which increase in value simply because someone is always willing to pay a higher price. Examples include cryptocurrency and meme stocks, which proliferate through social media.

Traditionally, ‘value’ stocks, or steady earners have produced more consistent growth over the long term. We saw a brief return to this pattern early in 2021, but the ‘rotation’ was swiftly reversed and tech giants resumed dominance.

But what goes up must come down. Where share prices are based on (sometimes misguided) investor sentiment, this means that fluctuations are based on something less tangible than the genuine value of an asset. A downturn can signal to investors that it is time to exit an investment, which can result in further price drops.

Post Covid Fatigue

The effects of the pandemic will be seen for a long time. While life has, for the most part, returned to normal, there are still limitations, the threat of illness, and the natural trepidation about returning fully to normal.

The government has brought in measures such as the furlough scheme, Coronavirus Business Interruption Loans (CBILs), Eat Out to Help Out, and the stamp duty holiday to ensure that the economy keeps ticking over. But these are all temporary fixes to a temporary problem. Some of these businesses already faced issues, particularly in the retail sector, which are unlikely to get any better.

The problems apparent before Covid, coupled with the long-term consequences of the pandemic, could hinder businesses, slow down growth, and lead to a fall in share prices.

It is Inevitable

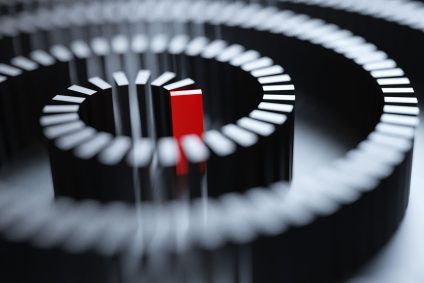

However, the main indicator that a significant market crash is due is that we have not had one for a while. The market is cyclical, and a few years of prosperity is usually followed by a crash and a recovery.

The good news is that generally the markets have more good years than bad, and prices usually move in an upwards direction over the longer term.

Q: What can you do about it?

Control What You Can

We can’t control the economy, or even predict it with any degree of accuracy. So, step away from the news and social media, and focus on what you can control:

- Avoid overstretching your budget.

- Keep a cash reserve of at least 6 months’ expenditure to see you through any rough points.

- Make sure you have the right insurance to protect you and your family if the worst happens.

- Invest consistently and for the long-term, taking an appropriate amount of risk.

- Avoid trying to predict or time the market. Investing throughout the downturns, rather than trying to avoid them, will improve your returns over time.

- You can change risk profiles at any time with next to no cost. One has to be careful with a GIA (General investment account) to factor in any potential CGT implications, but there are no tax concerns when switching (selling and then re-buying funds) within an ISA, Pension or Bond (Onshore or Offshore).

N.B. It may seem logical and appropriate to reduce one’s risk profile during periods of volatility or an impending correction, but in most circumstances, for long terms investors, it is usually a mistake to alter risk profiles in these circumstances. This is because one forgets often to revert back to one’s original risk profile after the correction and you cannot time the point to do this with any accuracy. AS we always say at Tandem, “Don’t try and time the markets! It is time in the markets, not timing the markets.”

As the late great (founder of Vanguard) Jack Bogle said:

“The winning formula for success in investing is owning the entire stock market through an index fund, and then doing nothing. Just stay the course.”

– John C. Bogle

“The idea that a bell rings to signal when investors should get into or out of the market is simply not credible. After nearly 50 years in this business, I do not know of anybody who has done it successfully and consistently.”

– John C. Bogle

“Don’t do something—just stand there.”

– John C. Bogle

Please do not hesitate to contact a member of the team to find out more about the topics mentioned above.

1 UK inflation surges to 3.2% as food and transport costs rise | Financial Times (ft.com)

2 UK employers struggle with worst labour shortage since 1997 | Business | The Guardian