Coronavirus has triggered the greatest economic uncertainty of our generation. It has affected everyone to some degree, and it is not over yet.

It was inevitable that the virus would have some impact on investment markets. Not only does a global crisis damage investor confidence, but many businesses, and indeed entire industries, will face some difficult decisions in the coming months if they are to survive.

But the economy is both cyclical and extremely resilient. Where some industries struggle, others will thrive. Innovation rises in the face of a challenge, and it has been many years since the world faced a challenge quite like this.

The pandemic has shone a glaring light on our weaknesses as a society and as an economy – once we overcome this, we will be stronger than ever.

How has Coronavirus Affected Financial Markets?

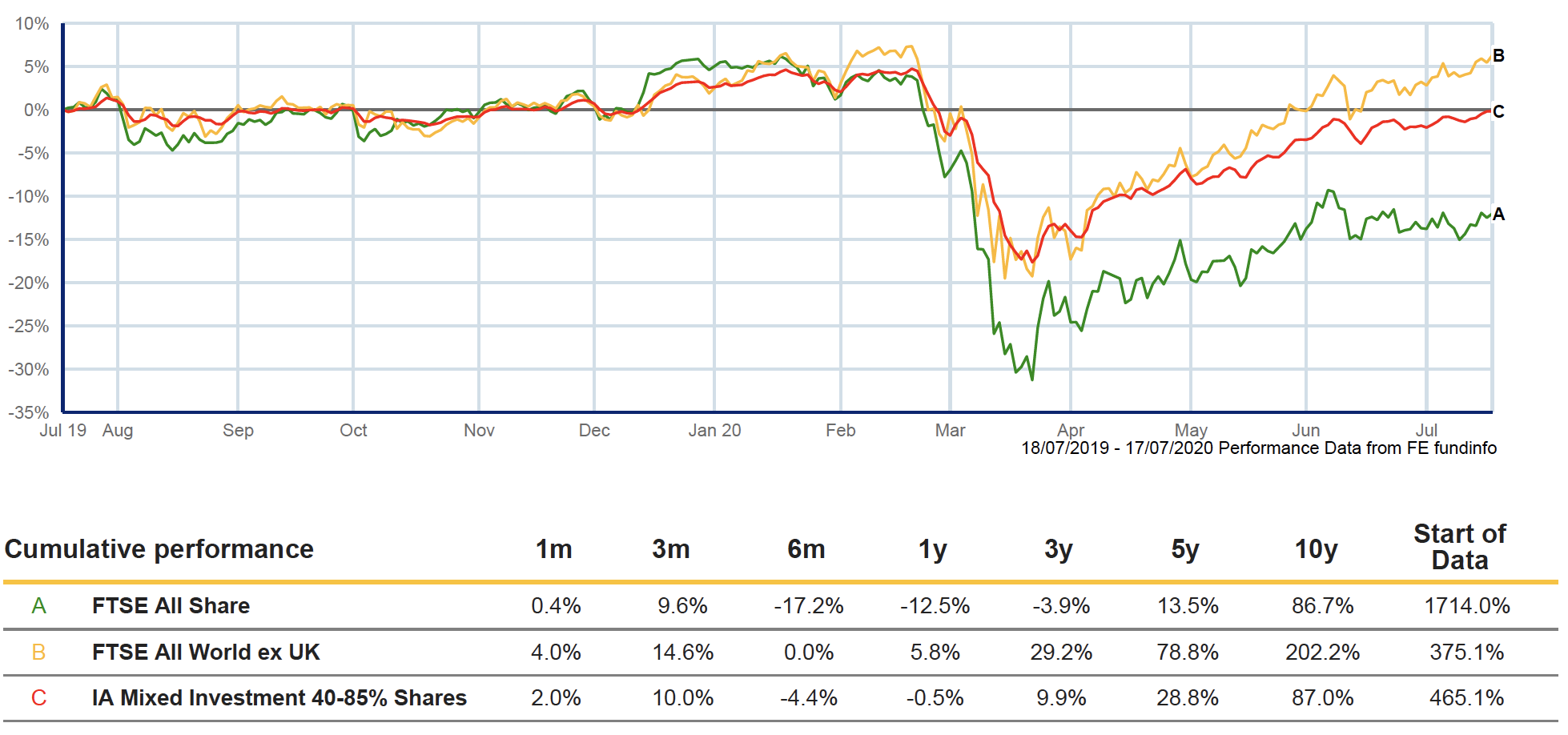

The chart below shows the fluctuations of the FTSE All Share (representing UK equities), the FTSE All World index (global equities), and the Mixed Investments 40% – 85% (a broad approximation of a balanced investment portfolio across a range of asset classes).

As you can see, all three indices dipped sharply around mid-March. At that point, many parts of the world were approaching their peak in terms of dealing with the disease and the UK was heading for lockdown. There were also some oil disputes going on at around the same time – this didn’t receive the same amount of attention, but it certainly didn’t help.

The dip was mainly fueled by investor sentiment. As more people sold their assets to take a more cautious position for the coming crisis, prices fell. And of course, as prices drop, more people become worried and sell their investments.

Optimism turned the tide fairly quickly, boosted by increased profits in the technology and pharmaceutical sectors. Global equities and diversified portfolios have mostly either matched or exceeded their July 2019 values. UK equities are a little behind, but we are still in the process of returning to normality.

Should You Withdraw Your Money?

It is natural to want to withdraw money when prices are falling, but this is usually a bad idea, for a number of reasons:

- It is impossible to time the market and know if you are selling at the right time.

- Equally, we cannot predict the right time to buy back into the market.

- Any information that may affect share prices is already factored in. Unless you are the first investor to sell, the likelihood is that you will not receive an optimum price for your shares.

- The best days of a recovery usually follow shortly after a dip. If you miss out on the days which generate the highest growth, this can drastically reduce your annual return.

- The time and stress of trying to manage a portfolio according to fluctuations in the market.

What History Has Taught Us

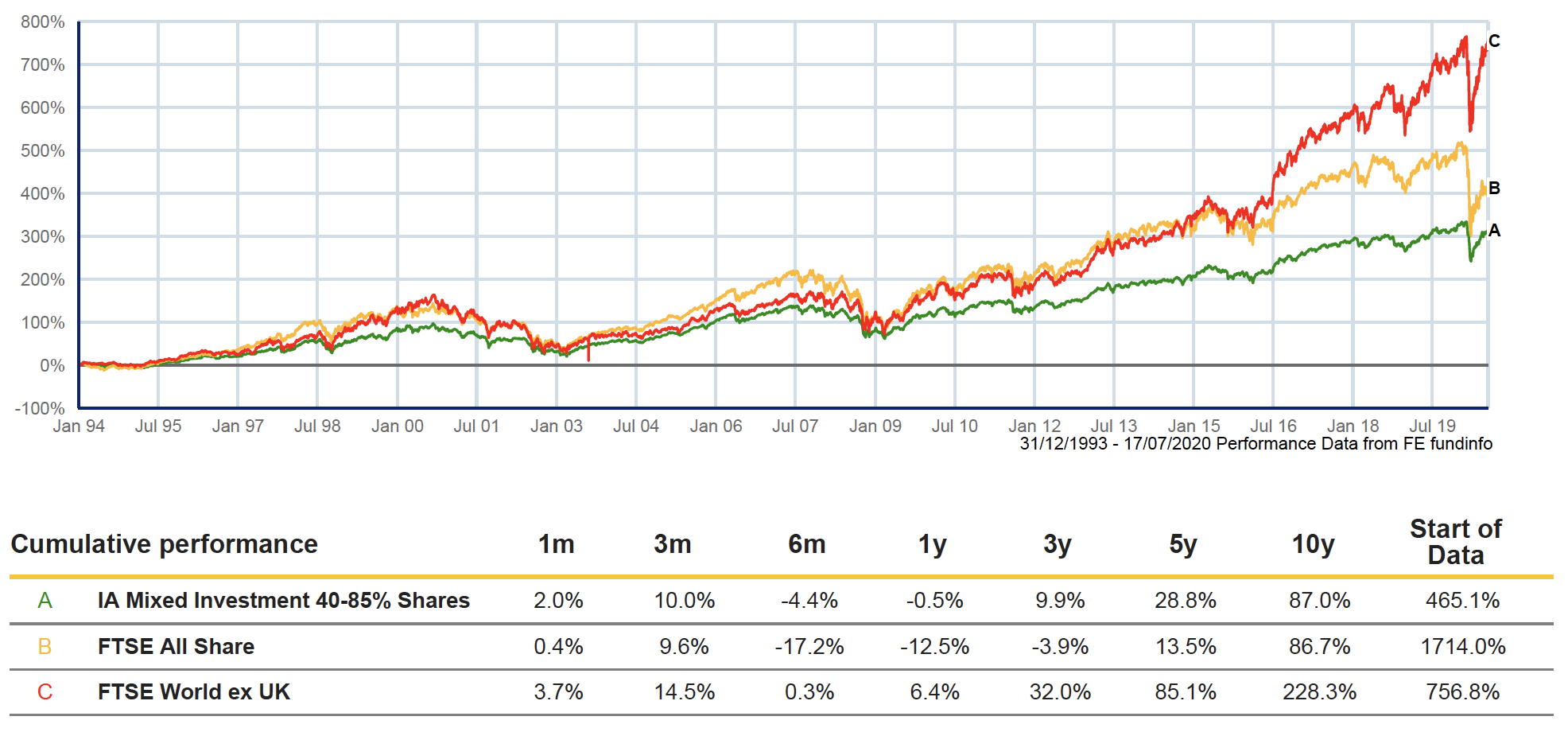

Below is the same chart as before, although this time going back to 1994:

We can see several dips in the market during this time, for example:

- The September 11th terrorist attacks, closely followed by the tech bubble

- The 2009 financial crisis

- Pre-Brexit vote angst

- Covid19

But there are other, more important observations to be had:

- Despite the dips, growth has consistently been positive over the longer term.

- The recoveries last longer than any downturn

- Each recovery not only restores values to previous levels but exceeds them.

- Even major world events, which seem insurmountable at the time, appear as a small blip in the context of long-term investment growth.

- The total return over time is correlated with the amount of risk taken.

History teaches us that it is ‘time in the market,’ not ‘timing the market,’ that provides the best chance of achieving your investment goals.

What Happens Next?

There are two possible viewpoints on this matter:

- As the UK (and indeed, much of the world) has yet to fully recover and adjust, there are opportunities to be had.

- We are yet to feel the full impact of the damage caused by the virus and a more cautious outlook is advisable.

We cannot know in advance which of these statements is correct, but the likelihood is, it will be a combination of both.

On the one hand, many smaller businesses, or those in particularly vulnerable sectors, may not survive. The resulting job losses (as well as more people being careful with their money rather than spending), are likely to impair the wider economy.

However, a number of businesses have flourished during the crisis, particularly those that did not rely on providing ‘in-person’ services. Others have innovated and adapted, and may find that they are now more resilient.

We have no way of predicting exactly how and when the economy will react following the pandemic.

The key is to adopt an investment strategy that plans for all potential scenarios.

Your Financial Strategy

When planning your investments, there is a lot of noise to filter out. This can include the financial press, friends’ opinions or even your own emotions and biases.

Here are our top tips to ensure that your financial strategy remains on track, regardless of what is happening in the world or the economy:

- Keep a cash reserve to ensure that you don’t need to dip into your investments at short notice. This allows your funds time to recover.

- Follow your goals rather than the markets.

- Take an acceptable level of risk with your asset allocation. This will depend on:

3a. The returns you need

3b. The timescale until you require access to the money

3c. The amount you can afford to lose - De-risking your portfolio during turbulent times is usually counter-productive. Your risk profile can change as your circumstances and attitudes evolve, but it should not fluctuate in line with the market.

- Hold a wide range of different asset classes across a variety of regions and business sectors. As we don’t know how world events will affect the different types of investment, holding a wide selection is the key to reducing risk and improving returns.

- Don’t make investment decisions based on emotion.

The best way to ensure that you have a well-diversified portfolio, managed in line with objective evidence, is to outsource the day to day investment decisions to a professional.

Please don’t hesitate to contact a member of the team if you would like to find out more about your investment options.